By Hugo Rapp, Analyst, Loan Sales, Real Estate Sales, Mission Capital Advisors

In early June, New York State Lawmakers passed the Housing Stability and Tenant Protection Act of 2019. The legislation is a sweeping overhaul of rent laws aimed at increasing tenant’s rights and limiting landlord’s ability to increase rents, evict delinquent tenants and move units to free market status. There are a number of notable changes that come as a result of the rent reform, as outlined below:

Rent Regulation Law Expiration: The new rent regulations are permanent unless the state government repeals or terminates them. Rent regulations previously expired every four to eight years.

Statewide Optionality: Prior geographical restrictions on the applicability of rent laws have been removed, allowing any municipality that otherwise meets the statutory requirements to opt into rent stabilization.

Security Deposit and Tenant Protection:

- Security deposits are limited to one month’s rent with additional procedures to ensure the landlord promptly returns the security deposit.

- Evicting a tenant using force and/or locking them out is now a Class A Misdemeanor.

- On free market units requires landlords to provide notice to tenants if they intend to raise rents more than five percent or do not intend to renew a tenant’s lease.

Vacancy & Longevity Bonus: Landlords were previously able to raise rents as much as 20% each time a unit became vacant. This bonus has been repealed.

High Rent Vacancy Deregulation & High Income Deregulation: Prior to the 2019 reform, units would become exempt from rent regulation laws once the rent reached a statutory high-rent threshold and the unit was vacated or the tenant’s income was $200,000 or higher in the previous two years. This decontrol is no longer applicable under the 2019 reform.

Preferential Rents: The new reform prohibits landlords who offered preferential rents to raise rents to the full legal rent upon tenant renewal. Under the current legislation, the landlord can only increase rents to the full legal rent once a tenant vacates.

Major Capital Improvements: Rent increases based on MCI’s are now capped at 2% annually amortized over a 144-month period for buildings with 35 or less units or 150-month period for buildings with more than 35 units. The new laws eliminate MCI increases after 30 years and require 25% of MCI’s be audited.

Source: Ariel Property Advisors

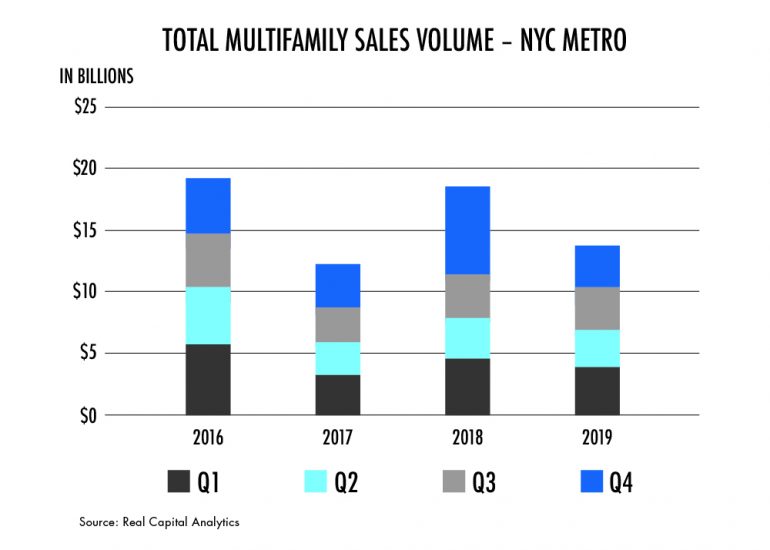

The new regulations make it difficult for landlords to upgrade and convert existing rent stabilized units into market-rate apartments, essentially limiting the potential upside from investing in primarily rent stabilized buildings. As a result, investment activity decreased significantly in 2019. Total sales volume for NYC multifamily properties was just $13.8Bn in 2019, down 26.1% from the $18.7Bn seen in 2018, according to Real Capital Analytics. The new regulations have halted individual apartment improvements as well as any major capital improvements as landlords are no longer rewarded with higher rents for improving units. It is important to note that while investment activity decreased significantly in 2019, sales volume still outpaced the $12.4Bn seen in 2017.

The new regulations make it difficult for landlords to upgrade and convert existing rent stabilized units into market-rate apartments, essentially limiting the potential upside from investing in primarily rent stabilized buildings. As a result, investment activity decreased significantly in 2019. Total sales volume for NYC multifamily properties was just $13.8Bn in 2019, down 26.1% from the $18.7Bn seen in 2018, according to Real Capital Analytics. The new regulations have halted individual apartment improvements as well as any major capital improvements as landlords are no longer rewarded with higher rents for improving units. It is important to note that while investment activity decreased significantly in 2019, sales volume still outpaced the $12.4Bn seen in 2017.

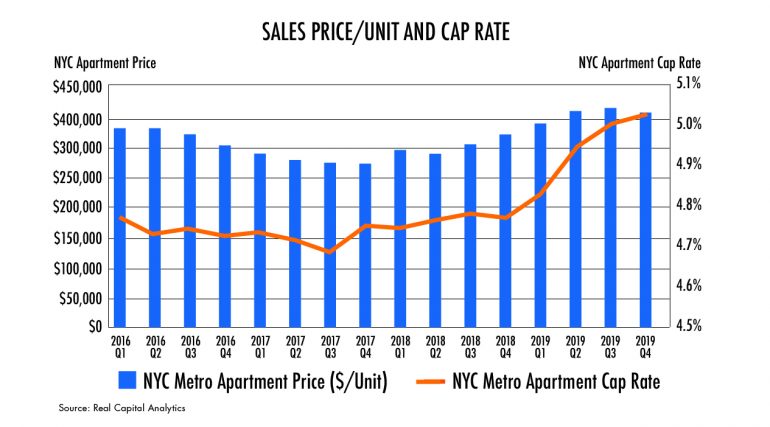

As we enter the first quarter of 2020, the possibility of discounted multifamily valuations coupled with historically low interest rates have attracted investors with a different business model buying loans at par where LTV’s have increased and maturity is looming. On the contrary, the new regulations create a unique challenge for those who have either purchased or lent on multifamily assets in New York under the assumption of significant future rent appreciation. For those investors/lenders, the future may not be as grim as they might expect. Despite several discount sales and declining sales volume, price per unit in the NYC multifamily market has remained steady, declining slightly at the end of 2019. Furthermore, cap rates have widened by just 26 bps in 2019, offering both investors and lenders the option to sell off assets that exceed their risk tolerance and mitigate any future losses. Investors and lenders should assess the viability of selling off assets that are heavily affected by the new regulations as strong pricing levels from market players with adapted business models may result in a less costly outcome than internal resolution.

As we enter the first quarter of 2020, the possibility of discounted multifamily valuations coupled with historically low interest rates have attracted investors with a different business model buying loans at par where LTV’s have increased and maturity is looming. On the contrary, the new regulations create a unique challenge for those who have either purchased or lent on multifamily assets in New York under the assumption of significant future rent appreciation. For those investors/lenders, the future may not be as grim as they might expect. Despite several discount sales and declining sales volume, price per unit in the NYC multifamily market has remained steady, declining slightly at the end of 2019. Furthermore, cap rates have widened by just 26 bps in 2019, offering both investors and lenders the option to sell off assets that exceed their risk tolerance and mitigate any future losses. Investors and lenders should assess the viability of selling off assets that are heavily affected by the new regulations as strong pricing levels from market players with adapted business models may result in a less costly outcome than internal resolution.

[Source: Real Capital Analytics www.rcanalytics.com]