Buch the Trend — A Commercial Real Estate Blog

The Place for PACE

By Steve ‘Buch’ Buchwald – The Debt & Equity Finance Group

(Steve ‘Buch’ Buchwald, New York, 3/25/2019) — In my previous article on Historic Tax Credits, we discussed one complicated financing structure commonly used by developers to capitalize their deals. In this article, we will discuss PACE Financing. I will do an article on several of these – a quick list includes Historic Tax Credits, PACE Financing, EB-5, and Ground Leases. Each of these specialty finance products adds layers of inflexibility to recoup equity, make refinancing decisions, account of cost overruns, and exit or refinance at attractive terms. My next article will be about EB-5, which was similarly popular a few years ago and now many developers regret the decision to take such an inflexible, difficult to deal with piece of capital just to save a few hundred basis points during construction on a small piece of the capital stack.

(Steve ‘Buch’ Buchwald, New York, 3/25/2019) — In my previous article on Historic Tax Credits, we discussed one complicated financing structure commonly used by developers to capitalize their deals. In this article, we will discuss PACE Financing. I will do an article on several of these – a quick list includes Historic Tax Credits, PACE Financing, EB-5, and Ground Leases. Each of these specialty finance products adds layers of inflexibility to recoup equity, make refinancing decisions, account of cost overruns, and exit or refinance at attractive terms. My next article will be about EB-5, which was similarly popular a few years ago and now many developers regret the decision to take such an inflexible, difficult to deal with piece of capital just to save a few hundred basis points during construction on a small piece of the capital stack.

If you are in the commercial real estate development or financing business, I would be surprised if the term PACE Financing hasn’t crossed your desk by now. So…what is PACE? PACE stands for “Property Assessed Clean Energy”. Putting aside the minutiae of energy efficiency and what costs qualify, the key components to address are whether to employ PACE, where it lies in the capital stack, its security and repayment terms.

Before we explore what PACE really is, let me first address how it is pitched. PACE lenders have hired some amazing sales people and put out some extremely compelling materials about their programs. These materials paint a rosy picture – at the end of this article I will address how their materials could present a more balanced view – but borrowers are often drawn to low interest rate financing alternatives regardless of the potential costs and penalties down the road or across the rest of the capital stack. Like all new forms of financing, developers should be discerning and cautious. Low interest rate financing alternatives that look attractive on paper can have unintended consequences as the project progresses, particularly when it needs to be refinanced, recapitalized, or sold.

So how is PACE pitched? It is pitched as a long-term, low cost mezz alternative. Why pay 12% for mezzanine debt or preferred equity when you can get PACE for 7% fixed? However, looking behind the curtains, PACE cannot be compared to mezz in terms of security and its position within the capital stack. A PACE loan is a self-liquidating loan that is secured by a tax lien and is repaid through tax payments over a 20-year period. Like any tax lien, it is in first position, ahead of any senior lender, and it is literally on the state’s tax assessment roll. That is why some states allow PACE and some do not. But if PACE is the most senior piece of capital in the capital stack, why should it get a higher interest rate than the senior lender? Good question – it shouldn’t.

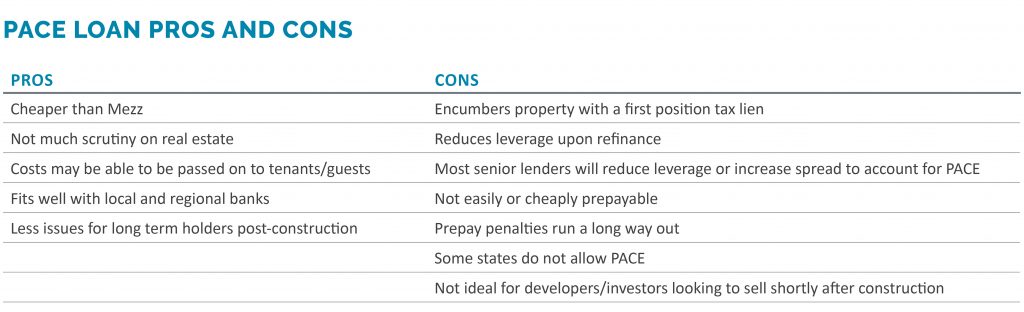

Putting PACE into your capital stack also has a potential cascade effect. If the senior is getting pushed up in effective LTV by the PACE loan, then it will either charge a higher spread on what should be a much larger piece of capital than the PACE piece would represent, effectively killing or more than killing whatever benefit it should provide over a traditional mezz loan, or it will reduce its leverage dollar for dollar at the same rate. Either way, that is not what is shown in PACE marketing materials where it looks as if the senior lender keeps its leverage the same at the same rate. Add on top of this a yield maintenance or hefty 5%+ prepay penalties that reduce in amount but go out a very long time, a reduced NOI due to the tax lien upon refinance, and other ancillary fees, one will generally find that PACE can be an expensive financing alternative, particularly as it pertains to recourse averse developers, developers with larger projects, and merchant builders or partnerships with fund LP capital that want to exit quickly.

To be clear, there is a place for PACE. If you are looking to develop a smaller scale property, desire to hold on to the property for a long time, are in a state that allows for PACE, and are employing local community or regional senior bank debt (typically partial to full recourse), then PACE may make sense. These lenders just care about their Loan to Cost and are underwriting to stabilized DSCR.

One of the perks of PACE is that the green energy aspect of it allows for a rationale to pass the tax lien on to tenants in commercial buildings through their lease or to guests at a hotel as an ancillary charge. While this does affect the end user’s effective rent or ADR, respectively, the underwriting can certainly pass muster for these local and regional bank lenders. Going back to the PACE marketing materials where the lender is pushed up in the capital stack and keeps their loan amount and rate the same – this is now a possibility – and the PACE works as intended (and marketed). It is no wonder then that almost every senior lender that has closed with PACE financing has this lender profile.