From Steve Buchwald, Managing Director, Debt & Equity

March 24th, 2020

Lending Update | March 24, 2020

Bridge Lending Update:

Appetite drastically varies by lender right now. They can be classified into the following groups:

- Debt Funds with Balance Sheets / Unlevered (No Repo):

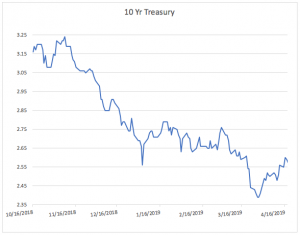

Status: Open for business, being more cautious on deal profile / leverage but still pricing generally at historical lows – all in rates are really the thing to look at as there is no parity in this sector. In general, expect widening in rates due to where perm market seems to be pricing.

- Debt Funds (Repo – Not Margin Called) / Mortgage REITs

Status: On hold for 30-60 days (possibly longer). Doing triage on existing loans or uncertain how to price deals. Some Mortgage REITs say they are still lending, however.

- Debt Funds Dependent on CLO

Status: Completely shut down.

- Debt Funds That Lay Off a Senior

Status: These lenders vary in their appetite right now. Some senior lenders are still active on certain product types, while others are on pause. Non-recourse senior construction lenders still seem to be actively lending.

- High Yield Lenders (Family Office or Offshore Account)

Status: Aggressively pursuing deal profiles they would usually be priced out of.

Perm Lending Update:

- Insurance Companies

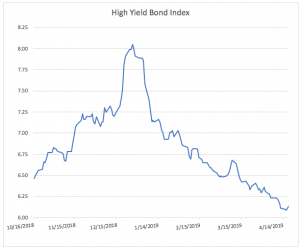

Status: Pricing is all over the place due to the volatility in the corporate bond market and varies by lender as much as 75 bps on the same transaction. The spread between BBB- and AAA credit is the widest ever.

- CMBS Market

Status: In turmoil with spreads widening more than anyone could have imagined a few weeks ago. Deals that were app’d months ago have been re-traded to all-in rates in the ~4.50% range that would have priced in the ~3.00% range a couple of weeks ago. This will have a ripple effect in spreads and pricing throughout the industry.

- Agency Debt

Status: Still active but experiencing record inflows and processing delays.

Conclusion:

Approximately 1/3 of the lenders are not lending right now, 1/3 are being highly cautious and more conservative, and 1/3 are pursuing deals at higher rate profiles. Expect new deals to execute at rates similar to those from 1.5-2 years ago at more conservative leverage levels.

Lenders are now preferring deals with less complication and story to those that are more difficult to understand and underwrite.A big outstanding question that remains is how deals will be closed right now given the difficulty doing site tours, inspections, etc.

Sectors hit hardest by recent events are (in order): hospitality, retail, senior and student housing, office, industrial, multifamily. Lending appetite will likely go in the opposite direction with hospitality and certain types of retail being the most challenging to finance in the short term. Oil markets are also highly impacted.

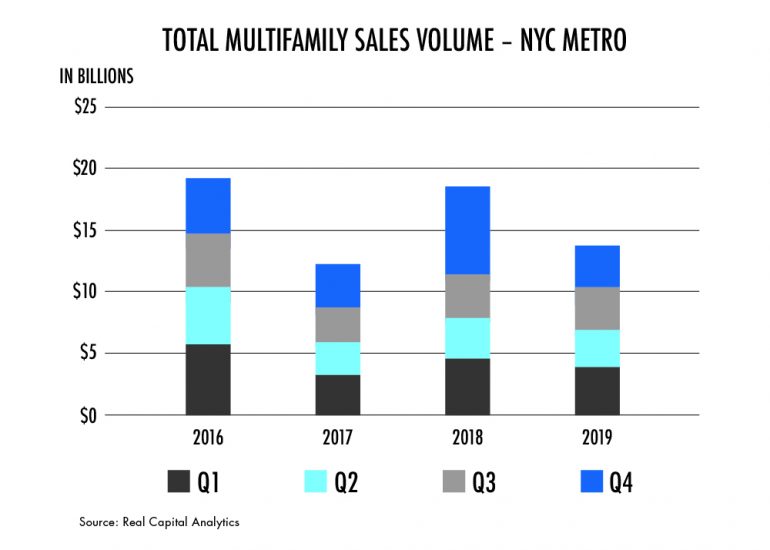

The new regulations make it difficult for landlords to upgrade and convert existing rent stabilized units into market-rate apartments, essentially limiting the potential upside from investing in primarily rent stabilized buildings. As a result, investment activity decreased significantly in 2019. Total sales volume for NYC multifamily properties was just $13.8Bn in 2019, down 26.1% from the $18.7Bn seen in 2018, according to Real Capital Analytics. The new regulations have halted individual apartment improvements as well as any major capital improvements as landlords are no longer rewarded with higher rents for improving units. It is important to note that while investment activity decreased significantly in 2019, sales volume still outpaced the $12.4Bn seen in 2017.

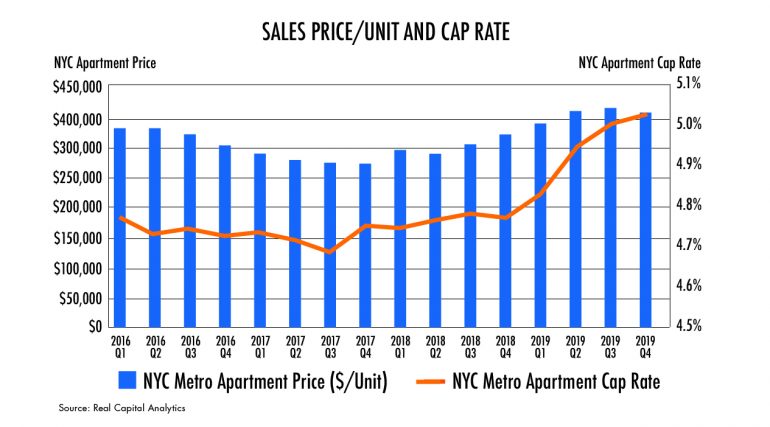

The new regulations make it difficult for landlords to upgrade and convert existing rent stabilized units into market-rate apartments, essentially limiting the potential upside from investing in primarily rent stabilized buildings. As a result, investment activity decreased significantly in 2019. Total sales volume for NYC multifamily properties was just $13.8Bn in 2019, down 26.1% from the $18.7Bn seen in 2018, according to Real Capital Analytics. The new regulations have halted individual apartment improvements as well as any major capital improvements as landlords are no longer rewarded with higher rents for improving units. It is important to note that while investment activity decreased significantly in 2019, sales volume still outpaced the $12.4Bn seen in 2017. As we enter the first quarter of 2020, the possibility of discounted multifamily valuations coupled with historically low interest rates have attracted investors with a different business model buying loans at par where LTV’s have increased and maturity is looming. On the contrary, the new regulations create a unique challenge for those who have either purchased or lent on multifamily assets in New York under the assumption of significant future rent appreciation. For those investors/lenders, the future may not be as grim as they might expect. Despite several discount sales and declining sales volume, price per unit in the NYC multifamily market has remained steady, declining slightly at the end of 2019. Furthermore, cap rates have widened by just 26 bps in 2019, offering both investors and lenders the option to sell off assets that exceed their risk tolerance and mitigate any future losses. Investors and lenders should assess the viability of selling off assets that are heavily affected by the new regulations as strong pricing levels from market players with adapted business models may result in a less costly outcome than internal resolution.

As we enter the first quarter of 2020, the possibility of discounted multifamily valuations coupled with historically low interest rates have attracted investors with a different business model buying loans at par where LTV’s have increased and maturity is looming. On the contrary, the new regulations create a unique challenge for those who have either purchased or lent on multifamily assets in New York under the assumption of significant future rent appreciation. For those investors/lenders, the future may not be as grim as they might expect. Despite several discount sales and declining sales volume, price per unit in the NYC multifamily market has remained steady, declining slightly at the end of 2019. Furthermore, cap rates have widened by just 26 bps in 2019, offering both investors and lenders the option to sell off assets that exceed their risk tolerance and mitigate any future losses. Investors and lenders should assess the viability of selling off assets that are heavily affected by the new regulations as strong pricing levels from market players with adapted business models may result in a less costly outcome than internal resolution.

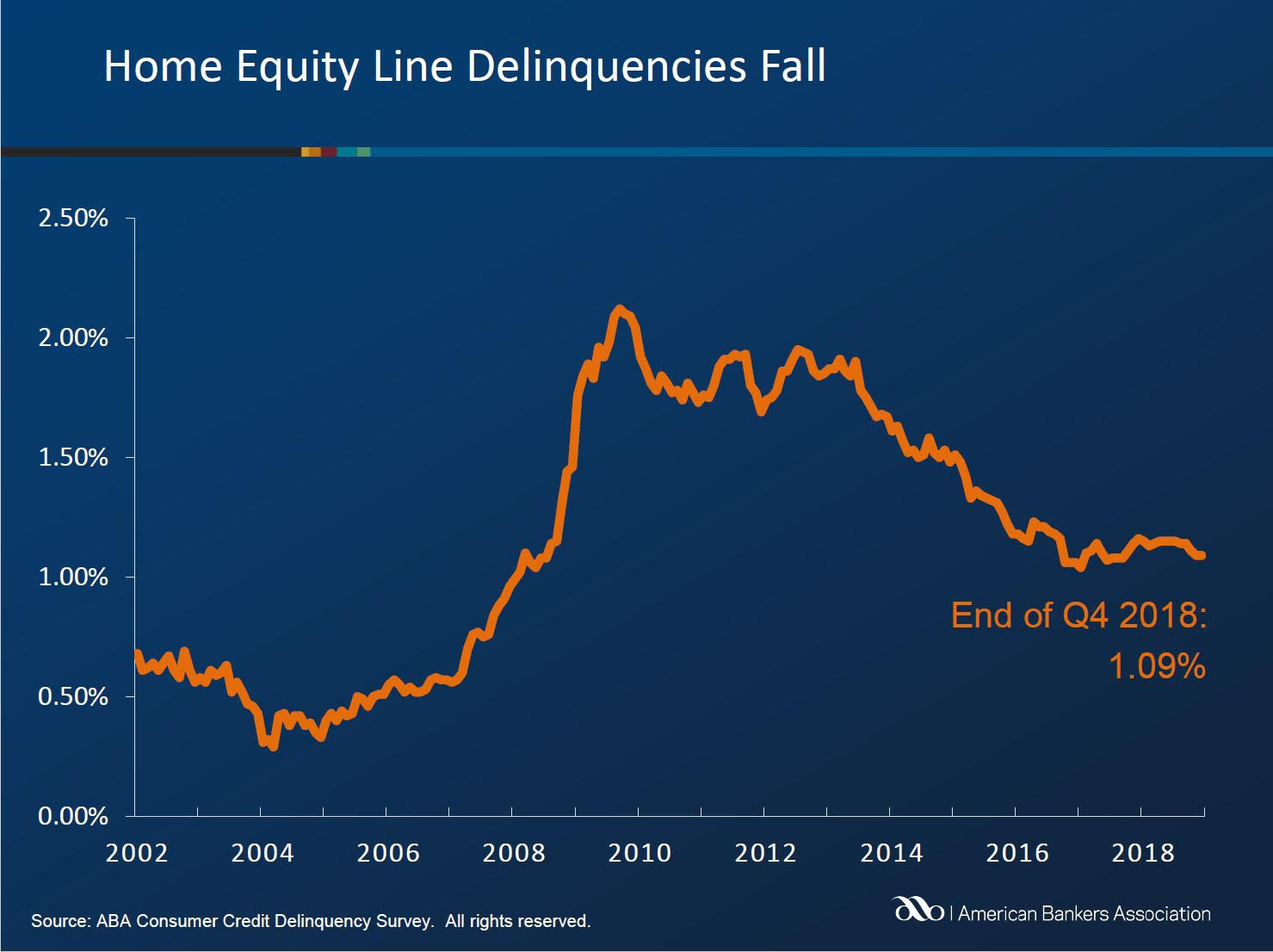

Underlying HELOC fundamentals continue to improve alongside a strengthening US labor market and continued housing price appreciation. Secondary market HELOC pricing/yields have benefitted from the recent rally in the fixed income and credit markets.

Underlying HELOC fundamentals continue to improve alongside a strengthening US labor market and continued housing price appreciation. Secondary market HELOC pricing/yields have benefitted from the recent rally in the fixed income and credit markets. The credit line can be used to cover future costs such as medical bills, home renovations, student tuition, or emergencies. HELOCs bear lower interest rates than other comparable revolving facilities such as credit cards. HELOCs and other 2nd liens usually see an uptick in origination volumes when interest rates rise, since it’s more economical for borrowers to take out a second mortgage instead of refinancing an existing low fixed rate. Generally speaking, HELOCs lost the benefit of interest deductibility with the recent tax law changes, subject to some grandfathering provisions.

The credit line can be used to cover future costs such as medical bills, home renovations, student tuition, or emergencies. HELOCs bear lower interest rates than other comparable revolving facilities such as credit cards. HELOCs and other 2nd liens usually see an uptick in origination volumes when interest rates rise, since it’s more economical for borrowers to take out a second mortgage instead of refinancing an existing low fixed rate. Generally speaking, HELOCs lost the benefit of interest deductibility with the recent tax law changes, subject to some grandfathering provisions.