“Europe is definitely more undercapitalized than their U.S. counterparts and more likely to do extensions and other maneuvers to preserve capital,” said David Tobin, principal at Mission Capital Advisors, which is marketing several real-estate portfolios for North American banks.

Month: April 2012

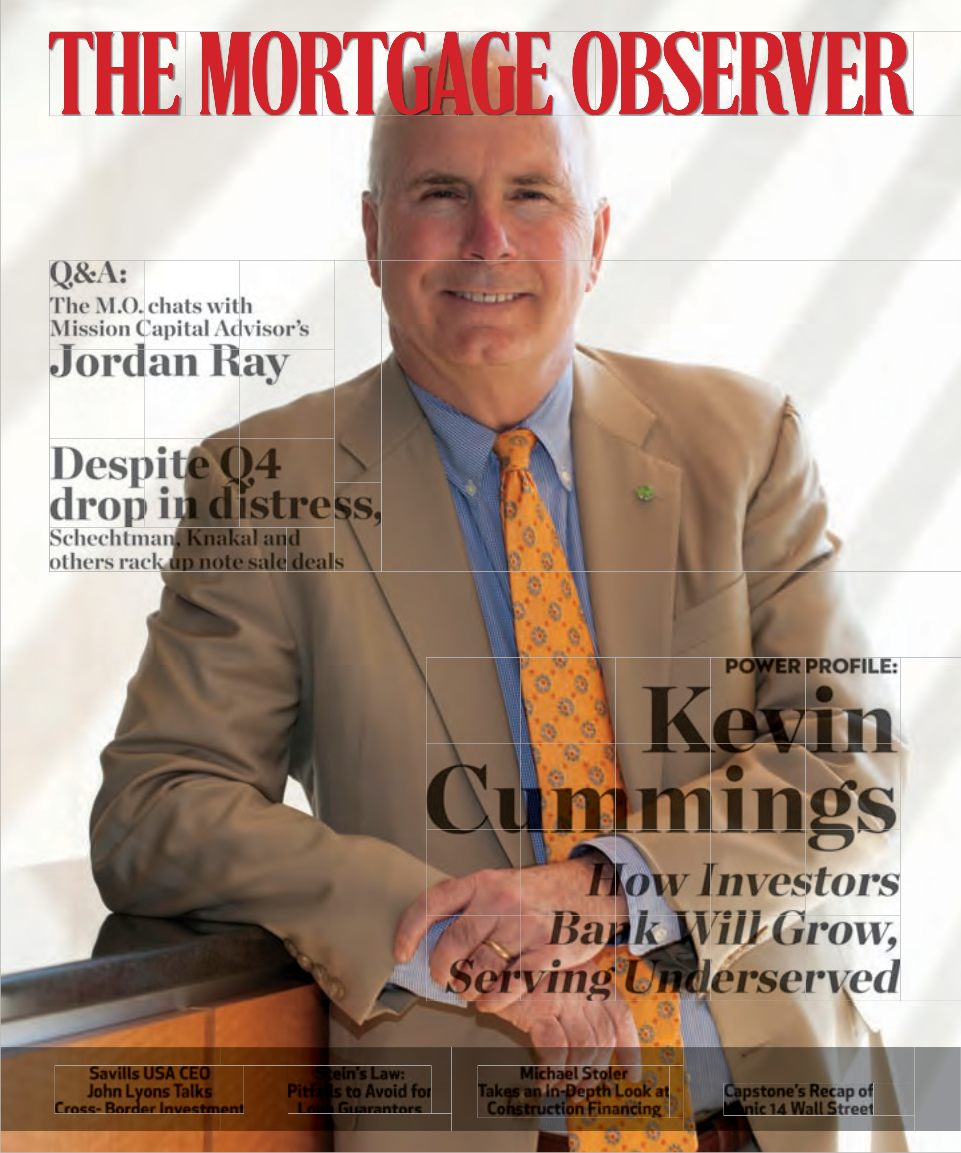

This month, The Mortgage Observer spoke to Mission Capital Advisor’s Jordan Ray about the climate at Mission Capital Advisors, where he sees capital flowing and the importance of supercharging borrowers.

may 2012

Q&A:

The M.O. chats with Mission Capital Advisor’s Jordan Ray

Despite Q4

drop in distress,

Schechtman, Knakal and

others rack up note sale deals

The Insider’s Monthly Guide to New York’s Commercial Mortgage Industry

Power Profile:

Kevin

Cummings

How Investors Bank Will Grow, Serving Underserved

Savills USA CEO John Lyons Talks

Cross- Border Investment

Stein’s Law: Pitfalls to Avoid for Loan Guarantors

Michael Stoler

Takes an In-Depth Look at

Construction Financing

Capstone’s Recap of

Iconic 14 Wall Street

Q&A / May 2012

Jordan Ray

Mission Capital Advisors

This month, The Mortgage Observer spoke to Mission Capital Advisor’s Jordan Ray about the climate at Mission Capital Advisors, where he sees capital flowing and the importance of supercharging borrowers.

by Ian Thomas

age here is in the 30s. We all sort of rode the wave

of technology boom like everybody else did. One of

the things that attracted me to Mission was that when

The Mortgage Observer: Can you tell me a little

about your background and how you got started in real estate?

![]()

Jordan Ray: I’ve been in the business since 2001. I started out at Ackman-Ziff and I was there for almost five years. I’ve been a commercial mortgage broker and equity advisor for my entire career—ever since graduating from the NYU program. I grew up in Mon- treal and in Palm Beach County, Florida, and went to school in D.C. at American University.

I started working at Ackman-Ziff when I was in grad school—it was a great place to grow up in this side of the business. In 2009 when the world started to turn and there really wasn’t a lot of financ- ing, everybody started thinking about the future. It was an opportunity for me to come here to join Mission with a colleague of mine, Jason Cohen, be- cause he knew the guys over here and Mission has been one of the most active loan sales advisors in the country—selling about a billion dollars of sub- and nonperforming debt every quarter. And they had no real finance desk. The idea was to come here and sell loans for a year to do something because there wasn’t much going on, but always have an eye toward starting the finance business when the mar- ket came back. Last year was our first year back in the finance business—we did about $540 million of debt and equity.

Can you give me some idea of what your day-to- day is like?

When a deal comes in I’m spending about 85 percent of my time on the deal. Now that we’re hiring more execution folks, I’m planning to spend more time looking for new business. On the execution side when we’re placing business we spend a lot of time up front on a deal figuring it out.

We have a very heavy technology focus here at Mission. That sort of sets us apart from where I used to be—not that there’s anything bad. It’s just a little different because we’re a younger firm. The average

they sell loans, generally investors know it is a very tech-heavy process, so we spend a lot of money on proprietary data rooms and proprietary customer rela- tions management so we know exactly who is doing what at any given time.

What’s the firm’s philosophy regarding growth?

We have very little turnover here, which is something that is rare. The guys who make the decisions about this business all come from other brokerage firms. So we’ve all seen the pitfalls of growth. We’ve seen good and bad. We’ve seen smart growth and we’ve seen just adding bodies to add bodies because it makes more money. We’ve been very slow to add bodies because when you bring someone in, you want to make a com- mitment to them and you want to know that they’re going to be there for the long haul because we have a very interesting environment.

Regarding the economic climate—is there less uncertainty out there compared with six months or a year ago?

We’re adding jobs slowly. We’re adding different kinds of jobs in places like New York. There’s a lot of tech now—a lot less finance, a lot more tech. Rates are probably artificially low, as we all know. Unfortunately I’m not much of an economist. I’m just an advisor, so all I can do is try to find the best deals for my clients at any given time in the cycle. I do know that when you look at some of the things that are holding our side down, i.e. banks that are stuck with product, too many loans clogging their pipelines, that stuff is fil- tering out slowly. There’s more lending because the cream is rising to the top a little bit but the healthy lenders are starting to lend and ones that aren’t are sort of petering out. And that’s another point, by the way, just to back up for a second. The loan sale busi- ness has helped us find and start relationships with regional and local banks that I probably never would have had before because those are the clients on the loan sale side.

Is lending loosening a little bit? Or is it still for the select borrower in select markets?

It always helps to have a high-class, very-top-tier spon- sor. We’ve done a couple of deals where, especially on the construction side, where you have a great deal but in order to have it financeable in our opinion you need to bring in a partner to add horsepower to the borrow- ing entity. So we’ve done a couple of deals where that has been the case and we think that if you are going to do a large construction deal, you sort of need to be a bank’s … you need to be their one or two deals like that that year right now.

Where do you see capital flowing today? Is it the usual places?

Look, everybody likes to use the sound bytes and they’re all the same—gateway markets and all that boring stuff and you can even joke about that, but the reality is that there’s a reason we call them gateway markets and capital cities. Lenders and investors want to be in markets where the recovery is happening the fastest. We’ve been doing a lot of work in New York, D.C. and Miami.

We did a large condominium project here in New York last year where we brought in a very prominent private equity fund to be a partner in the equity. It’s a deal on 18th street—210 West 18th Street. We rep- resented that venture to close in a $97.5 million con- struction loan. That was a two bank deal.

Where do you see the securitization market going these days? Is it picking back up?

It’s certainly picking up. There’s a lot of fixed-rate se- curitization shops out there—secondary and primary shops. When the securitization market is chugging it’s sort of a commodity. It’s about who can give you the best execution.

28

The market for distressed debt has grown increasingly aggressive as clarity related to asset values emerge, said Will Sledge, a managing director at Mission Capital. Also driving demand is the need for private equity to deploy capital raised in the early stages to take advantage of the impending sell-off.

Best Buy, which is considered an A-plus retailer in the electronics space where telephone sales and electronics sales and computer sales should be flying if they are closing 50 stores, I think that has major structural implications for big box retailer, David Tobin said. The implication here is that e-commerce is eating very, very directly into brick-and-mortar retailers.

Observers note that the next batch of securitized commercial mortgages to start maturing in 2013 will be those from the period where underwriting tightened severely, which could put downward pressure on delinquencies. So if you have a sharp increase this year, you’re going to have an equally sharp decrease next year, quotes David Tobin, commenting on the Trepp report.

“We are concerned about the structural implications of the Best Buy store closure announcement,” Tobin, principal of Mission Capital Advisors, said. “This signifies continued erosion in the retail sector and we are challenged to think of who the replacement tenant is for these stores.”

David Tobin, principal at Mission Capital Advisors, said that two factors contributed to the jump in CMBS delinquency rates maturing 2007 loans and unimpressive occupancy across all property types

![]()

(/)

LEASES (/LEASES/) FINANCE (/FINANCE/) SALES (/SALES/)

DESIGN +(C/OreNaSAlTgBRrOUaUCpThI(O//)ANBOU(/TD/)E(S/IrGeNa–lgCOraNpSThR/UmCyT/IOpNro/)file)

CMBS Delinquency Rate Jumps

BY CARL GAINES (/AUTHOR/CARL-GAINES/) APRIL 4, 2012, 10:46 A.M.

![]()

![]()

CMBS delinquency rates jumped sharply in March, according to data from Trepp. For March 2012, the rate jumped 31 basis points to 9.68 percent, bringing the value of delinquent loans to $58.1 billion.

(http://www.commercialobserver.com/2012/04/cmbs- delinquency-rate-jumps/manus-clancy-feb2010/)

MANUS CLANCY.

The jump is in line with Trepp’s earlier predictions. As The Commercial Observer reported last month, (http://www.commercialobserver.com/2012/03/trepp-cmbs-delinquency-rate-drops-deceptively/) senior managing director Manus Clancy said that, despite a drop for February 2012, that delinquency rates would follow an upward trend.

“We predicted late last year that the delinquency rate would rise largely on the impact of 2007 loans coming due, and today’s report underscores that forecast,” Mr. Clancy said in a prepared statement about this most recent data. “After the rate fell nicely in January and February, we were cautiously hopeful that we’d be wrong. This month’s report shows that the market has a lot of wood to cut and that a rate north

of 10 percent can’t be ruled out.”

For February, multifamily and office fared the worst and in fact the office delinquency rate set a new high, rising 37 basis points to 9.41 percent. Overall, $5 billion in newly delinquent loans helped to bring the

rate up for the month.

David Tobin, principal at Mission Capital Advisors, said that two factors contributed to the jump—

maturing 2007 loans and unimpressive occupancy across all property types.

“Obviously, the ‘Class of 2007’ loans were never expected to ‘graduate on time’ and we expect similarly high newly delinquent loan amounts throughout the year,” Mr. Tobin said, adding that this should drop off in a year.

Meanwhile, Fitch Ratings released its annual default survey, which pointed to a slow-down in U.S. CMBS defaults for 2012. The agency predicts cumulative defaults to reach 14.5 percent in 2012. Last year’s defaults reached 12.7 percent.

Fitch also pegged office loans as of particular concern, finding that the defaults on office loans hit 38.6 percent of all defaults for 2011.

CGaines@observer.com![]()

![]()

![]()

(/REALGRAPH/)

(/REALGRAPH/JOIN)

JOIN

Organizations in this story

INDUSTRY GROUP

Fitch Ratings

(/realgraph/organizations/fitch-ratings)

LENDER

Mission Capital Advisors

(/realgraph/organizations/mission-capital-advisors)

KEYWORDS: Trepp (/tag/trepp/), David Tobin (/tag/david-tobin/), Fitch Ratings (/tag/ tch-ratings/), Manus Clancy (/tag/manus-clancy/), Mission Capital Advisors

(/tag/mission-capital-advisors/), CMBS (/tag/cmbs/)

![]()

![]()

TRENDING STORIES

(/2016/04/brooklyn-navy-yard-revamp-effects-are-being-

FEATURES

felt-all-along-brooklyns-flushing-avenue/)

Brooklyn Navy Yard Revamp E ects Are Being Felt

All Along Brooklyn’s Flushing Avenue

(/2016/04/is-demand-for-midtown-south-office-space-

RESEARCH

slowing-down/)

Is Demand For Midtown South O ce Space

Slowing?

FINANCE

Deutsche Bank Berkshire Mortgage

Acquired, Renamed

BY CARL GAINES

(/2012/03/deutsche-bank-berkshire-mortgage-acquired- renamed/)

(/2016/04/shorewood-head-banks-on-combining-

PLAYERS

crowdfunding-with-coworking/)

Shorewood Head Banks on Combining

Crowdfunding With Coworking

(/2016/04/national-academy-puts-three-carnegie-hill-

SALES · COMMERCIAL

properties-on-the-market-for-120m/)

National Academy Puts Three Carnegie Hill

Properties on the Market for $120M![]()

LEASES (/LEASES/) Retail (/leases/retail/) O ce (/leases/o ce/)

FINANCE (/FINANCE/)

Acquisition (/ nance/acquisition/) Construction (/ nance/construction/) CMBS (/ nance/cmbs/)

Re nance (/ nance/re nance/)

SALES (/SALES/)

Residential (/sales/residential/) Commercial (/sales/commercial/) Mixed Use (/sales/mixed-use/) Land (/sales/land/)

Hotels (/sales/hotels/)

DESIGN + CONSTRUCTION (/DESIGN-CONSTRUCTION/) Architecture (/design-construction/architecture/) Construction (/design-construction/construction/) Infrastructure (/design-construction/infrastructure/)

Wired City (/design-construction/wired-city/) Policy (/design-construction/policy/)

Urban Planning (/design-construction/urban-planning/)

Neighborhoods (/design-construction/neighborhoods/)

MORE (/MORE/)

Features (/more/features/) Columnists (/more/columnists/) Analysis (/more/analysis/) Research (/more/research/) Industry (/more/industry/)

Legal (/more/legal/)

Players (/more/players/)

ABOUT (/ABOUT/)

Realgraph (/realgraph/about) Subscribe (/subscribe/) Advertise (/advertise/)

Contact (/contact/)

E-Newsletter signup:

Enter your email address SIGN UP

Daily News Finance Weekly

(https://twitter.co(mht/tcposm://mwowbwse.fravcerb)(ohottkp.cs:o//mw/wcowm.limnkoebdsienr.vceorm) /company/commercial-observer)

© 2016 OBSERVER MEDIA · TERMS (/TERMS) · PRIVACY (/PRIVACY)