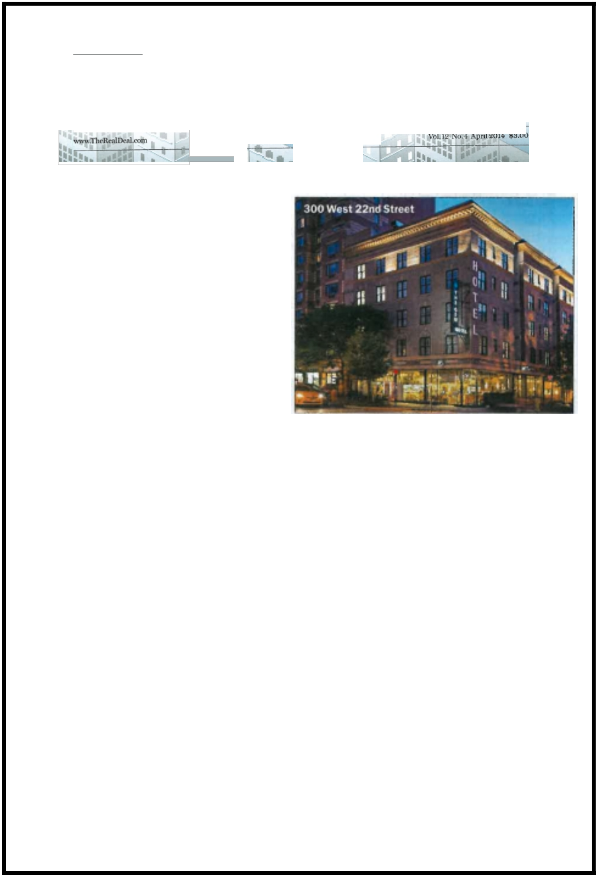

Mission Capital Advisors announced that its Debt and Equity Finance Group has arranged $15 million in first mortgage financing for the Palihouse West Hollywood, a 37-key, boutique, long-stay hotel in the heart of West Hollywood, CA.

Media Contact: John Yocca jyocca@beckermanpr.com

201-‐465-‐8018

FOR IMMEDIATE RELEASE

Mission Capital Advisors Arranges $15 Million in First Mortgage Financing For Palihouse Hotel in West Hollywood

Completed on Behalf of Beverly Pacific, LLC, the Financing Reflects Mission Capital’s Ability to Identify Ideal Capital Sources

WEST HOLLYWOOD, Calif. (April 30, 2014) — Mission Capital Advisors, a leading national real estate capital markets solutions firm, today announced that its Debt & Equity Finance Group has arranged $15 million in first mortgage financing for the Palihouse West Hollywood, a 37-‐key, boutique, long-‐stay hotel in the heart of West Hollywood, Calif.

Secured on behalf of Palihouse owner Beverly Pacific, LLC, the loan equates to $405,000 per key for the hotel, which has recently implemented a general update of the property, including a refresh of its rooms, lobby, common areas and restaurant. Ownership also intends to install a rooftop bar and lounge.

The Mission Capital team that secured the financing from a large domestic commercial bank was led by Managing Director Jordan Ray, Associate Director Steven Buchwald and Director Gregg Applefield, who relocated to the company’s Newport Beach office in 2013 to expand its ability to source, underwrite and structure commercial real estate transactions on behalf of West Coast-‐based owners, investors and developers.

“This deal reflects Mission Capital’s unique ability to identify the ideal lender by tapping into an unparalleled network of capital sources and leveraging a deep understanding of the marketplace, ultimately resulting in the best financing for the sponsor,” Applefield said. “It’s the first deal that the borrower and lender are completing together, and we think it could be the start of a long-‐term relationship between the two. As we continue to expand our presence on the West Coast, this is the type of low-‐cost financing that our clients here can expect.”

Palihouse West Hollywood is a luxury urban lodge that offers studio, one-‐ and two-‐bedroom guest suites and loft-‐style residences, a roof deck for private entertaining and fine dining at the Palihouse Courtyard Brasserie.

About Mission Capital Advisors

Founded in 2002, Mission Capital Advisors, LLC is a leading national, diversified real estate capital markets solutions firm with offices in New York City, Florida, Texas, California and Mobile, Al. The firm delivers value to its clients through an integrated platform of advisory and transaction management services across commercial and residential loan sales; debt, mezzanine and JV equity placement; and loan portfolio valuation. Since its inception, Mission Capital has advised a variety of leading financial

institutions and real estate investors on more than $45 billion of loan sale and financing transactions, as well as in excess of $14 billion of Fannie Mae and Freddie Mac transactions, positioning the firm strongly to provide unmatched loan portfolio valuation services for both commercial and residential assets. Mission Capital’s seasoned team of industry-‐leading professionals is committed to achieving clients’ business objectives while maintaining the highest levels of integrity and trust. For more information,

visit www.www.missioncap.com.