Commercial and industrial (C&I) loan portfolios are often overlooked when considering assets for disposition via the secondary loan market. The more liquid nature of real estate debt versus C&I often results in lenders first considering disposition of these assets when making portfolio management decisions. Despite this, C&I loans secured by business assets and/or business real estate, should be high on lender’s list when considering asset sales due to demand by other banks (for performing or re-performing) and investors (for troubled or non-performing).

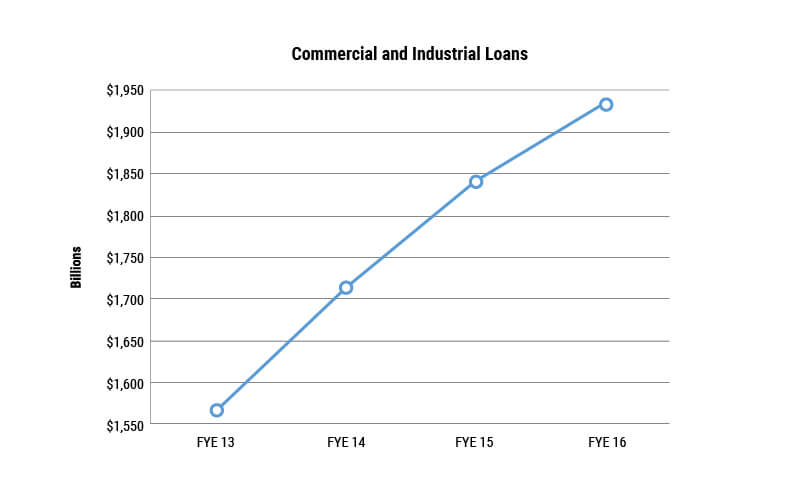

Per the FDIC, C&I lending has grown over the past several years, reaching an apex of $1.936 trillion dollars as of year-end 2016.

While much of this growth is the result of new businesses seeking capital, loan growth can also be attributed to lenders diversifying away from real estate and construction lending often at the direction of regulators. Some of this increase in loan growth can result in borrowers becoming over-levered, having taken advantage of easier money and loosening credit standards.

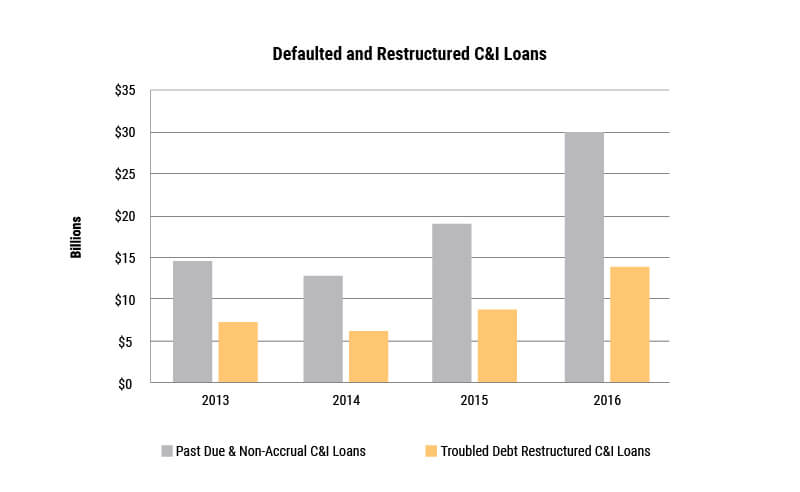

Since the end of 2016, the pace of loan growth has abated, with negative growth observed during 11 of the past 17 weeks according to Federal Reserve data. Furthermore, delinquencies in the C&I space are rising, with the number of delinquencies growing every quarter since 4Q14. The FDIC reports that 1.56% of C&I loans are currently past due or on non-accrual (see below chart). According to BankRegData.com, in 4Q16, there were approximately $26.6bn of non-performing C&I loans, which represented 19.84% of all non-performing loans.

The increase in delinquencies is largely attributable to challenges within the energy sector, as readily observed at a regional level among banks with exposure to markets that derive an outsized amount of economic activity from oil and gas exploration. Additional delinquencies are likely to be observed due to macro-economic factors in the coming months. C&I loans not secured by fixed assets are frequently pegged to variable rates. As indices rise in response to anticipated Fed rate hikes, borrowers may breach debt service covenants, or find themselves in payment default, should they fail to grow revenue in tandem with increased interest expense.

Banks have responded to increased delinquencies by building reserves and increasing their loan-loss provisions by approximately $3.6bn in 2016. At the same time, credit focused hedge funds / investment funds, merchant capital firms that specialize in providing working capital to small and middle market companies, value investment credit firms, global private equity firms, and opportunistic regional banks have raised funds to take advantage of market dislocation. Many of these investors have a penchant for assisting borrowers facing difficulty making good on their credit obligations by restructuring loans in tandem with providing additional “rescue” capital, accounting and other financial support, and general business guidance. In doing so, these investors are able to resuscitate companies that might otherwise suffocate under the burden of mounting debts. This additional capital allows investors to offer compelling bids relative to the typical recovery experienced by lenders. A study conducted by the FDIC indicated that loss given default experienced by failed banks averaged 45.5% for C&I loans on a weighted average basis, significantly higher than losses associated with CRE loans, because of a myriad of operating company issues (difficulty paying vendors, obtaining raw materials, distributing inventory, making payroll) which result in a massive decline in enterprise value.

By way of example, Mission Capital recently traded a sub-performing C&I loan secured by the business assets of a home goods supplier whose credit had been frozen, resulting in difficulty obtaining raw materials and in turn constraining production of finished goods. The prognosis for this company was bleak in the face of declining revenue which would have further impaired an already struggling business. Mission created a market for the debt, generating multiple bids in a competitive process. Ultimately the loan traded to a buyer with a penchant for restructuring small business debt at a price that resulted in a gain on the lender’s book value.

At a time when lending activity is slowing, lenders may find themselves playing a game of “hot potato” with classified assets as borrowers struggle to refinance debt in the face of declining lending appetite and tightening credit standards. This, in tandem with increased delinquencies, creates an environment where high loss severities associated with C&I loans are likely to be realized. In the face of headwinds in the C&I lending space, now is an optimal time for lenders to evaluate their C&I assets to determine if a loan sale is a viable and potentially optimal method of portfolio management.

Click here to learn more about Mission Capital’s Asset Sales team