Impact Of Macroeconomic Trends On Residential Mortgage Industry: Favorable Credit Environment For Whole Loans Sales

[Published by the Loan Sales and Real Estate Sales Desk, Mission Capital]

New York (11/29/2018)

- Current market conditions have created a favorable environment to monetize whole loans.

- Strong fundamentals in the labor markets led to vastly improved credit performance and fuller valuations in the loan space.

- Investors continue to recognize the higher returns and wider moat that whole loans offer compared to traditional bond investments.

- As a macro-economic backdrop, the unemployment rate is now at its lowest level in almost 40 years and wages grew at a healthy pace of 2.9% over the last 12 months.

- Alongside the positive economic developments, loan sale volumes shifted substantially from Non-Performing to Re-Performing loans as loan servicers developed practices to collect more meaningfully on charged off loans and modify impaired loans more effectually.

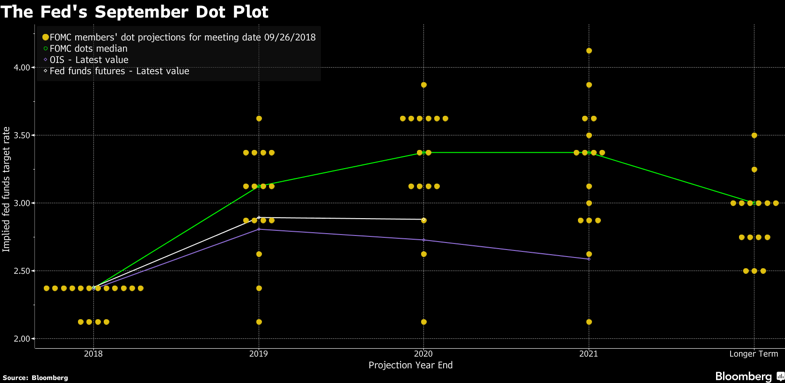

- Meanwhile, the positive credit performance was offset by softness in rates, which sold off in early October in response to Fed hikes and balance sheet run off. Likewise, the Fed’s Dot Plot shows a forthcoming inversion of the discount window, signaling a looming recession.

- Given the full valuations and improved performance, it’s an opportune time for banks to sell their assets at attractive levels so they can focus on their core business of originating new loans. Further, this source of loan product provides investment managers an opportunity to diversify their exposure away from traditional bonds and into whole loans or privately structured products that generate more attractive returns. On the buy-side, the strong credit fundamentals provide an opportunity for funds to harvest their lower yielding assets at favorable levels so they can focus on working out more impaired assets.

About Loan Sales & Real Estate Sales

Mission Capital represents preeminent financial institutions, investors and government agencies on the sale of performing, sub-performing and non-performing debt secured by all types of commercial and consumer collateral, commercial real estate investment property and tax liens. For more information, visit www.www.missioncap.com/loan-sales-real-estate-sales