The debt and equity finance group of Mission Capital Advisors recently arranged first mortgage financing for the Ellington, a mixed-use development located at 3670 Woodward Ave.

Month: December 2014

Mission Capital’s Debt & Equity Finance Group arranged first mortgage financing for The Ellington located at 3670 Woodward Avenue in Detroit, Michigan.

Media Contact: Shlomo Morgulis Beckerman

201-465-8007 smorgulis@beckermanpr.com

FOR IMMEDIATE RELEASE

Mission Capital Advisors Arranges First-Mortgage Financing

For The Ellington in Detroit

Deal is Most Recent Example of Firm’s Expertise in Revitalized Greater Detroit Area

DETROIT (Dec. 23, 2014) — Mission Capital Advisors announced today that its Debt & Equity Finance Group arranged first mortgage financing for The Ellington located at 3670 Woodward Avenue in Detroit, Michigan.

The Mission Capital team of Tom Hall, Ari Hirt, Steven Buchwald and Jamie Matheny secured the loan on behalf of RAM Realty Services, a Florida-based real estate firm that developed the property in 2005.

The subject loan is collateralized by The Ellington’s fully occupied retail component, as well as 254 stalls in the adjacent Midtown Parking Garage.

The Ellington is a mixed-use development with street level retail below 55 luxury residential units located on the corner of Woodward and Mack avenues in a high-traffic area of Midtown Detroit. The property's tenants include Bank of America, Starbucks and JP Morgan Chase, and it is shadow anchored by the first- ever inner city Whole Foods Market.

“As real estate fundamentals remain strong, we are seeing a variety of lenders increasingly willing to provide loans to owners of retail properties,” said Hall. “RAM could not have timed their project any better with The Ellington’s debut coinciding with the current trending of Detroit’s Midtown

neighborhood. With an influx of entrepreneurs and young professionals along with planned transportation enhancements, Midtown has become a prime retail market.”

Earlier this year, Mission Capital successfully secured long-term, low-interest financing at suburban

Detroit shopping centers in Troy and Farmington Hills, Michigan.

“This deal represents the most recent example of our ability to secure favorable financing on retail properties across the US,” said Hall.

Mission Capital has been extremely active this year in assisting clients with retail opportunities across the country. Recent deals completed by the firm include $7.5 million in cash-out financing for a Texas shopping center, and $12 million in financing for retail shopping centers in Ohio.

About Mission Capital Advisors

Founded in 2002, Mission Capital Advisors, LLC is a leading national, diversified real estate capital

markets solutions firm with offices in New York City, Florida, Texas, California and Mobile, Alabama. The firm delivers value to its clients through an integrated platform of advisory and transaction management services across commercial and residential loan sales; debt, mezzanine and JV equity placement; and loan portfolio valuation. Since its inception, Mission Capital has advised a variety of leading financial institutions and real estate investors on more than $45 billion of loan sale and financing transactions, as well as in excess of $14 billion of Fannie Mae and Freddie Mac transactions, positioning the firm strongly to provide unmatched loan portfolio valuation services for both commercial and residential assets. Mission Capital’s seasoned team of industry-leading professionals is committed to achieving clients’ business objectives while maintaining the highest levels of integrity and trust. For more information, visit www.www.missioncap.com.

Mission Capital’s Managing Director Jordan Ray comments on the ever changing state of the CMBS market.

The Never-Ending Story of CMBS

October 30, 2014

By Erika Morphy | National

A funny thing happened as the CMBS market picked itself up after the financial crisis of 2008 and vowed never again. The measures that were put in place to prevent another meltdown—some, admittedly at the insistence of regulators— have helped to usher in a resurgence in lending and increase in competition. Take, for example, the documentation now required for a CMBS loan. These guidelines are much more standardized, says Jordan Ray, managing director of New York City’s Mission Capital Advisors. Transparency has increased, as was intended, as well as easier poaching of borrowers, which was not.

“It has made it much easier for conduits to accept other conduits’ loan documents to win business,” Ray says. “The end result is that the plain vanilla CMBS is now very much a commoditized business and those who want to get deals done need

to do something special.” Besides the usual—interest only terms, floating rate transactions—Ray has seen lenders originate mezzanine loans and keep them on their balance sheet, as the extra edge. Or offer stronger subordination levels or shorter-term loans.

“It can be little things, but more lenders are willing to go out of the box somewhat to win business as competition intensifies.”

Of course it’s not just standardized paperwork that is driving this trend. In general, the CMBS market is hitting new post-crisis high notes thanks to improving fundamentals, an improved economy and the prolonged low-interest rate environment, which has also fueled alternative and competing forms of finance.

“Conduits are competing for every last scrap,” Ray says.

If this sounds painfully familiar, that’s because it is yet another chapter in the never-ending story of CMBS (well, all markets actually). The market moves— sometimes dramatically, sometimes not—between risk and safety depending on larger macroeconomic conditions, fundamentals in commercial real estate and what the competition is doing.

For now, the center appears to be holding sway.

“You want issuance to climb and a steady pace and not spike—and so far that is what is happening right now,” says Steve Renna, CEO of the Washington, DC- based CRE Finance Council. Third quarter 2014 saw a robust $22 billion in CMBS issuance, he says, and puts the industry on track to meeting a psychological post-crisis high-note of $100 billion. “That will exceed by a healthy margin the $81 billion we saw in 2013,” Renna says.

The State of the Market

This is not just a numbers story, though. CMBS is clearly on more solid footing than it has been since the crash. Originators are using more prudent assumptions in their underwriting and credit enhancements have risen to reflect declining credit profiles and the rise in leverage levels.

In fact credit enhancement levels in US CMBS are close to double those in 2006 and 2007, a recent Fitch Ratings report noted.CMBS has also been bolstered by improving fundamentals, which is reflected in the overall improvement in asset performance.

Commercial real estate performance and macroeconomic measures have slowly improved over the past few years, Fitch Ratings noted, “providing stable occupancy and, for hotels and multifamily properties especially, significant improvement in revenues.” Besides the general economic improvement, Fitch also pointed to the limited new property construction as playing a role in asset performance.

“Standardized documentation has made it much easier for conduits to accept other conduits’ loan documents to win business. The end result is that the plain vanilla CMBS is now very much a commoditized business and those who want to get deals done need to do something special.” —Jordan Ray, Mission Capital Advisors

Also, pool structures have become simpler in many cases. Fitch Ratings notes that we are seeing less “hyper-tranching” and that operating advisor and controlling class calculations have been introduced to better manage potential conflicts of interest. Finally, senior bondholders are better protected in that they now recover principal before junior bondholders receive interest when assets are liquidated.

If there is any room for angst in this cozy picture, it is the competition. Give or take, there are about 43 active conduits in the market now—each, as Ray says, scrambling for scraps.

The potential problem, simply put, is this: as competition increases, underwriting standards drop.

We saw it in the past and even now, in this CMBS 2.0 environment, we are seeing shades of it not just in such metrics as LTV and DSCR, but also in more subtle aspects such as weaker loan structures, Fitch said. It points to, as an example, the increasingly common feature of having specific dollar amount caps on so-called “bad boy” carveouts.

The competition is coming from not only new entrants in the conduit market, but also other lenders that have been used to a meek CMBS market of the past few years. Life insurance companies, for example, no longer have the market to themselves anymore. As a result, says Shelley Magoffin, SVP of Grandbridge Real Estate Capital, “they’ve gotten very creative in how they differentiate themselves from the newfound competition, including such tactics as “providing funding before a property is stabilized, offering IO and earnouts, things that they weren’t doing three years ago.”

Still, it is a fine line between weakening loan structures and more aggressive underwriting and a robust capital market that has developed the necessary chops to take on more risk with the goal of furthering development. In October, as one example of the latter, Prudential Mortgage Capital Co. loaned the Jacksonville,

FL-based 22 Lantern LLC $18.1 million in a CMBS structure for Lantern Square Apartments, a failed condo conversion that the company was turning into a multifamily project.

Lantern 22 initially acquired the property in 2006. Just before the economic crash, the owners converted the apartment complex into a condo and began trying to sell units. Lantern is using the CMBS loan to refinance an existing condo conversion mortgage loan and reacquire units from third parties in the building. Also, much of the new competition entering the market has been around the

block more than once and not likely to try extreme structures. Walker & Dunlop, a

Bethesda, MD-based real estate finance firm, is about to originate its first round of CMBS transactions under a new platform it launched last year.

At the end of September, the company announced it contributed its first $58 million of collateral in multifamily and retail loans for an upcoming securitization with Wells Fargo. W&D’s CMBS platform is on track to contribute $200 million in collateral to future securitizations by the end of 2014. Meanwhile, its CMBS originations are likely to accelerate with Walker & Dunlop’s recent acquisition of Johnson Capital, which has a respectable footprint in the CMBS market.

The origin of W&D’s CMBS deal is telling, though, for the market. The main reason the firm got into this space was to diversify its offerings away from its core platform of GSE executions, and in this respect it appears to have succeeded. During a recent earnings call, CEO Willy Walker described how the deal came about: “We quoted a three-property, multifamily deal in June for execution with

the GSEs. The borrower requested more proceeds than an agency loan could provide. So we quoted the deal for our conduit.”

Then, in the process of quoting the deal for the conduit, the borrower asked W&D to look at three transitional properties that needed bridge financing, which also wound up being funded. “A year ago we would have lost the deal after providing the GSE quotes,” Walker said. “Today, due to our new CMBS conduit and scaled balance sheet lending operation, we financed these six properties, totaling $67 million.”

It is, in other words, how CMBS was meant to operate in the capital markets: as a complementary backstop when other lending doesn’t quite fit the borrower’s needs. All courtesy of a new provider in the market.

Preparing for the Refi Wave….

These new providers and the solid macroeconomic environment and commercial real estate fundamentals suggest that the CMBS ecosystem is ready for what is expected to be one of its biggest challenges post the 2008 financial crisis: refinancing the $600 billion or so of loans made during 2005-2006 time period.

Certainly this bonanza is one driver for these new entrants. In September, when the Macquarie Group and Principal Real Estate Investors announced they were partnering on a new CMBS platform the upcoming wave of refis was cited. “There will be a substantial volume of commercial mortgage loans maturing over the

next few years,” says Timothy Gallagher, New York City-based managing director and head of commercial real estate markets at Macquarie. “That provides Macquarie with a sound opportunity to establish a CMBS debt platform in the US.”

…With New Underwriting Standards in the Background

However, there’s one tiny glitch for some of these hopeful borrowers in waiting:

standards have changed considerably since that time.

“You want issuance to climb at a steady pace and not spike—and so far that’s what is happening right now. The industry is on track to meeting a psychological post-crisis high-note of $100 billion exceeding what we saw in 2013.” —Steve Renna, CRE Finance Council

It’s a CMBS 2.0 world now and besides the statutory changes to the model, underwriters are not likely to forget the lessons of 2008. Yes, there is more aggressiveness in the underwriting, but it is nowhere close to previous iterations. “This is a major issue: a lot of these loans that have been locked up in CMBS for the past 10 years are looking to refinance out, and there have been a lot of changes,” says Matthew McGovern, a 20-year industry veteran, who recently joined the Irvine, CA-based GRS Group as director of its national leadership team.

The economic landscape changed in values, and underwriting standards have changed in some cases dramatically, he said, noting that “loans that met the underwriting criteria in the old phase 1 may not meet that same bar today.”

GRS is seeing it already, “as some of these loans are being pulled forward and are being prepaid; we’re seeing them with existing due diligence on them that was acceptable at that time, but borrowers are stunned at the increased reserve and environmental requirements.” Referring to the latter, McGovern said he has run into existing contaminated sites under monitoring programs, and even no- further-action letters are now subject to much more stringent standards.

“Unfortunately, borrowers don’t always understand why it’s an issue now when it wasn’t back when they financed. So, we’re helping them understand and work through that. It’s not without pain in some respects. Hopefully, it doesn’t impact a lot of properties, but there will certainly be enough that it will impact.”

Lather, Rinse, Repeat

Other borrowers—many in fact, as the economy continues its recovery—won’t have such concerns. They will be happily tapping the conduits to lock in low interest rates and take out proceeds, if possible.

That was the driving force behind two CMBS loans Marcus & Millichap Capital Corp. recently secured to refinance the Hampton Inn Crystal City in Arlington, VA and the Holiday Inn Capital Square in Columbus, OH. The $25-million CMBS

debt placement for the Crystal City property had a fixed interest rate of 4.76%

and a 65% loan to value. The Holiday Inn’s $5.8-million CMBS loan’s interest rate was 4.8% and a 70% LTV. Both loans were maturing and the borrowers wanted

to advantage of the lower interest rates and take out equity.

Certainly for the rest of the year and into 2015, depending on the direction of interest rates, it will be lather, rinse, repeat, with only the end-use of the proceeds differing by borrower.

Real Capital Solutions secured a $16.5-million CMBS loan to refinance its 244- unit Eden’s Edge multifamily property in Jacksonville. The Louisville, CO-based

investment and development firm wanted the five-year loan “to continue strategic investment in their target markets,” the originator Greystone reported.

On the other end of the deal-size spectrum and the opposite end of the country is property investor David Werner, who recently secured a $700-million CMBS loan—a 10-year, fixed-rate, interest-only deal, specifically—to acquire the leasehold interest in New York City’s 1.8-million-square-foot Mobil Building. Morgan Stanley Mortgage Capital Holdings provided the financing, which was arranged by Meridian Capital Group and Eastdil Secured.

There was a lot of competition for the deal despite its size and complexity, insiders in the know told reporters. This is concerning to some, even as the CMBS market’s growing prowess is clearly a boon to commercial real estate.

Grandbridge Real Estate Capital’s Magoffin, for one, is worried, though not overly, about the growing aggressiveness of the market. “It’s great that there is CMBS money out there, though I think it’s still the loan of last resort. But it’s a little concerning that some of the CMBS money has gotten so aggressive so quickly. It might be a little too much a little too fast, but nowhere what it was in

2006.”

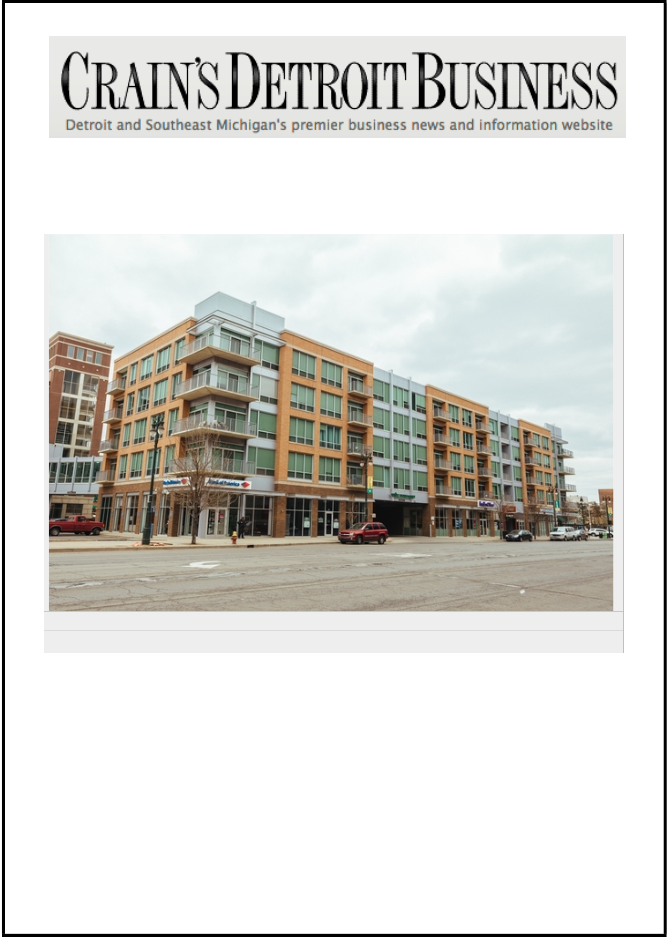

A $5.5 million first-position mortgage for the Ellington development at Woodward and Mack avenues in Midtown has been secured. The retail component and the adjacent 254-space Midtown Parking Garage are collateral on the loan, which was arranged by New York City-based Mission Capital Advisors LLC’s debt and equity finance group.

$5.5M mortgage secured for Ellington

development in Midtown

By Kirk Pinho

COSTAR GROUP

The Ellington development has 55 units above 13,000 square feet of retail.

A $5.5 million first-position mortgage for the Ellington development at Woodward and Mack avenues in Midtown has been secured.

Completed in 2005, the development by Florida-based Ram Realty

Services has 55 units and about 13,000 square feet of retail space occupied by Bank of America, Starbucks and J.P. Morgan Chase.

The retail component and the adjacent 254-space Midtown Parking Garage are collateral on the loan, which was arranged by New York City-based Mission Capital Advisors LLC’s debt and equity finance group.

“As real estate fundamentals remain strong, we are seeing a variety of lenders increasingly willing to provide loans to owners of retail properties,” said Tom Hall, vice president in the Mission Capital group, which was financial adviser on the loan.

“Ram could not have timed their project any better with the Ellington’s debut coinciding with the current trending of Detroit’s Midtown neighborhood. With an influx of entrepreneurs and young professionals along with planned transportation enhancements, Midtown has become a prime retail market.”

The seven-year loan with an interest rate around 2.5 percent closed Dec. 15, Hall said.

“We had strong interest in this, not just from this lender but others. That bodes well for the fundamentals in Midtown and downtown. There are lenders interested in providing financing.”

He would not disclose the lender other than to say it is a commercial bank based in the Southeast.

Kirk Pinho: (313) 446-0412, kpinho@crain.com. Twitter: @kirkpinhoCDB

Mission Capital Advisors has arranged non-recourse financing totaling $14.3 million on behalf of PEBB Enterprises for two shopping centers. The properties include the Shoppes at Chapel Hill, a regional shopping center in Cuyahoga Falls, Ohio, and Walden Park Shopping Center in Austin, Texas.

The Debt & Equity Finance Group arranged non-recourse financing totaling approximately $14.3 million on behalf of PEBB Enterprises for two shopping centers Shoppes at Chapel Hill, a regional shopping center in Cuyahoga Falls, Ohio, and Walden Park Shopping Center in Austin, Texas.

Media Contact: Shlomo Morgulis smorgulis@beckermanpr.com

201-465-8007

FOR IMMEDIATE RELEASE

Mission Capital Advisors Arranges $14.3 Million in Financing for PEBB Enterprises Properties in Texas and Ohio

Leading Real Estate Capital Advisory Firm Continues to be Active in Central U.S. with

Financing of Two Shopping Centers

NEW YORK (Dec. 18, 2014) — Mission Capital Advisors announced that its Debt & Equity Finance Group arranged non-recourse financing totaling approximately $14.3 million on behalf of PEBB Enterprises for two shopping centers Shoppes at Chapel Hill, a regional shopping center in Cuyahoga Falls, Ohio, and Walden Park Shopping Center in Austin, Texas.

The Mission Capital team of Jordan Ray, Ari Hirt, Steve Buchwald, and Jamie Matheny represented

PEBB Enterprises in arranging financing for both deals.

“We generated strong interest from lenders for The Shoppes at Chapel Hill, and received numerous aggressive bids that enabled us to secure a 10-year, interest-only loan for our client,” said Ray. “We are seeing increased lender interest in quality properties in secondary and tertiary markets as real estate fundamentals remain strong.”

The Shoppes at Chapel Hill is an 85,229-square-foot, well-established shopping center located in a prime retail corridor in Cuyahoga Falls, Ohio, serving all of the Northern Akron and Southeast Cleveland suburbs. The property is anchored by tenants including Staples and Michael’s, and also features a Panera Bread and Brick House Tavern.

Following Mission Capital’s successful procurement of financing for PEBB’s Shoppes at Chapel Hill, the premier real estate investment, development and management firm retained Mission to secure cash-out financing for its Texas property.

“With new tenants set to move into the property but not yet open for business, securing favorable financing for the Walden Park Shopping Center presented some challenges,” said Hirt. “However, by leveraging our knowledge of the lending market, we were able to generate a tremendous number of competitive bids in the low 4-percent range, for a 10-year loan that is interest-only for five years. Ultimately, we were able to secure favorable high leverage financing with low spreads.”

Situated in a primary retail corridor of northwest Austin, Walden Park Shopping Center is a 57,569-

square-foot shopping center. Located near key highways and thousands of residential units, the property is home to a mix of national and local retailers, including anchor tenants HomeGoods, Ulta Salon,

Cosmetics & Fragrance, and Kirkland’s.

In recent months, Mission Capital has been extremely active in assisting clients with opportunities in secondary and tertiary markets. The PEBB transactions come on the heels of a $31.4-million financing arranged in October for a multifamily project in Indianapolis. Other recent transactions include the

procurement of financing for two shopping centers in Michigan, a shopping center in Alabama and a shopping center in Ohio.

“We were very satisfied with the market Mission created for our Ohio deal,” said Jared Weiner, PEBB Principal. “It was for this reason that we retained Mission to secure financing at the Walden Park Shopping Center, and considering the favorable cash out financing they secured in a somewhat challenging transaction, we have been quite impressed with the lender interest they have been able to generate.”

About Mission Capital Advisors

Founded in 2002, Mission Capital Advisors, LLC is a leading boutique real estate capital advisory firm specializing in high value-add debt, mezzanine, and JV equity, with offices in New York City, Florida, California and Texas. The firm is keen on maintaining its reputation as the premier New York based real estate capital advisory firm. Mission Capital’s seasoned team of industry-leading professionals is committed to achieving clients’ business objectives while maintaining the highest levels of integrity and trust. For more information, visit www.www.missioncap.com.

The Debt & Equity Finance Group arranged non-recourse financing totaling approximately $14.3 million on behalf of PEBB Enterprises for two shopping centers Shoppes at Chapel Hill, a regional shopping center in Cuyahoga Falls, Ohio, and Walden Park Shopping Center in Austin, Texas.

Media Contact: Shlomo Morgulis smorgulis@beckermanpr.com

201-465-8007

FOR IMMEDIATE RELEASE

Mission Capital Advisors Arranges $14.3 Million in Financing for PEBB Enterprises Properties in Texas and Ohio

Leading Real Estate Capital Advisory Firm Continues to be Active in Central U.S. with

Financing of Two Shopping Centers

NEW YORK (Dec. 18, 2014) — Mission Capital Advisors announced that its Debt & Equity Finance Group arranged non-recourse financing totaling approximately $14.3 million on behalf of PEBB Enterprises for two shopping centers Shoppes at Chapel Hill, a regional shopping center in Cuyahoga Falls, Ohio, and Walden Park Shopping Center in Austin, Texas.

The Mission Capital team of Jordan Ray, Ari Hirt, Steve Buchwald, and Jamie Matheny represented

PEBB Enterprises in arranging financing for both deals.

“We generated strong interest from lenders for The Shoppes at Chapel Hill, and received numerous aggressive bids that enabled us to secure a 10-year, interest-only loan for our client,” said Ray. “We are seeing increased lender interest in quality properties in secondary and tertiary markets as real estate fundamentals remain strong.”

The Shoppes at Chapel Hill is an 85,229-square-foot, well-established shopping center located in a prime retail corridor in Cuyahoga Falls, Ohio, serving all of the Northern Akron and Southeast Cleveland suburbs. The property is anchored by tenants including Staples and Michael’s, and also features a Panera Bread and Brick House Tavern.

Following Mission Capital’s successful procurement of financing for PEBB’s Shoppes at Chapel Hill, the premier real estate investment, development and management firm retained Mission to secure cash-out financing for its Texas property.

“With new tenants set to move into the property but not yet open for business, securing favorable financing for the Walden Park Shopping Center presented some challenges,” said Hirt. “However, by leveraging our knowledge of the lending market, we were able to generate a tremendous number of competitive bids in the low 4-percent range, for a 10-year loan that is interest-only for five years. Ultimately, we were able to secure favorable high leverage financing with low spreads.”

Situated in a primary retail corridor of northwest Austin, Walden Park Shopping Center is a 57,569-

square-foot shopping center. Located near key highways and thousands of residential units, the property is home to a mix of national and local retailers, including anchor tenants HomeGoods, Ulta Salon,

Cosmetics & Fragrance, and Kirkland’s.

In recent months, Mission Capital has been extremely active in assisting clients with opportunities in secondary and tertiary markets. The PEBB transactions come on the heels of a $31.4-million financing arranged in October for a multifamily project in Indianapolis. Other recent transactions include the

procurement of financing for two shopping centers in Michigan, a shopping center in Alabama and a shopping center in Ohio.

“We were very satisfied with the market Mission created for our Ohio deal,” said Jared Weiner, PEBB Principal. “It was for this reason that we retained Mission to secure financing at the Walden Park Shopping Center, and considering the favorable cash out financing they secured in a somewhat challenging transaction, we have been quite impressed with the lender interest they have been able to generate.”

About Mission Capital Advisors

Founded in 2002, Mission Capital Advisors, LLC is a leading boutique real estate capital advisory firm specializing in high value-add debt, mezzanine, and JV equity, with offices in New York City, Florida, California and Texas. The firm is keen on maintaining its reputation as the premier New York based real estate capital advisory firm. Mission Capital’s seasoned team of industry-leading professionals is committed to achieving clients’ business objectives while maintaining the highest levels of integrity and trust. For more information, visit www.www.missioncap.com.

Underwriting Under Qualified Mortgage /Ability-To-Repay Rules

By Anthony Grasso & Mission Global

In the past, loose underwriting practices included failure to verify consumers’ income or debts or using such income to calculate the borrower’s ability to afford the payments based on adjustable rate mortgage lower “teaser” interest rates. Not surprisingly, when the scheduled monthly mortgage interest rate adjustments occurred thereafter, payments would jump to unaffordable levels, a major mortgage crisis contributing factor. Regulators initial response to the skyrocketing mortgage delinquency rate was to adopt a rule under the Truth in Lending Act in 2009 prohibiting creditors from making higher-priced mortgage loans without assessing consumers’ “ability to repay” the loans.

This rule was followed by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), when Congress adopted similar Ability-to-Repay (ATR) requirements for virtually all closed-end residential mortgage loans. The Dodd-Frank Act also provided a presumption of compliance with ATR requirements, and protections from legal liability, for a certain category of mortgages, called Qualified Mortgages (QM). The Consumer Finance Protection Bureau (CFPB) implemented the ATR and QM provisions for covered mortgage loan products (Conforming/FHA/VA/USDA) with new loan applications taken on or after 01/10/2014.

Under the ATR rule, there are the eight underwriting factors that must be considered to meet the requirements of the rule:

- Current, or reasonably expected income or assets (other than the value of the property that secures the loan) that the consumer will rely on to repay the loan.

- Current employment status (if the employment income was relied upon when assessing the consumer’s ability to repay).

- Monthly mortgage payment for this loan.

- Monthly payment on any simultaneous loans secured by the same property.

- Monthly payments for property taxes and insurance that the consumer is required to buy, and certain other costs related to the property such as homeowner’s association fees or ground rent.

- Other debt obligations including but not limited to alimony, and child-support obligations.

- Monthly debt-to-income ratio, or residual income, calculated using the total of all the mortgage and non-mortgage obligations listed above as a ratio of gross monthly income.

- Credit history.

The QM requirements generally focus on prohibiting certain risky features and practices, such as negative amortization, interest-only periods, or loan terms longer than 30 years. In addition, points and fees generally may not exceed 3 percent of the total loan amount, although higher thresholds are provided for loans below $100,000. There for four categories of QM mortgages: General QM, Temporary QM, Small Creditor QM and Balloon-payment QM. For simplicity purposes, we will review the General QM requirements below:

In order for the loan to be a General QM, a lender must:

- Underwrite based on a fully amortizing schedule, using the maximum rate permitted during the first five years after the date of the first periodic payment adjustment.

- Consider and verify the borrower’s income or assets, current debt obligations, alimony, and child-support obligations.

- Determine that the member’s total monthly debt-to-income ratio (DTI) is no more than 43 percent.

- Points and fees are less than or equal to 3% of the loan amount (higher thresholds allowed for loans less than $100,000)

The presumption of compliance for a QM loan depends on whether it is higher-priced or not. Higher priced, according to the CFPB, means that a first lien mortgage’s APR is greater than 1.5% higher than AOPR (the Average Prime Offer Rate), which is based on the average terms offered to highly qualified borrowers (2.5% higher on jumbo loans).

- If a loan is not higher-priced, and meets the QM criteria, a court will conclusively presume that the creditor complied with the ATR rule and the lender is said to have a safe harbor.

- If a loan is higher-priced, and meets the QM criteria, a court will presume it complies with the ATR requirements. However, higher priced QM loans that are presumed to comply with the ATR requirements have conditions allowing borrowers to rebut that presumption (referred to as QM rebuttable presumption loans).

Many lenders have considered the significant potential liability and litigation expenses for an ATR violation and have limited themselves to making only QM safe harbor loans (where the borrower’s claim ends when the lender proves it has made a QM). The lenders that offer non-QM loans charge higher rates to offset the potential legal and compliance risk, although those risks are relatively small. The current ATR QM rule was a giant step in the right direction although we support work with policymakers to support future enhancements.

The following is a link to a compliance guide published by the CFPB:

http://files.consumerfinance.gov/f/201603_cfpb_atr-qm_small-entity-compliance-guide.pdf

Mission Global delivers custom solutions to our clients for QM/ATR Underwriting reviews by leveraging our deep transactional experience, proprietary technology, subject matter expertise and best-in-class talent. Click here to learn more.