Banks have been reluctant to part with well yielding performing loans despite strong premium pricing in recent years. The common themes warranting sales include overall CRE concentration issues (>300% of total risk based capital), portfolio risk management sales (tenant exposure, lease roll, etc.), divesting of non-strategic geographies and/or high risk asset classes (e.g. hospitality) or exiting non-strategic borrower relationships (e.g. offered loan is bank’s sole asset with a borrower). M&A activity, monetizing legacy assets on disparate servicing systems or taking profits on low basis reperforming loans have also emerged as top themes for banks seeking to sell performing debt. Despite weak supply, 2016 performing sales attracted a broad bidder market from community banks to large super-regionals (who were not always able to out price smaller rivals). Transactions settling in late Q4 suffered a relatively minor post-election setback, as well as negative price adjustments following the Fed’s rate hike announcement in December. Despite the adjustment, transactions continued to execute by year end with premium pricing. 2017 has seen increased sales resulting from mergers. Additionally, the volume of conduit “kick-out” loans has increased, as smaller CMBS shops struggle to compete under “risk retention” paradigm and others close their doors.

![]()

PERFORMING COMMERCIAL & MULTIFAMILY LOAN SALES

![]()

PORTFOLIO CHALLENGE

![]()

CRE Concentration Regulatory

Guidance

Regulator guidance to banks cautions that CRE

concentration in bank portfolios should not exceed

300% of risk based capital, and the outstanding balance

of bank CRE portfolio should not grow more than 50%

during the prior 36 months

MISSION CAPITAL SOLUTION

![]()

![]()

Over-Exposure to Specific Borrower Strategic dispositions when lending limits to specific borrowers impede ability to originate new loans to the borrower

Mission Capital advises clients

nationwide on the sale of performing

Exit Non-Strategic Borrower

Relationships

Offered loan is bank’s sole relationship with a borrower

(i.e. no depository or other banking services)

loan portfolios, delivering custom asset marketing solutions via our world-class talent, proprietary![]()

Prudent Risk Management Exiting geographies, change in credit appetite, exiting deals with tenant roll risk, divesting asset classes, etc.

technology, transactional experience, and deep relationships.![]()

M&A Activity![]()

Legacy or Reperforming Portfolios

Strategic disposition of assets outside desired footprint / outside lending parameters

Monetize legacy assets on disparate systems or

low basis reperforming TDRs

TRANSACTION TRADE THEME SUMMARY

![]()

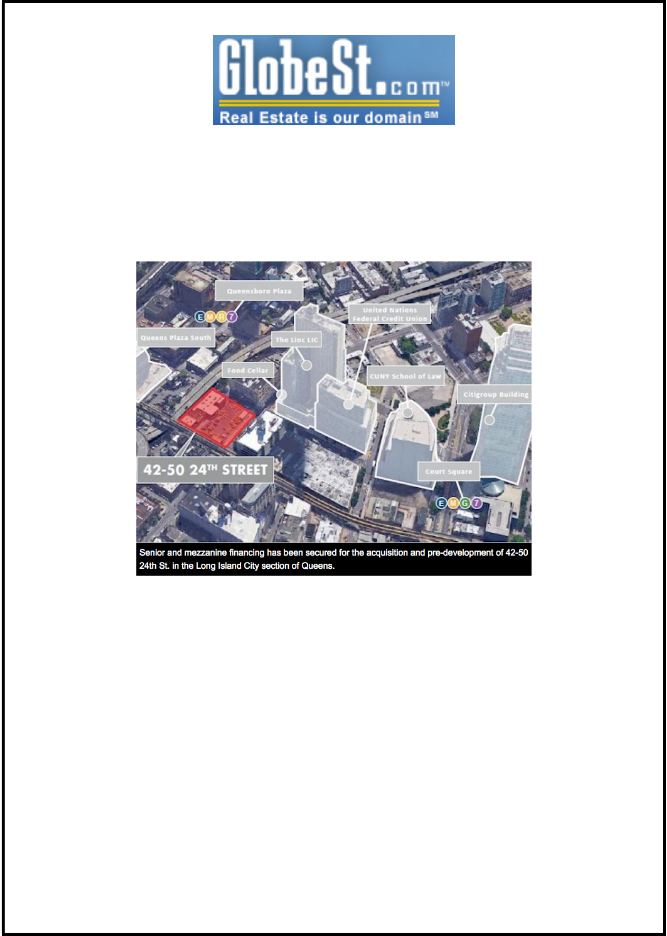

Small Regional West Coast Bank

![]()

CRE Loans, Performing

Large National Commercial Bank Lender

![]()

CRE Loans, Performing

GSE Lender

![]()

Healthcare & Multifamily/Student Housing, Performing

Private Equity

CRE Loans, Performing

Premium to Par, Gain on Book Value

Premium to Par, Gain on Book Value

Gain on Book Value, Portfolio Risk Management

Gain on Book Value, Harvest Gains

$23mm total UPB, recently originated, traded at 100.85%. High demand from secondary market.

$11.6mm total UPB, traded at 100.11%. Bids ranged from 90% of par to 100.11%. High demand from secondary market, market accustomed to asset type.

$194mm total UPB, traded at 91%. Government Seller. High demand from secondary market.

$12.3mm total UPB, traded for 89%. Portfolio made up of non- seller originated loans previously acquired on the secondary market. High demand from secondary market.![]()

|

KEY FACTORS FOR UPSIDE PRICING |

|

|

KEY FACTORS FOR UPSIDE PRICING |

At or above market coupon |

|

KEY FACTORS FOR UPSIDE PRICING |

Strong cash flow and payment history |

|

KEY FACTORS FOR UPSIDE PRICING |

LTV < 70%; DSCR > 1.3x; Maturity < 5 yrs |

|

KEY FACTORS FOR UPSIDE PRICING |

Average asset size > $2.5mm |

|

KEY FACTORS FOR UPSIDE PRICING |

Variable rate or limited remaining fixed rate term |

|

KEY FACTORS FOR UPSIDE PRICING |

Reasonable floor on variable rate portion of term |

|

KEY FACTORS FOR UPSIDE PRICING |

Prepayment protection |

|

KEY FACTORS FOR UPSIDE PRICING |

Full recourse / Personal guarantees |

|

KEY FACTORS FOR UPSIDE PRICING |

Credit tenant |

|

KEY FACTORS FOR UPSIDE PRICING |

No lease hangout on single tenant loans |

|

KEY FACTORS FOR UPSIDE PRICING |

“Full doc” / in compliance with financial reporting requirements |

|

KEY FACTORS FOR UPSIDE PRICING |

Recent appraisals |

|

KEY FACTORS FOR UPSIDE PRICING |

TYPES OF

INVESTORS

Banks

Mortgage REITs

Insurance Companies

Structured Finance Buyers

CONTACT

NEW YORK

Tel: 212-925-6692

FLORIDA

Tel: 561-622-7022

TEXAS

Tel: 512-327-0101

CALIFORNIA

Tel: 949-706-3001