HELOC Secondary Market Commentary

New York (4/25/2019)

Co-authored by Steven Bivona, Vice President, Loan Sales & Real Estate Sales & David Tobin, Principal, Mission Capital

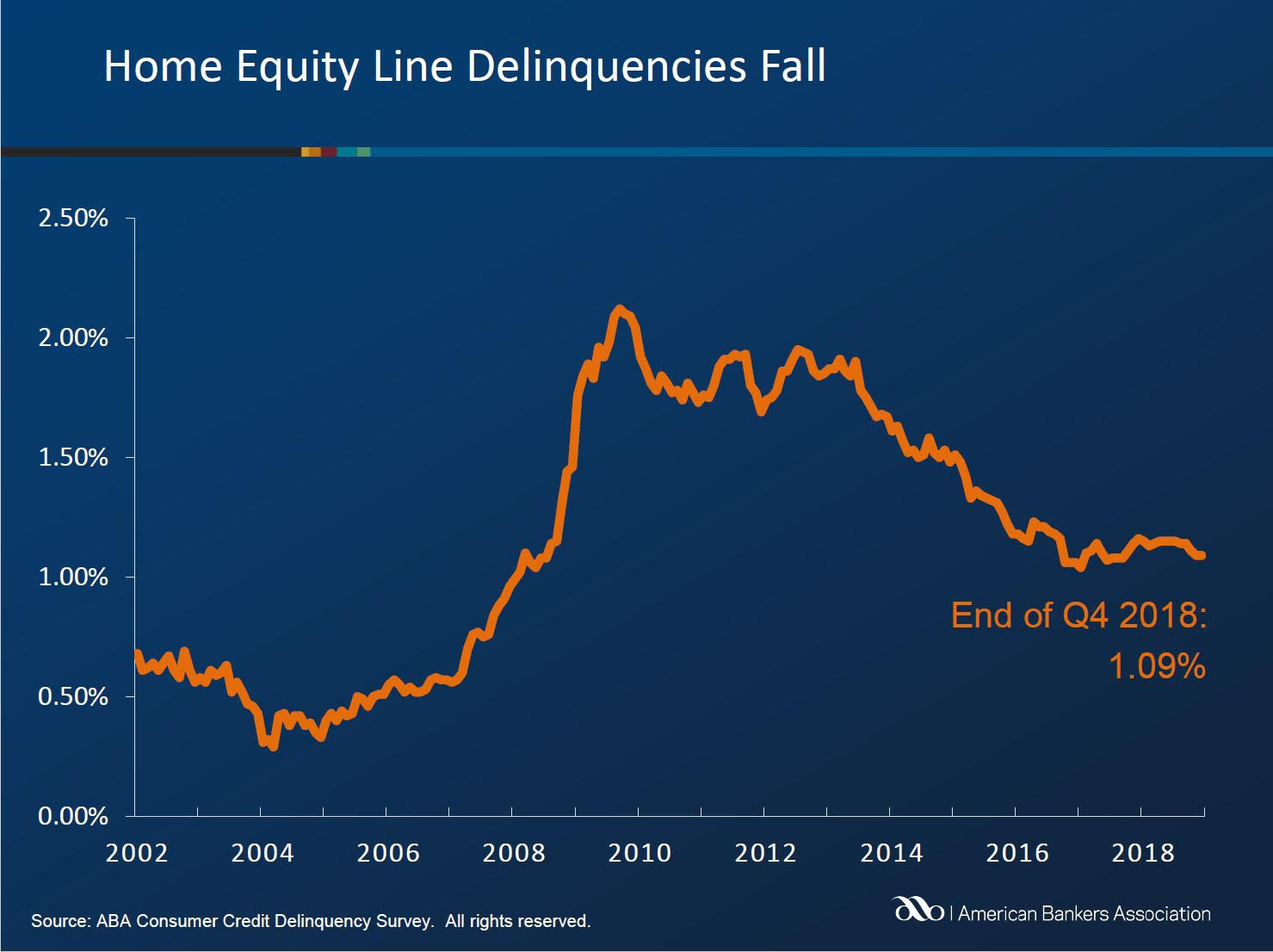

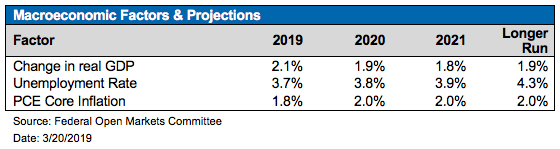

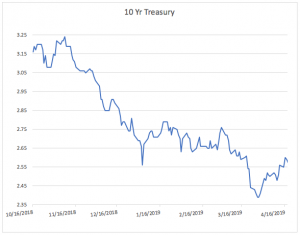

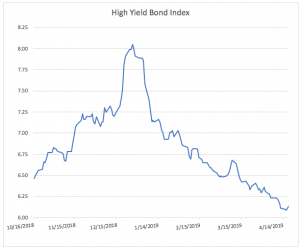

Underlying HELOC fundamentals continue to improve alongside a strengthening US labor market and continued housing price appreciation. Secondary market HELOC pricing/yields have benefitted from the recent rally in the fixed income and credit markets.

Underlying HELOC fundamentals continue to improve alongside a strengthening US labor market and continued housing price appreciation. Secondary market HELOC pricing/yields have benefitted from the recent rally in the fixed income and credit markets.

Roughly $340 billion HELOCs are currently outstanding on bank balance sheets (down from a peak of $611 billion in 2009). Recent legacy loan portfolio sales have generated substantial interest as asset class awareness has increased, demand for alternative fixed income products has grown and most importantly, as the majority of legacy HELOCs are now closed to advance. This creates a more traditional amortizing product which lends itself well to smaller bite size private label 144a securitizations and by extension…Wall Street.

Product Overview and Uses/Benefits

Legacy HELOCs carry floating interest rates with roughly 6% current coupons. The product typically features an initial draw period of 5 to 15 years where interest only payments are collected. This is then generally followed by a 10 to 20 year amortization period where principal is paid down or refinanced into a similar product.

From a borrower perspective, the revolving nature of the product makes it useful for cash management.  The credit line can be used to cover future costs such as medical bills, home renovations, student tuition, or emergencies. HELOCs bear lower interest rates than other comparable revolving facilities such as credit cards. HELOCs and other 2nd liens usually see an uptick in origination volumes when interest rates rise, since it’s more economical for borrowers to take out a second mortgage instead of refinancing an existing low fixed rate. Generally speaking, HELOCs lost the benefit of interest deductibility with the recent tax law changes, subject to some grandfathering provisions.

The credit line can be used to cover future costs such as medical bills, home renovations, student tuition, or emergencies. HELOCs bear lower interest rates than other comparable revolving facilities such as credit cards. HELOCs and other 2nd liens usually see an uptick in origination volumes when interest rates rise, since it’s more economical for borrowers to take out a second mortgage instead of refinancing an existing low fixed rate. Generally speaking, HELOCs lost the benefit of interest deductibility with the recent tax law changes, subject to some grandfathering provisions.

Recent Transactions and Trends

In terms of the secondary market, the following asset classes have been actively trading the HELOC space. Contact Mission for pricing quotes:

- Legacy Performing HELOCS – prices dependent on rate type (fixed vs. variable), coupon, remaining term and balloon features

- Re-performing legacy HELOCs are trading slightly back of performing 2nds largely due to lower coupon

- Legacy charge-off HELOCs

- Non-performing partially secured charge off HELOCs – prices dependent on collateralization

- Performing charge off HELOCs (under modified terms or settlement agreement terms) – prices dependent on terms

- Unsecured charge off HELOCs with minimal or no cash flow

Trade ideas include the following:

- Pair Second Lien Performing, Non-Performing with Charged-Off Assets to enhance gain on sale / cash proceeds from assets / offset NPL losses. The Pair Trade also allows Clean Up Calls for legacy securitization using High Water Mark charge off sale proceeds to retire bonds.

- Reduce Fixed Rate Exposure by selling second mortgages that are closed to advance / fixed rate / terming out (less desirable due to lack of inherent interest rate hedge and with less chance of refi).

- Sell Closed-End NPL HELOCs Paired With Re-Performing loans (RPLs) with attractive 6.00%+ coupons and at least 12-24 months of re-performance or post-modification payment history to achieve better overall execution for more problematic portfolio loans.

- High Water Mark Pricing for all performance types of legacy seconds due to housing price appreciation, cash flow demand and structured investors (private 144a securitization market).

Given the positive developments in the macroeconomy and secondary markets, in conjunction with legacy HELOCs structurally reaching their amortization period, financial institutions have found it to be an opportune time to transaction in the HELOC space.

|

|

|