NYC Finance Q&A with Mission Capital Advisor’s Jordan Ray.

Month: January 2013

JDS Development Group and Property Markets Group have secured $45 million in financing for their luxury condominium development in the former Verizon building in Hell’s Kitchen. The consortium’s broker Jason Cohen, the managing director of Mission Capital Advisors, told the Journal that the team’s track record of working together had eased any skittishness the bank, PB Capital, may have had.

The consortium’s broker Jason Cohen, the managing director of Mission Capital Advisors, told the Journal that the team’s track record of working together had eased any skittishness the bank, PB Capital, may have had. It’s important having a group that’s experienced in doing deals together, Cohen said.

Property Markets Group, developer of Walker Tower in Manhattan, has received $22 million to buy the land where it is planning the 190-unit Echo Aventura project. Mission Capital Advisors arranged the financing.

Mission Capital’s Jordan Ray discusses the “Core is so 2012” trend currently happening in the markets.

FREE E-NEWSLETTER

SUBSCRIBE

I t t t r f

SIGN UP FOR FREE!![]()

![]()

If you don't see images, click here to view

Story Ideas . Events To ensure delivery, please add newsletter@bisnow.com to your address book, learn how

IM6 PTRESNSDYSOTUOR

Emails sent last week in response to New York's Hippest Hotels didn't reach us due to a tech malfunction, so please

resend your suggestions, recommendations, and thoughts to

HippestHotels@Bisnow.com.

Scheduled to appear on Jeopardy or just need something to debate with your industry cohorts besides Rex Ryan's tattoo? Here are important NY real estate trends that’ll drive the new year.

1) FEWER BUILDINGS FOR SALE

January 7, 2013

If you're looking to snap up some buildings this year—like American Realty Capital New York Recovery REIT, which last week bought 256 W 38th St for $48.6M—good luck. Studley capital transactions head Woody Heller (whose team brokered the deal) tells us new product coming to market will be modest compared with 2012; there isn't a big outside incentive like

the threat of rising taxes. Owners still want to transact, he says, whether due to maturing investment funds, compelling

prices, or global economic concerns.

Help

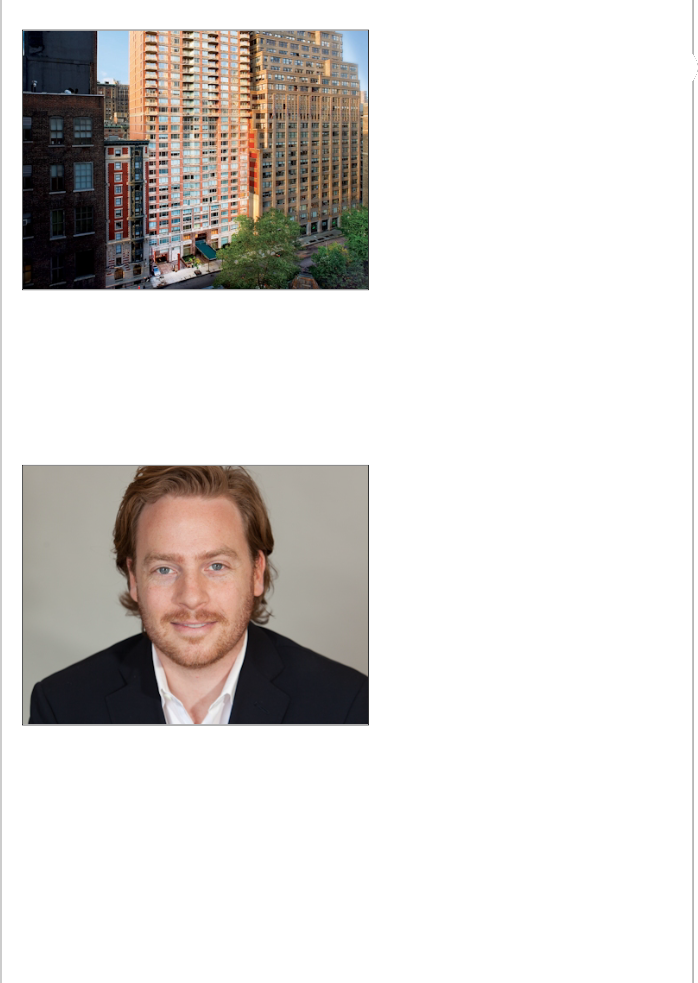

Woody’s 2012 highlights include selling 31 W 27th St for $65M; the 50story Madison Belvedere (above, center) for $300M, one of the year's largest residential deals; and the 62unit luxury rental 111 Kent Avenue, Williamsburg, which sold for record Brooklyn prices ($900k/unit and $875/SF). Four of the past five years, his team has sold the largest development site of the year—and 2013 looks to be no different. No wonder he’s

receiving the Louis Smadbeck Broker Recognition Award at REBNY’s 117th annual banquet Jan. 17. (Get your tickets here.)

2) CORE IS SO 2012

The biggest change Mission Capital Advisors managing director Jordan Ray sees this year are lenders—particularly CMBS— looking outside core to secondary and even tertiary markets; he's doing deals in Louisville, Ann Arbor, the Midwest shale regions, SoFla, and Orange County. Financing in NY is still robust, especially with more capital sources originating debt and equity on multifamily rentals. Brooklyn’s a sweet spot; even neighborhoods outside of Williamsburg and Park Slope are attracting money with varying recourse.

3) OFFICE LEASING STILL SOSO

Colliers launched the year brokering a 25k SF renewal for law firm Grubman, Indursky, Shire, & Meiselas at Carnegie Hall Tower (Newmark Grubb Knight Frank repped landlord TF Cornerstone). Despite some hefty deals, 2012 was a low average year for NYC office leasing, shy of the median 23M to

25M SF, says Colliers Eastern region prez Joe Harbert. Expect much of the same this year, he says—but we may see an uptick in Q1 with new budgets in place and if Europe remains on a positive trajectory. “If so, we’re on track for 2% to 3% growth,” he says. (Note to 2013: don’t mess with Joe and his boxing glove.)

4) LUXURY RETAIL GANGBUSTERS

Shoppers continue to spend money on luxury goods—now retailers need more space. Madison, Fifth, SoHo, and the upper 60s on Columbus are strongly leased, says Winick Realty Group director Kelly Gedinsky. So when a tenant is looking, competition is right behind. Take Meatpacking’s 420 W 14th, where she’s currently leasing 6,400 SF; potential shoewear tenants have been drawn by neighboring Patagonia and Ugg. This demand won’t ebb soon, she says: “Everyone’s nipping at each other’s heels.” (Shoewear tenants will offer literal heel nipping protection.)

5) HOTEL INVESTORS BEARISH?

2012 was spectacular for NYC tourism, breaking records with 52 million visitors. But even with strong hotel fundamentals, healthy occupancy, and hotels nearing peak RevPAR, JLL Hotels SVP Gilda PerezAlvarado says some investors are actually bearish on the sector, with relatively flat budgets and concerns about general macro trends, increased benefit costs, and labor constraints. But NY remains tops—just look at recent impressive deals like the Essex House, The Setai, and The Plaza, she says.

6) INDUSTRIAL LANDLORDS GRAB REINS

NY and NJ industrial tenants have extracted every bit of savings out of their supply chains and are more efficient that ever, says Cushman & Wakefield executive director Stan Danzig. That’s good news for landlords: there’s pentup demand, since tenants still need more space or need to consolidate. Stan's only concern for 2013 is potential spec overbuilding. Along the Turnpike, rents have jumped from $2 to $3/SF to $4 to $4.50/SF; hot submarkets include Edison, the port areas, and the Meadowlands.

It's cruel that Girl Scouts have started selling cookies after we’ve made our resolutions. Goodbye, treadmill… hello Samoas! amanda@bisnow.com and amanda.metcalf@bisnow.com.

CONTACT EDITORIAL CONTACT ADVERTISING CONTACT GENERAL INFO

This newsletter is a journalistic news source which accepts no payment for featured interviews. It is supported by conventional advertisers clearly identified in the right hand column. You have been selected to receive it either through prior contact or professional association. If you have received it in error, please accept our apologies and unsubscribe at bottom of the newsletter. © 2013, Bisnow on Business, Inc., 1817 M St., NW, Washington, DC 20036. All rights reserved.

Subscribe

FREE E-NEWSLETTER

Email SIGN UP FOR FREE!

Careers / Contact Us / FAQ / Media Kit / Press / Archives / Privacy Policy / Terms of Use

Mission Capital’s Managing Director Luis Vergara comments on the state of shadow inventory figures.