$21,636,400 Hospitality Loan Sale

-

- Secured by a Hyatt Regency (468 keys)

- Maturity Default – Non-Performing

Suburban ChicagoFor more Loan Sale and Real Estate deals on the market, visit https://market.www.missioncap.com.

$21,636,400 Hospitality Loan Sale

Suburban ChicagoFor more Loan Sale and Real Estate deals on the market, visit https://market.www.missioncap.com.

$105,724,991 Performing Hospitality Loan Portfolio

$26,488,941 Hospitality Loan Sale

$92,371,508 Residential Loan Portfolio Sale

Go to Mission Market for more deals currently on the market.

CLOSED DEAL ALERT — $21,000,000 Performing Loan Sale

• Hospitality

• Jacksonville, FL

• Current deals available at www.missioncap.com

Go to Mission Market for more deals currently on the market.

Mission Capital Advisors. The Real #1 in Loan Sales in 2020.

• Number of Assets Offered: 3,717

• 2020 Total UPB: $2,076,815,327

• Deal Count: 25

Go to Mission Market for more deals currently on the market.

David Tobin, Principal of Mission Capital, discusses what our clients should expect from Mission Capital Advisors now that the company has been acquired by Marcus & Millichap. Hint: it’s good.

This is just the beginning so stay tuned to this space as we release more content pertinent to Mission Capital Advisors, Marcus & Millichap as well as Loan Sales and Real Estate Sales and Debt & Equity.

Due to an unprecedented volume of businesses seeking relief from the fallout of COVID-19, SBA-authorized Banks and Lenders receiving Paycheck Protection Program Form 2483 Applications are experiencing or will experience a variety of business process issues.

Mission Capital provides PPP Lender Support to Banks and Lenders in multiple ways:

Clarification of guidance and requirements for loan forgiveness / lender reimbursement are evolving. Mission Capital PPP Lender Support ensures that Banks and Lenders are prepared for Advance Purchase / Forgiveness Report Submission.

How to Get Started With Mission Capital PPP Lender Support:

You are important to us, and we are here to help you in this trying time.

|

Due to an unprecedented volume of businesses seeking relief from the fallout of COVID-19, Mission Capital is expecting long queues from most banking institutions qualified to lend the highly in-demand PPP SBA loans. We know that you and your assets need relief quickly, are focused on asset management and corporate concerns, and are seeking assistance. If you have a very strong banking relationship that is participating in the program it is always recommended to reach out to that institution first as they will give preference to existing customers in the queue. We are standing by to assist those without strong pre-existing relationships or are concerned about waiting in a queue with lenders who may be unable to get them PPP loans as soon as possible. The team at Mission Capital has been in constant contact with numerous SBA lenders – many of whom are our clients, as well as attorneys, and accountants to gain an understanding of how to size and optimize PPP proceeds and determine the effect the potential uses of proceeds has on loan forgiveness. We are ready to assist you in navigating this tricky process as your Agent at no cost to you. As your Agent we will be compensated by the Lender based on the limited SBA approved schedule. Starting on Friday, April 3, 2020, we can apply for these PPP loans on your behalf. We encourage you to reach out to us as soon as possible and are happy to discuss any nuances with you over the phone at 212-925-7708. In the meantime, please find relevant links below to expedite the loan application process.

Please send completed forms and documents to: sbacares@missioncap.com. We can also provide a secure FileBox link for files containing sensitive information. Feel free to reach out and/or send these items directly to your Mission Capital coverage executive as well. You are important to us, and we are here to help you in this trying time. Best Regards, |

From Steve Buchwald, Managing Director, Debt & Equity

March 24th, 2020

Appetite drastically varies by lender right now. They can be classified into the following groups:

Approximately 1/3 of the lenders are not lending right now, 1/3 are being highly cautious and more conservative, and 1/3 are pursuing deals at higher rate profiles. Expect new deals to execute at rates similar to those from 1.5-2 years ago at more conservative leverage levels.

Lenders are now preferring deals with less complication and story to those that are more difficult to understand and underwrite.A big outstanding question that remains is how deals will be closed right now given the difficulty doing site tours, inspections, etc.

Sectors hit hardest by recent events are (in order): hospitality, retail, senior and student housing, office, industrial, multifamily. Lending appetite will likely go in the opposite direction with hospitality and certain types of retail being the most challenging to finance in the short term. Oil markets are also highly impacted.

In early June, New York State Lawmakers passed the Housing Stability and Tenant Protection Act of 2019. The legislation is a sweeping overhaul of rent laws aimed at increasing tenant’s rights and limiting landlord’s ability to increase rents, evict delinquent tenants and move units to free market status. There are a number of notable changes that come as a result of the rent reform, as outlined below:

Rent Regulation Law Expiration: The new rent regulations are permanent unless the state government repeals or terminates them. Rent regulations previously expired every four to eight years.

Statewide Optionality: Prior geographical restrictions on the applicability of rent laws have been removed, allowing any municipality that otherwise meets the statutory requirements to opt into rent stabilization.

Security Deposit and Tenant Protection:

Vacancy & Longevity Bonus: Landlords were previously able to raise rents as much as 20% each time a unit became vacant. This bonus has been repealed.

High Rent Vacancy Deregulation & High Income Deregulation: Prior to the 2019 reform, units would become exempt from rent regulation laws once the rent reached a statutory high-rent threshold and the unit was vacated or the tenant’s income was $200,000 or higher in the previous two years. This decontrol is no longer applicable under the 2019 reform.

Preferential Rents: The new reform prohibits landlords who offered preferential rents to raise rents to the full legal rent upon tenant renewal. Under the current legislation, the landlord can only increase rents to the full legal rent once a tenant vacates.

Major Capital Improvements: Rent increases based on MCI’s are now capped at 2% annually amortized over a 144-month period for buildings with 35 or less units or 150-month period for buildings with more than 35 units. The new laws eliminate MCI increases after 30 years and require 25% of MCI’s be audited.

Source: Ariel Property Advisors

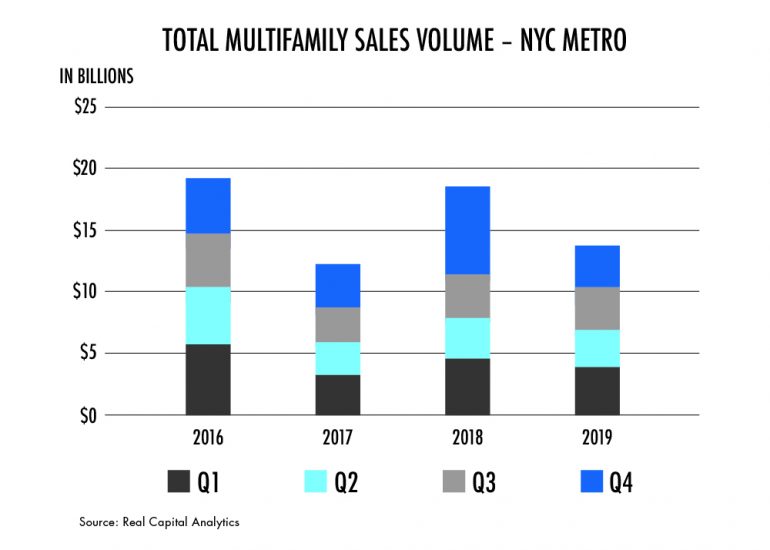

The new regulations make it difficult for landlords to upgrade and convert existing rent stabilized units into market-rate apartments, essentially limiting the potential upside from investing in primarily rent stabilized buildings. As a result, investment activity decreased significantly in 2019. Total sales volume for NYC multifamily properties was just $13.8Bn in 2019, down 26.1% from the $18.7Bn seen in 2018, according to Real Capital Analytics. The new regulations have halted individual apartment improvements as well as any major capital improvements as landlords are no longer rewarded with higher rents for improving units. It is important to note that while investment activity decreased significantly in 2019, sales volume still outpaced the $12.4Bn seen in 2017.

The new regulations make it difficult for landlords to upgrade and convert existing rent stabilized units into market-rate apartments, essentially limiting the potential upside from investing in primarily rent stabilized buildings. As a result, investment activity decreased significantly in 2019. Total sales volume for NYC multifamily properties was just $13.8Bn in 2019, down 26.1% from the $18.7Bn seen in 2018, according to Real Capital Analytics. The new regulations have halted individual apartment improvements as well as any major capital improvements as landlords are no longer rewarded with higher rents for improving units. It is important to note that while investment activity decreased significantly in 2019, sales volume still outpaced the $12.4Bn seen in 2017.

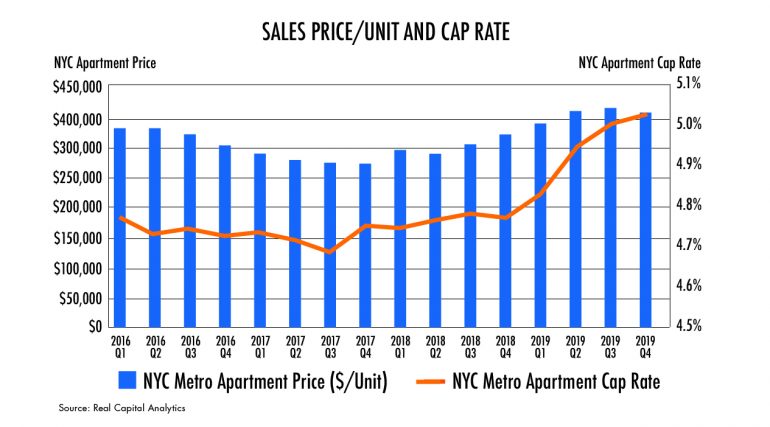

As we enter the first quarter of 2020, the possibility of discounted multifamily valuations coupled with historically low interest rates have attracted investors with a different business model buying loans at par where LTV’s have increased and maturity is looming. On the contrary, the new regulations create a unique challenge for those who have either purchased or lent on multifamily assets in New York under the assumption of significant future rent appreciation. For those investors/lenders, the future may not be as grim as they might expect. Despite several discount sales and declining sales volume, price per unit in the NYC multifamily market has remained steady, declining slightly at the end of 2019. Furthermore, cap rates have widened by just 26 bps in 2019, offering both investors and lenders the option to sell off assets that exceed their risk tolerance and mitigate any future losses. Investors and lenders should assess the viability of selling off assets that are heavily affected by the new regulations as strong pricing levels from market players with adapted business models may result in a less costly outcome than internal resolution.

As we enter the first quarter of 2020, the possibility of discounted multifamily valuations coupled with historically low interest rates have attracted investors with a different business model buying loans at par where LTV’s have increased and maturity is looming. On the contrary, the new regulations create a unique challenge for those who have either purchased or lent on multifamily assets in New York under the assumption of significant future rent appreciation. For those investors/lenders, the future may not be as grim as they might expect. Despite several discount sales and declining sales volume, price per unit in the NYC multifamily market has remained steady, declining slightly at the end of 2019. Furthermore, cap rates have widened by just 26 bps in 2019, offering both investors and lenders the option to sell off assets that exceed their risk tolerance and mitigate any future losses. Investors and lenders should assess the viability of selling off assets that are heavily affected by the new regulations as strong pricing levels from market players with adapted business models may result in a less costly outcome than internal resolution.

[Source: Real Capital Analytics www.rcanalytics.com]

In prior articles, I’ve discussed various forms of non-traditional financing sources including HTCs, PACE, and EB-5. As the traditional LP equity market is increasingly selective for ground up development deals at this stage of the cycle, more and more of these transactions are attempting to utilize these alternative sources to reduce the required equity. One method often circled by developers is selling off the fee interest in the property by creating a new ground lease as a form of financing.

The concept in the eyes of these developers is simple – reduce the capital stack by the sale price of the fee interest and finance the leasehold position separately with a leasehold mortgage in order to maximize leverage. Unfortunately, lenders see right through this and it rarely works as intended.

First of all, the lenders who are willing to lend on the leasehold position are well aware that there is little to no acquisition or purchase price in the capitalized budget, and that this is because there is intrinsic negative value created by the future ground lease expense. Lenders will take the Net Present Value of this expense through the end of the ground lease term at a discount rate of between typically 4% and 6% depending on location. This value is the effective cost of the land and thus increases the last dollar Loan to Value exposure of the lender. 65% LTC on the leasehold position can be as high as 100% LTV depending on terms of the ground lease. This leads lenders to reduce their leverage on the leasehold mortgage and thus does not typically have the intended result of reducing the required equity. Additionally, leasehold mortgage spreads are typically wider than the equivalent first mortgage.

Lenders also hesitate to lend on leasehold positions when the ground lease payments represent too high of a percentage of the projected NOI. As the ground lease payments surpass 20% of projected NOI, there will be little to no financing options available to the borrower.

Add to these complications and constraints the fact that the developer is devaluing the property on the exit by, not only the NPV of the remaining ground lease payment expense, but also due to the leasehold ownership structure holding an intrinsic reduced market value to fee simple ownership. Additionally, ground leases can have various escalations in them that can compound and spiral out of control over time. This is exacerbated by maturities, fair market value resets, payment escalations beyond real rent growth, and other mechanisms or forces that may benefit the fee owner. For example, the famed Lever House in New York City is a case study of a high value leasehold asset undone by a combination of fair market value resets and remaining term. Many other examples abound in and out of New York City.

This is not to say leasehold financing is entirely unavailable or not necessary in certain circumstances. Certainly, if to acquire a particular parcel of land that is owned by a family or individual who wants to hold it for generational cash flow, a ground lease needs to be created to strike a deal, then it is a necessary evil that the developer must navigate. It also can increase the depreciation tax benefits of real estate ownership relative to overall value by excluding the non-depreciable land. If, however, it is simply a financing tool, it will not materially change the actual leverage but instead adds complexity and risk to a deal.

Mezzanine debt and preferred equity may, on their face, seem more expensive on paper. They are, however, a far better leverage and flexibility option than a ground lease.