5/19/2017 Lodging Magazine May 2017

Where And What To Invest

Ellen Meyer

Listening to the market helps hoteliers make the best use of investment dollars.

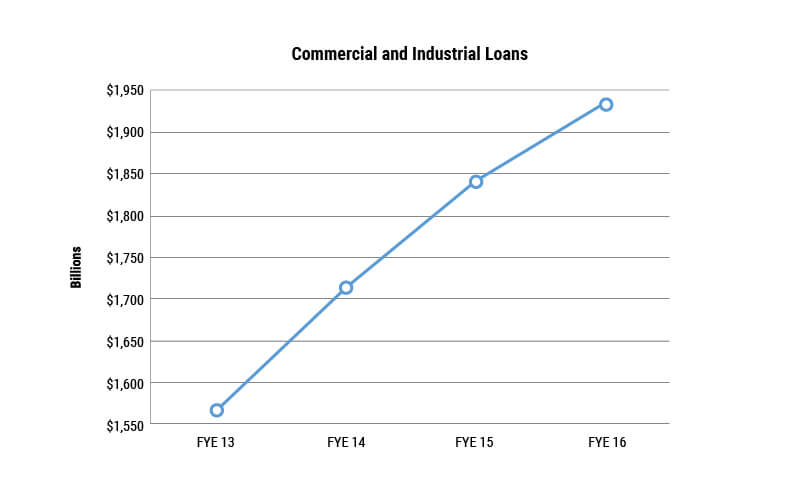

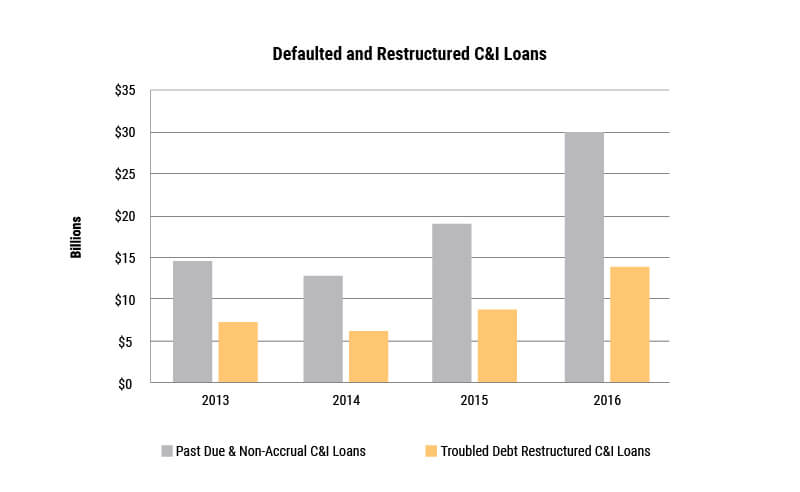

For the past several years, the hotel industry has enjoyed solid economics and record-setting growth following the difficult era of the Great Recession. Now, the tides are turning once more, and the industry is starting to show slower—but still steady—growth. While hoteliers are aiming to capitalize on a still-strong market, lenders are starting to tighten up and there is less available debt for the taking. This is making many investors move cautiously, looking to make the most of their dollars.

But what is the best way to invest?

Where should people be funneling their dollars? To gain a current perspective on the ever-changing hotel investment scene, LODGING recently spoke to representatives from both the financing and sales transaction sides of the equation. Among the topics they discussed were the current state of the market, the impact of tighter money, a stronger dollar, and changing consumer preferences on their respective businesses.

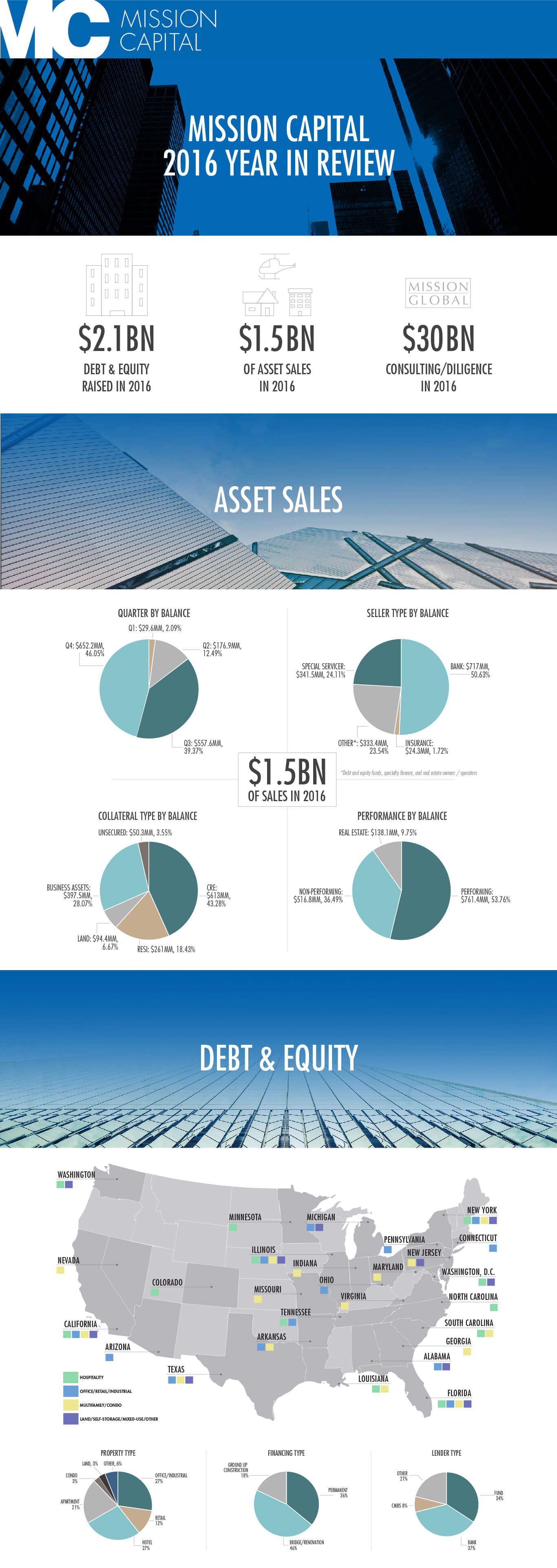

On the financing side is Jordan Ray, principal of The Debt & Equity Finance Group at Mission Capital Advisors, where he oversees business development, strategy, placement, and execution of real estate capital on behalf of major owners, investors, and developers nationwide.

Ray is quick to say that he rarely advises clients specifically on where they should invest, preferring instead to focus on the deals that are being done currently. He also makes clear that his comments are based on the deals being done at his own firm, which he says has no designated hotel group but likely handles more of those types of transactions than those that do. “Mission Capital represents a lot of really different and interesting hotels, developers, owners and operators, and projects,” Ray explains. “And we aim to do what’s best for our clients at any given part of the cycle.” Most of his deals, he says, involve raising debt, though his firm handles a few equity deals each year. He also adds that when his firm believes especially strongly in a particular deal, they may invest along with the client. “This is mainly because we believe in what we’re selling.”

Steve Kirby is managing principal of Mumford Company, a hotel brokerage and advisory services firm, where in addition to being an active broker, he manages the marketing and administration operations of the company’s five offices. Kirby says right now is a good time both for buyers and sellers, but maintains that it’s difficult to generalize what constitutes a “good investment” due to regional taste differences. “Lodging is a street-corner business; what works in Atlanta may not work in N.Y.” However, he maintains, the most popular type of hotel investments continue to be limited-service projects with a mid-market focus. “Most of those types of properties, which have been developed over the past 20 years, have been very successful.” Yet, noting what he calls “amenity creep,” Kirby says the lines are becoming blurred between upper-scale and mid-market properties. “It is often difficult to tell the difference other than in the meeting space. The rooms are just as nice. They have slightly more amenities at the full-service hotels, but in general, the product offerings in the guest rooms and in the public areas are very similar.”

CHANGING CONSUMER PREFERENCES

Perhaps in line with Kirby’s observation about “amenity creep,” Ray discussed how the rise of a new kind of consumer has driven investment in properties that would have been tough sells in the past. “Consumers’ preferences and what they actually want out of the lodging experience is changing. There is more demand for less traditional, more experiential hotel stays.”

Ray observes that the reasons for going to one hotel over another are changing. “While in the past, people might choose a hotel because it was a flagship, near a particular attraction or business location, or due to a loyalty program, an increasing number of people want to be able to work, eat, hang out, and do things in places where they are comfortable.” This, he says, can have a very desirable snowball effect. “When people enjoy spending time in the hotel as well as the location’s attractions, they are more likely to become loyal and spend their money as well as time there, and to generate buzz through social media and digital marketing, encouraging their friends to check out those places, too, when they come to those major markets.”

Ray notes also that in many of these major markets, an increasing number of hotels have become hubs for gathering. “Many people still want to hang out in the lobby of the Ace Hotel in Midtown Manhattan when visiting New York, but there are about 12 different places like that right now, where everyone wants to hang out in the lobby. The experiential part of that makes us want to stay there. So, there are a lot of other draws versus loyalty programs.”

Given his belief in these types of properties, it should come as no surprise that these are the ones his firm gets increasingly behind, to the extent that Mission Capital has developed a niche of sorts, financing less conventional, distinctive hospitality spaces; they include Graduate Hotels—which are in “dynamic university towns,” such as Ann Arbor, Michigan—and also what might be considered lifestyle or boutique hotels.

Ray says selling lenders on boutique properties isn’t that different than selling guests on booking a hotel stay. “It used to be challenging to finance these unique properties, but a market for these assets has developed, so there is now an appetite among lenders for these types of properties, which have become easier to sell,” says Ray. Being able to explain the appeal of an asset that provides an alternative experience, he says, is essential in order to sell a client on buying or developing it. “It all comes down to people. Just like other human beings, those making decisions about investments often need to do more than just hear or read about them. They often need to experience them for themselves to understand their appeal.”

DEMAND GENERATORS

Ray believes that properties that will stand the test of time are best located in environments where there are demand generators—e.g., state universities, capitals, and growth—and “a great sense of place.” He maintains, “Even though preferences change, a lot of really great assets are being created without the help of big brand names, and these assets are becoming synonymous with the place.”

Both Ray and Kirby noted the trend toward incorporating hotels into larger mixed- use developments, including those with residences. “The way that we look at that, is, obviously, there are shared elements between residence and hotels, but when you have condos, you end up dollar cost averaging down your basis in your hotel room,” says Ray. “I think nearly everywhere a developer has done some retail, restaurants, and living space, they try to incorporate a lodging product of some kind,” says Kirby.

CHANGING INVESTMENT ENVIRONMENT

Ray and Kirby also weighed in on the impact of a stronger dollar—which has made investment by foreigners more expensive—and the challenges posed by either the reality or perception of tighter money.

Although Kirby says he believes obtaining loans is becoming more difficult for both construction and purchase, he considers it “doable but more difficult” for new construction. “The lenders are tightening on the new construction front without a doubt. We had our first rate increase in 10 years, and fully expect a couple more, but I think that the developers and operators are pricing that into their offers these days.”

Ray agrees that there are challenges, but says it’s his job to identify and overcome obstacles and make smart decisions.

“Of course, we would rather finance cash-flowing assets at this point in the cycle, but we earn our stripes by getting deals done in a certain environment, and we are getting them done.” Whether or not it is due to less purchasing power by foreign investors and tourists or by perceived problems with hotel room supply in New York, Ray says, the reality is that more deals with his firm are currently happening in markets like Austin, Chicago, Seattle, L.A., and Miami.

As far as foreign investment goes, Kirby, who maintains that “the U.S. is probably the safest investment market in the world now,” finds it hard to tell if the strong dollar has hindered it. “Chinese investors seem to be hampered more by restrictions their own government is placing on the allowable number of large acquisitions than by the strong dollar’s impact on the cost of these acquisitions. I don’t know if they limited it, but they have restricted it to further review before they allow the large acquisitions that they once did.”

LOOKING AHEAD

While Kirby says there are opportunities for both buyers and sellers now, he believes prices are maintaining high levels despite the spate of new construction—a pipeline that includes 4,960 projects and 598,688 rooms as of the end of 2016, according to Lodging Econometrics.

Kirby also says, “We think now is a good time for a lot of people to get out, not necessarily to get out of the market, but to reallocate their capital.” However, buyers who can operate a property more efficiently than the previous owner, he says, can profit by driving more money to the bottom line, if the top line stays the same. “I think we are going to see a lot of transactions this year, but now is a good time to take some profits if you can.” He reassures that this will change, as always, and there will be a buy and building opportunity over the next few years again.

“Labor costs will definitely rise over the next few years. The top line should be okay, the bottom line is probably going to be weaker going forward for the near term,” he explains.

BACKING A BRAND

Keeping investor interests in mind when developing Tru by Hilton Though the current lodging cycle is thought to be winding down, it hasn’t stopped the deluge of new hotel brands joining the market. However, it has affected the way that the big hotel companies are developing them. As these companies choose to invest in launching new brands, there is careful consideration given to developers’ return on investment.

An example of this phenomenon is the new midscale brand Tru By Hilton.

Launched just last January at the 2016 Americas Lodging Investment Summit, Tru is already seeing massive investment from the lodging community at large. As of February of this year, the brand has accumulated more than 170 signed deals in the U.S. and Canada and has more than 400 more in various phases of negotiation. This level of interest from the hotel community was not entirely unexpected— Tru was conceived and developed to be a smart investment for hoteliers. The hotels can be built on as little as an acre and a half of land, giving it a market flexibility that other flags might not offer. Additionally, Tru properties require less capital upfront, which makes financing easier.

Hilton also saw opportunities in the midscale segment, an area of the market that the company has not really explored in the past. “It’s always a good time to invest or buy in the midscale segment,” says Alexandra Jaritz, global head of the Tru by Hilton brand. “I don’t want to say that the segment is recession proof, but it’s definitely safer,” she adds. The first Tru property is due to open May 25 in Oklahoma City, Okla., and eight more will follow this year. Sixty more properties are set to open in 2018. As it stands, Tru is the fastest growing brand in Hilton’s history.

1: NEW YORK

BIG HOTEL OPPORTUNITIES IN THE BIG APPLE

With a pipeline of 192 properties and 30,541 rooms, New York City has the largest hotel development pipeline in the United States. The Big Apple is also the most populated city in the country, home to more than 8 million residents and hundreds of major corporations including Morgan Stanley, Citigroup, and ABC.

Comprised of five boroughs, the iconic city is full-to-the-brim with tourism hot spots such as the Empire State Building, Central Park, and Times Square. With a positively booming year-round tourism industry, New York City brought in more than 58 million visitors in 2015, around 12 million of which were international travelers, according to NYC and Company, a destination and marketing organization focused on New York’s five boroughs. Also in 2015, tourists spent more than $42 billion, which has a huge impact on the city’s overall economy.

As far as hotels are concerned, in 2016, NYC had an average occupancy of 85.8 percent and an average ADR of $258.89. Even though the statistics are impressive, hotel competition in the Big Apple is quite fierce, especially with all the new supply entering the market. That’s why many of the hotels opening over the next few years have a hook, helping them stand out to travelers. One such hotel will be the Graduate Roosevelt Island, due to open on the narrow island in the city’s East River in 2019.

As a brand, Graduate Hotels is focused on development in college towns. The Roosevelt Island property is located in the center of Cornell Tech and is the first and only hotel on Roosevelt Island.

David Rochefort, vice president of investments and asset management at AJ Capital Partners, the company behind the Graduate brand, believes it important for hotels to emphasize their uniqueness, especially in NYC. “There is an extreme draw to be a part of this city and to design something extremely unique within our portfolio,” he says. “It’s the best hotel market in the world.”

2: HOUSTON

DIVERSE DRIVERS AND A BUSINESS-FRIENDLY ENVIRONMENT PRIME THE HOUSTON HOTEL MARKET FOR CONTINUED GROWTH

Following the January 2016 crash in oil prices, it wouldn’t be too much of a stretch to think that the economy in Houston, Texas—a city internationally recognized for its energy market—would be suffering. But that is very much not the case. Houston’s economy has an ever-diversifying set set of drivers, from renewable energy sources like wind and solar, to healthcare and biomedical research, and even aeronautics.

According to Chris Green, COO of Greenbelt, Md.-based hotel management company Chesapeake Hospitality, Houston’s economy succeeds because the city is very business-friendly. “It’s a great place to do business. There aren’t a lot of barriers to entry and people are building new businesses there all the time.” Chesapeake manages two properties in the Houston market, including The Whitehall Houston, which is located in the city’s downtown.

The hotel pipeline in Houston is the second largest in the United States, totaling 169 properties and 18,373 rooms. Even with all the new supply coming in, Green isn’t particularly concerned about the longterm viability of Chesapeake’s Houston properties.

“You’ve got a really large marketplace with lots of amazing submarkets. You’ve got a whole bunch of city centers within one marketplace that all have their own unique business drivers,” he explains. “There’s something for everyone.”

3: DALLAS

INFRASTRUCTURE IMPROVEMENTS AND AN EXPANDING URBAN CENTER MAKE THIS TEXAS CITY A DEVELOPMENT HOTSPOT

With a pipeline of 140 properties and 17,291 new rooms, the city of Dallas, Texas has the third largest hotel development pipeline in the United States. For those familiar with the area, these numbers are no surprise— in 2016, the city had the highest year-over-year population growth in the country and it boasts the fifth largest metropolitan economy. It’s also home to a number of major corporations, including State Farm, Toyota, and JP Morgan.

With such a strong business environment and so much hotel competition coming to the Dallas market, many of the city’s existing properties are upping their game, investing in renovations to draw a bigger share of travelers. One of these hotels is the Sheraton Dallas Hotel by the Galleria. Purchased by North Palm Beach, Fla.- based Driftwood Hospitality Management in late 2016, the hotel is currently in the midst of major guestroom renovations. Steve Johnson, executive vice president of Driftwood, says that the renovations were a necessary move, especially considering the hotel’s location, which is surrounded by major office buildings and high-end residences. “We needed to have a product that would allow us to improve occupancy and RevPAR,” he describes. The hotel also sits right next to the city’s freeway, which was recently widened and updated during a $2 billion improvement project—just one example of the steps the city is taking to continue its growth and invest in its own infrastructure.

“Dallas has been growing well for as long as I can remember, and certain sectors— like ours—are growing faster than others. We feel really good about our investment in the Sheraton, and we expect it to remain strong for the foreseeable future,” says Johnson.

4: NASHVILLE

THE CAPITAL OF TENNESSEE’S BOOMING TOURISM SECTOR IS MUSIC TO THE HOTEL INDUSTRY’S EARS

For the past several years, the city of Nashville, Tenn., has enjoyed significant economic growth. The city is also experiencing increased wages and a tighter labor market. It’s currently a major music recording and production hub for both major and independent labels, earning it the moniker “The Music City.” Nashville is also a major healthcare hotspot—more than 300 health care companies call the area home. And in 2015, Nashville was named Business Facilities’ number one city for economic growth potential.

With so many ties to the music industry, Nashville tourism is booming. More than 670,000, tourists flock to the “Music City” annually to experience what it has to offer, including Music Row—an area dedicated to country, gospel, and Christian music—the Country Music Association, Country Music Television, and Universal Music headquarters.

With so many travelers and businesses coming to Nashville, it is a great time to be a hotelier developing in the area. There are 121 hotels and 14,873 rooms in the Music City’s hotel development pipeline. Projected RevPAR for this year is up 3.9 percent from 2016, and demand growth has climbed 4.4 percent.

Virgin Hotels started looking into the Nashville market immediately after launching their brand in 2010. “When we first visited the city, there was a lot of energy and an overall good vibe. We could feel the underlying culture that made the city tick. That culture was a perfect fit with what we were looking to offer Virgin customers,” says Allie Hope, head of development and acquisitions at Virgin Hotels. In December 2015, the company acquired a site on Music Row. The planning stage has been extensive, but Virgin will break ground on the property this summer and open the hotel in 2019. “We cannot wait,” says Hope. The 260-room property will have a rooftop pool and food and beverage options that reflect the Nashville culture.

5: LOS ANGELES

EVEN WITH HIGH BARRIERS TO ENTRY, THE HOTEL MARKET IN THE CITY OF ANGELS IS VERY IN-DEMAND

Home to one of the largest populations in the United States—3.8 million—and a strong economy where one in every six people works in a creative industry, Los Angeles, Calif., is a prime location for hotel development. However, getting a project off the ground in L.A. can be a major feat. The market is already very saturated and inflation and construction costs are steadily increasing. Southern California has also made it consistently difficult to build with complex zoning laws and height limits. However, this hasn’t really stopped people from trying—and succeeding—to bring new hotels to this market.

Even with numerous barriers to entry, Los Angeles boasts the fifth largest hotel construction pipeline in the United States—111 hotels and 18,723 rooms. According to Eric Jacobs, chief development officer at Marriott International, a lot of this supply can be traced back to 2009, when the recession offered developers a major opportunity to enter the L.A. market. “The southern California hotel market got very soft. Developers who otherwise wouldn’t have been able to open a hotel in this area could. Things in L.A. move very slowly. A lot of the hotels that are opening in the next couple of years have actually been in process since 2009.”

Right now, Marriott has many Los Angeles-based projects in the works. “When developing in L.A., hoteliers should keep in mind that the due to the city’s size, there are many different submarkets worth pursuing. There is no reason to limit yourself to downtown,” Jacobs notes.