Mission Capital Managing Director Jordan Ray discusses the state of Apartment Finance.

Experts: Financing Will Be Ample

Next Year

Multifamily executives are bullish about the future, with the apartment industry awash in cash at the midpoint of an expanding cycle.

By: Joe Bousquin

Illustration: Anna Parini

It’s pretty nice to have Kevin Finkel’s job right now. As executive vice president at Philadelphia-based Resource Real Estate, as well as chief operating officer for the company’s Opportunity REIT funds, there are a lot of people trying to get his attention. And almost all of them have fistfuls of cash.

“There’s more money than you could ever imagine looking for real estate assets right now,” Finkel says. “On both the equity and debt sides of the equation, for people who have money to get out, this is an incredibly competitive environment. When you go out to finance a project, there’s almost more interest than you can deal with.”

The biggest problem in Finkel’s job at the moment is a very good one to have: He has to wade through a sea of proposals just to be choosy about whose money he takes.

Within the apartment industry, he’s not alone. Transaction volume in the second quarter of 2014 increased 40 percent year over year, according to New York– based real estate research firm Real Capital Analytics (RCA). And that’s following on the bumper crop of 2013, a year that saw a new record in multifamily lending, at $172.5 billion, according to the Mortgage Bankers Association.

All across apartment land, other finance-minded professionals are reporting similar throngs of financiers lining up at their doors.

“There’s just so much capital out there, from a variety of different sources, chasing every available deal,” says Michael Ochstein, founder of Price Realty in Dallas, an owner and operator of 5,500 units.

Jordan Ray, managing director of the debt and equity finance group at New York–based Mission Capital Advisors, sums up the embarrassment of riches succinctly: “We are very, very busy right now.”

Suffice it to say, if you’re looking for funding, whether debt or equity, you shouldn’t be too hard-pressed to find it going into 2015. Finance executives interviewed for this article were uniformly optimistic about current conditions as well as what lies ahead for next year. They also proffered unique insights into multifamily’s topography of dwindling cap rates, compressed yields, and loosening lending terms.

The picture that emerges is one in which secondary markets are taking on increased importance, Class A projects are no longer the only belles at multifamily’s ball, and value-add is still your best bet, if you do it right. Perhaps most important, though, is the view that everything in multifamily’s universe should continue moving ahead swimmingly—as long as rents continue to stay high.

Cap Rates Have Become More Transparent

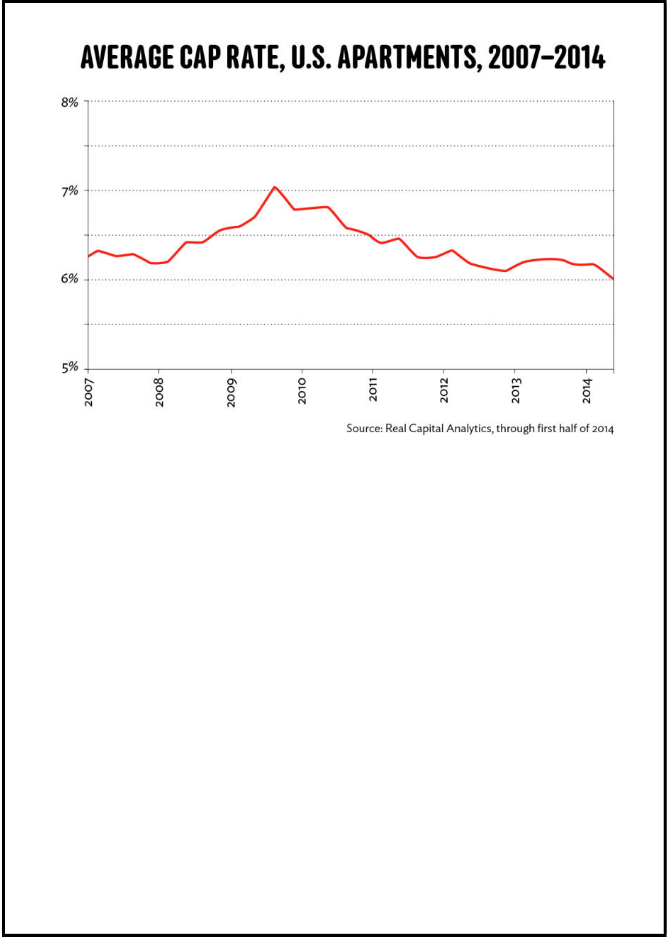

One of the conundrums in today’s multifamily universe is the ever-shrinking cap

rate. For apartments overall, cap rates at the midpoint of 2014 were hovering around 6 percent, according to RCA. They were considerably lower for mid- and high-rises, registering in just the high 4s. Five years ago, cap rates for apartments overall were above 7 percent.

The trend, fueled in large part by the flood of cash that has driven up prices, raises the question of whether cap rates can continue to drop. Most observers respond with a qualified yes.

“Can cap rates go lower? Maybe not in New York City—they’re pretty low [there] already,” says Zachary Bornstein, managing director of capital markets at New York–based Olshan Properties, an owner and manager of 19,000 units. “But in a smaller market where you can get a 5 percent yield and rental increases should still be fairly dramatic? I don’t see why anyone wouldn’t be willing to pay a lower cap rate in that case.”

Bornstein’s response highlights a marked difference from past cycles: Executives aren’t voicing a lot of concern over today’s low cap rates and the potential for them to continue to compress. Their reasons are threefold: The first is the still-

healthy 2x spread between cap rates and 10-year Treasuries, which means investing in multifamily, which offers small perceived risk, gives you significantly more return than “zero-risk” Treasury bonds. The second reason can be traced to the evolution of multifamily as a whole.

“If you’re looking at cap rates today versus 20 years ago, as an absolute number, they’re significantly lower,” says Pete Vilim, co-founder of Chicago-based Waterton Residential, which owns 19,000 units. “But I think what’s important is the difference in what that cap rate is telling you today—you can be a lot more confident that it’s realistic on a once-you-own-it basis.”

In other words, while a 4.8 percent yield on a high-rise might seem low historically, it’s also probably going to track more accurately than it has in the past. Vilim attributes that to the higher level of institutionalized operations, which have evolved dramatically over the past two decades. The use of technology, particularly revenue management and cost management platforms, has also helped the trend.

“Cap rates have compressed because you’re much more sure about what your next 12 months will look like,” Vilim says. “It’s not that they’re lower; it’s that they’re more transparent.”

The third reason execs aren’t overly bothered by falling cap rates is multifamily’s algebra: Because cap rates are a derivative of net operating income, which is

heavily influenced by the rents charged at a property, a low rate today won’t necessarily be low tomorrow.

“Even at low ‘going-in’ rates, properties in markets that experience rent growth can produce superior results down the road,” says Barbara J. Gaffen, co-CEO of Northbrook, Ill.–based Prime Property Investors, which holds 3,000 units. “That’s why cap rates will remain compressed on quality assets located in high-growth markets.”

Lessons From Single-Family’s Woes

Of course, that optimism hinges on demographics, in which 80 million

Millennials who either can’t or don’t want to buy homes will compete for a limited supply of apartments. But it’s also worth noting that the same math that makes low cap rates look good today also depends on rents continuing to rise. After all, the bubble on the single-family side kept expanding just fine, as long as prices kept going up.

This “trending” of rents is an area of concern that apartment finance pros are keeping an eye on.

“The biggest question on the horizon I see, at least for us, is affordability,” says Price Realty’s Ochstein. “We’ve seen tremendous ability to raise rents the past couple years and still feel there is room for more, but, at some point, there will be push-back.”

Another harbinger of the single-family debacle—looser lending terms—is also starting to crop up in apartment finance today.

“It’s not that lenders are becoming intoxicated,” says Finkel. “But they might be getting a little tipsy.” He points to the emergence of five- and 10-year interest-only loans in the marketplace. “It’s not fun being a multifamily lender today—it’s hard

to make money. I think if you surveyed lenders about the best terms they’ve offered in the last six weeks—and could get an honest answer—you’d be shocked.”

With those caveats, though, these observers see ample access to capital in

2015. While equity has flooded the market, debt remains more attractive, given today’s low interest rates and the fact that investors want higher returns, sometimes to the tune of 10 percentage points higher.

Beware of Taking Too Much Debt

Yet, with the view that the cycle is moving toward its midpoint, apartment finance pros express caution about how much debt one should take on, and for how long. Waterton’s Vilim, for example, says his firm doesn’t go any higher than a 65 percent loan-to-value ratio, and given the recessions of 2000–2001 and 2009–

2010, it would be prudent to keep a close eye on deals that will mature around

2020.

“If we’re midcycle, deals with a three- to five-year horizon should be OK, and those with a 10-year time frame should be OK,” Vilim says. “The person who could get hurt is the seven- to 10-year buyer with a mature fund that is due to be liquidated in 2020.”

Also, watch those fixed-rate loans, which often have hefty penalties for early exits. “One of the lessons from the last cycle is that a lot of people put on fixed- rate CMBS debt, which really handcuffs you when you want to sell your property before your maturity date,” says Finkel. “A lot of people have gains in properties they’d like to take advantage of in this very strong sales market, but can’t. They’re tied up in fixed-rate CMBS debt. The cost to get that loan taken off is high.”

In fact, it was those very types of loans, taken out in 2006 and 2007, that may lead to more properties coming onto the market in 2015, in the sweet spot of where many are seeing yield right now: value-add. While some developers can still make returns pencil out on new construction today, many have been hamstrung by rising land, material, and labor costs over the past three years. Those developers are selling what they’ve finished for a profit, but buying the lot next door to that finished property is often proving cost-prohibitive now. With acquisitions commanding low cap rates, that means value-add has been—and should continue to be in 2015—the place many investors go.

“In 2015, you’re going to start seeing the unwinding of what I would call the legacy-era investments,” Vilim says. “All of us who bought from 2006 to 2008 were stuck in those deals because of the recession, and many of us had 10-year debt that starts to mature next year. I think you’ll see a significant disgorgement of product that was bought in the peak of 2006 to 2008, [and] it’s probably ready for its next face-lift.”

Secondary Opportunities

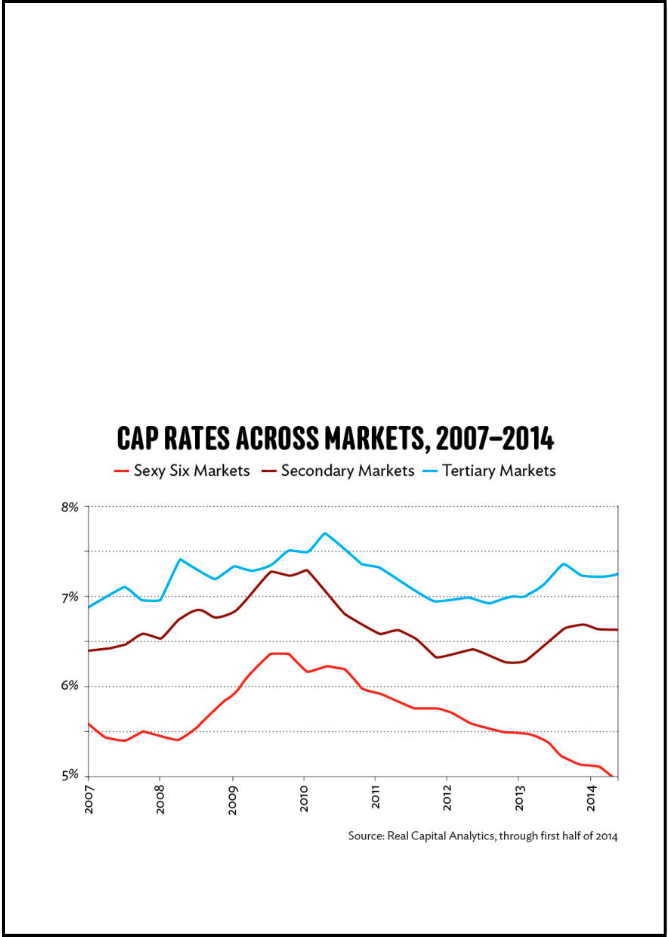

While coastal urban markets have been multifamily’s darlings in recent years, the competition for deals there, as well as dramatic increases in rents, has begun to make other markets attractive.

“The projects happening right now are all very similar to each other: high-end urban that targets the top 25 percent of highly educated renters,” says Finkel. “I’d be a little nervous about taking on too many of those deals. Apartment rental growth rates are slowest in Class A and highest at Class B and C. That’s where I see the opportunity, providing apartments for everybody who’s not in that top 25 percent.”

Indeed, according to RCA, markets such as San Diego; Philadelphia; Portland, Ore.; Baltimore; and Nashville, Tenn., had significant gains in the first half of

2014 as investors searched for attractive returns relative to primary markets.

In particular, Finkel likes targeting properties that were the fruit of another boom time for multifamily—the 1980s.

“There were so many apartments built in the 1980s, some of them extremely well located, that are renting for $800 to $900 today, and most of them haven’t seen a lot of improvements,” Finkel says. “If you can find those and do a significant upgrade to charge $1,200 to $1,300 in rent—the sweet spot for the median

income of $52,000 in this country—I think you’ve got a real opportunity.”