Media Contact: Ryan Smith rsmith@beckermanpr.com

201.465.8023

FOR IMMEDIATE RELEASE

Mission Capital Expands Southeastern U.S. Presence With Two

Additions to Florida Office

Terry Strongin Joins Firm as Director, While Director Rob Beyer Relocates from NYC

PALM BEACH GARDENS, Fla. (April 29, 2015) — As part of a strategic plan to grow its Florida presence and expand its Southeastern U.S. coverage capability, leading real estate capital markets solutions firm Mission Capital Advisors today announced a significant new hire and the relocation of one of its top executives.

A veteran of the commercial real estate and securities industries, Terry Strongin joins Mission Capital’s Palm Beach Gardens office as a Director in the Debt and Equity Finance Group.

Additionally, Rob Beyer, also a Director in Mission Capital’s Debt and Equity Finance Group, will relocate to the Palm Beach Gardens office from the company’s headquarters in New York City.

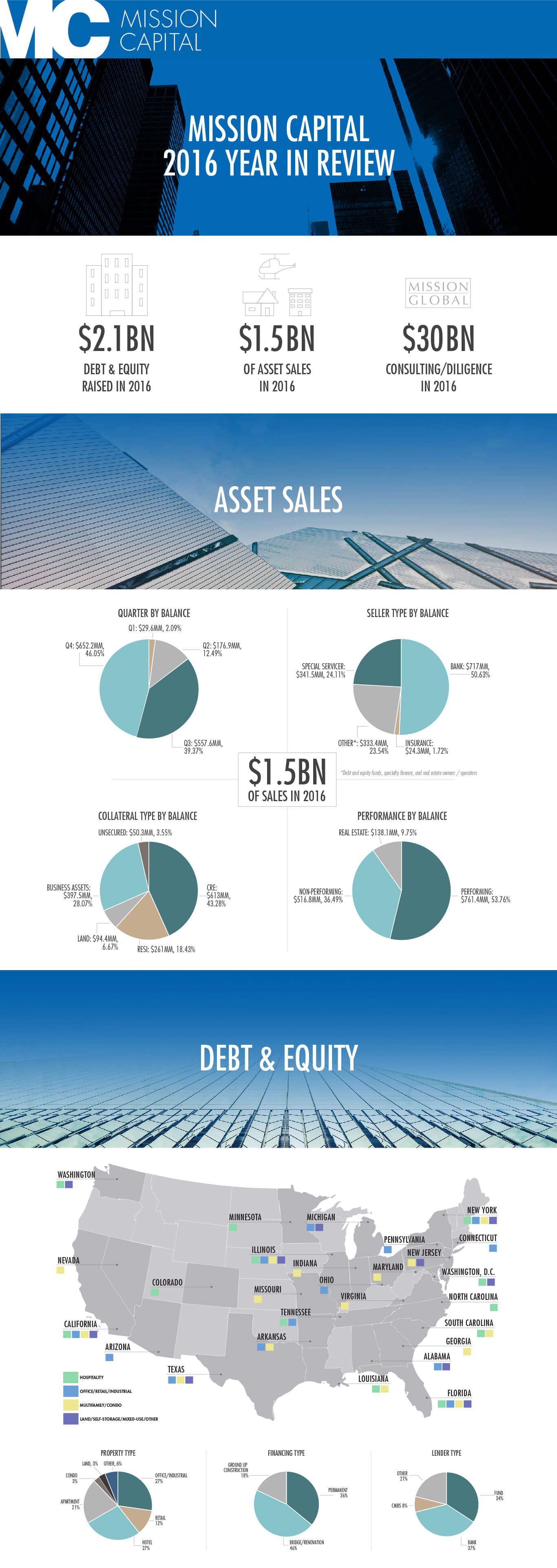

Since establishing a presence in Florida, Mission Capital has proved to be one of the Southeast’s most active arrangers of real estate debt and equity. Since 2010, the firm has arranged 12 deals in the Southeast, with a total value of approximately $550 million.

Noteworthy financings arranged by Mission Capital in Florida include the $16.75-million first-mortgage financing of Doral Court, a 209,075-square-foot office building in Doral; the $21-million refinancing of the Freehand Miami, a 256-bed, upscale boutique hotel located in Miami Beach; the $19.2-million construction financing of Sage Beach, a 24- unit luxury oceanfront condominium development in Hollywood; the $106-million construction financing of Echo Aventura, a 190-unit luxury condominium high-rise in Aventura; the $10-million acquisition financing for Hotel 18, a 45-key hotel in Miami Beach; the $38.5-million renovation financing of Garden South Beach, a 133-key, full- service hotel in Miami Beach; and the $22.5-million financing of a land loan for Echo Brickell, a 166-unit luxury condominium high-rise in Miami.

“The Southeastern U.S. is one of the regions that we’re strategically focused on. Aggressive expansion of our Debt & Equity Finance Group here is well supported by our ability to attract the market’s top talent and the strong economic activity and growth prospects,” Mission Capital Principal David Tobin stated. “As we work to expand our coverage of the region, we’ll continue to seek out talented commercial mortgage brokers with skill sets that are strongly aligned with the needs of our clients.”

In his new role, Strongin is responsible for sourcing, structuring and executing both debt and equity finance transactions nationwide. Additionally, he sources and executes commercial real estate investment sales transactions for the firm’s clients.

Prior to joining Mission Capital, Strongin headed the commercial lending group for a major real estate investment trust, and worked as a principal in boutique real estate investment and advisory companies. Career activities include commercial real estate lending, joint venture advisory, non-performing loan valuation and portfolio sales, equity syndication, commercial real estate brokerage, real estate development, and direct real estate investing. He has advised both private and institutional investors including major banks, top tier investment banks, FDIC, and large insurance companies and been directly responsible for negotiating, structuring, and closing over $500 million of real estate equity and debt transactions.

“Mission Capital has demonstrated its ability to execute transactions in Florida and a commitment to growing its Debt & Equity Financing business line in the state and the Southeastern region, and I’m excited to play a part in the expansion,” Strongin said. “I look forward to driving new businesses and cementing the firm’s key relationships in the region.”

In addition, Beyer, who is a graduate of the University of Miami, is relocating to a market with which he is extremely familiar. During his time at Mission Capital, where he is responsible for the origination, structuring and placement of debt, mezzanine and equity capital on behalf of real estate owners and developers, he has completed a number of significant deals. Examples include securing $37 million in financing on behalf of The Siegel Group, which operates flexible-stay apartment communities in Las Vegas known

as Siegel Suites and a highly structured shopping center refinance in the Midwest. He is also raising $30 million in construction financing and joint venture equity for the development of Union Village, a 125-bed skilled nursing facility and 40-bed long-term acute care hospital in Henderson, Nevada.

Prior to joining Mission Capital, Beyer worked for such prominent real estate firms as the Related Companies and a real estate investment bank in New York, where he consummated over $1 billion in equity and debt transactions for real estate companies throughout North America, Latin America and the Caribbean, with a particular focus on hotel assets.

“My time at Mission Capital has been extremely gratifying, and I’m very excited to relocate to Florida and serve as a leader of the firm’s effort to grow its footprint in this part of the country,” Beyer said. “I’m particularly interested in leveraging my experience in the hospitality and senior care sectors to help establish a pipeline of future projects in Florida, where we believe much opportunity exists.”

About Mission Capital Advisors

Founded in 2002, Mission Capital Advisors, LLC is a leading national, diversified real estate capital markets solutions firm with offices in New York City, Florida, Texas,

California and Mobile, Alabama. The firm delivers value to its clients through an integrated platform of advisory and transaction management services across commercial and residential loan sales; debt, mezzanine and JV equity placement; and loan portfolio valuation. Since its inception, Mission Capital has advised a variety of leading financial institutions and real estate investors on more than $45 billion of loan sale and financing transactions, as well as in excess of $14 billion of Fannie Mae and Freddie Mac transactions, positioning the firm strongly to provide unmatched loan portfolio valuation services for both commercial and residential assets. Mission Capital’s seasoned team of industry-leading professionals is committed to achieving clients’ business objectives while maintaining the highest levels of integrity and trust. For more information, visit www.www.missioncap.com.