The LIBOR Transition

September, 24, 2019 – by Kyle Kaminski

The London Interbank Offered Rate (LIBOR) is a benchmark interest rate that historically represented an average estimate of interest rates that the major global banks lent to one another on a short-term basis. Although originated in 1969 and currently one of the most frequently used interest rate benchmarks in lending, formal data collection did not occur until the mid 1980’s. It is estimated that approximately $250 trillion in LIBOR-benchmarked product is outstanding.

In 2012, financial regulators (currently the Financial Conduct Authority (FCA)) began requiring that reporting for LIBOR be based on actual transactions rather than estimates. Because of the new reporting requirement, several banks removed themselves from the process, resulting in declining participation. Additionally, the reporting requirement came at a time when unsecured borrowing was declining as banks began favoring overnight secured borrowing instead. With the decline in participation and in the reliability of the data being provided, experts began to question the validity of LIBOR as a benchmark. In fact, because of a growing sense of unreliability from market participants, the FCA decided that starting at the end of 2021 they would no longer require participating banks to continue to report nor would they publish the rate publicly, thus effectively ending LIBOR as a viable reference rate beyond 2021.

Following this announcement, consensus among lenders was that the lack of published rate could be problematic. Market participants are now contingency planning should LIBOR cease to exist. Appropriate plans should include the following: (i) a full review of loan portfolio to determine potential risk exposure (loans that mature after 2021), (ii) review of loan documentation, particularly interest-rate fall back language to determine potential risk exposure (unclear or inconsistent language, silent on fallback, etc.), (iii) after review, modify or sell loans that may have deficient fall back language, (iv) implement/review protocols to ensure they will be followed correctly, including the proper servicing of loans should fallback language be required to go into effect, (v) review preparedness of servicing systems to correctly capture modifications to affected loans in the event of a transition and (vi) consider originating new product using an alternative risk free rate.

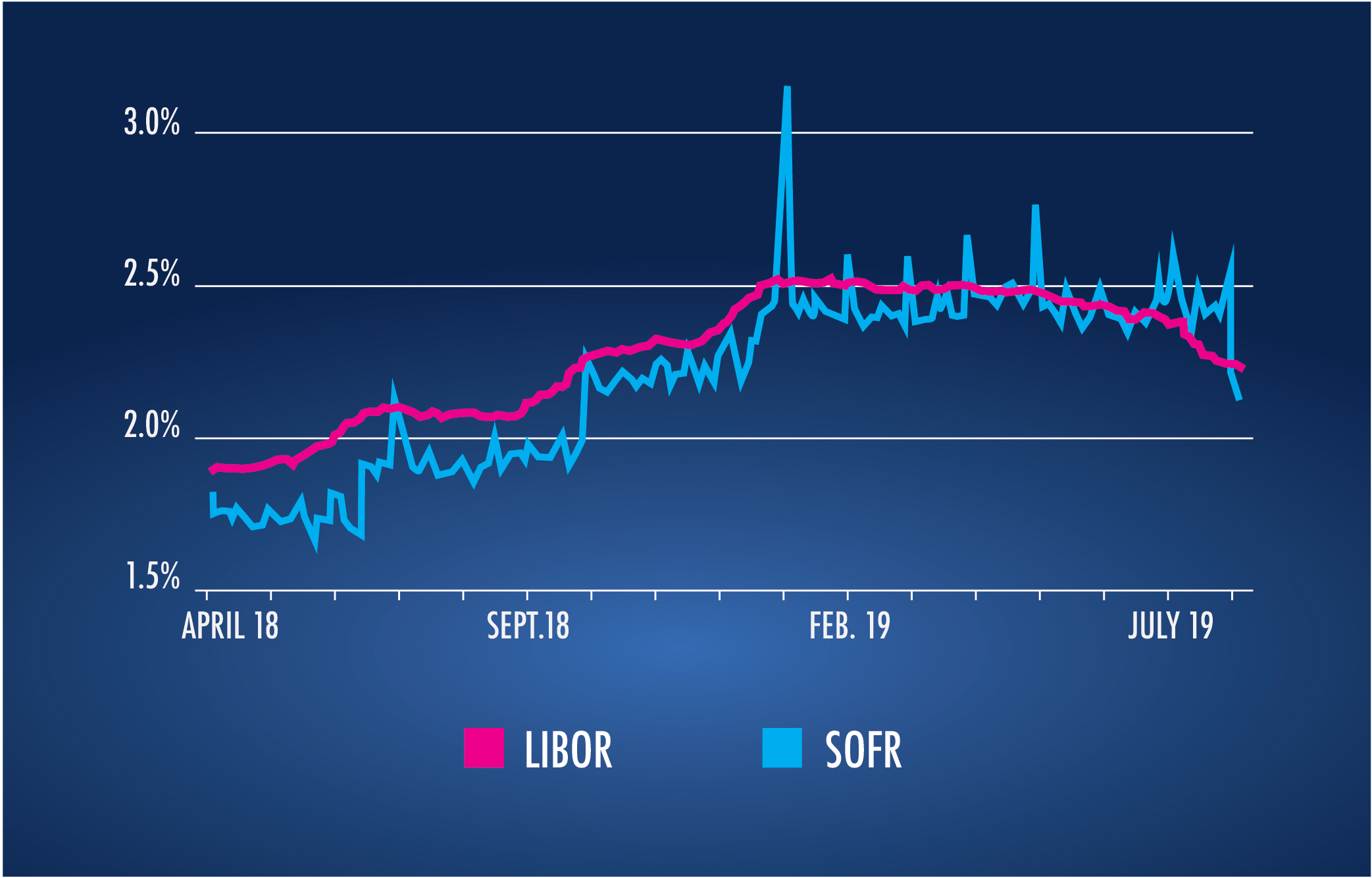

When modifying existing loans or originate new ones, lenders should transition to alternative risk-free rates such as the Secured Overnight Financing Rate (SOFR), which is currently backed by the Alternative Reference Rate Committee (ARRC). SOFR, which was established in April 2018 and currently monitored by the Federal Reserve Bank of New York, is one of the most popular alternative rates. The biggest difference between SOFR and LIBOR is that SOFR is entirely based on actual secured transactions that have occurred. Because of this, it has predominantly been a slightly lower rate than LIBOR over their corresponding lifetimes as displayed in the table below:

While it’s impossible to predict where LIBOR rates will be relative to any alternative rates when a potential hard stoppage of the publication of LIBOR occurs, at various times LIBOR and SOFR have been the same, or SOFR has been higher than LIBOR. This uncertainty may make modifications with borrowers a challenging proposition. Therefore, as stated above, lenders should assess the viability of selling off loans with deficient fall back language (or loans to borrowers that may be unresponsive) to mitigate portfolio risk in advance of a transition. Strong secondary market pricing from financial institutions that are equipped to navigate deficient rate language may result in a less costly outcome than internal resolution.