In response to Trepp’s findings, David Tobin, principal at Mission Capital Advisors, said the delinquency rate remains elevated because of the market pressures all vintages of originations are experiencing.

Tag: Featured

Mission Capital Advisors is offering a $108.1 million portfolio of mixed-quality commercial mortgages and residential loans on behalf of a bank client.

Mission Capital Offers $108.1Mln Mixed-Bag Loan Portfolio

Commercial Real Estate Direct Staff Report

Mission Capital Advisors is offering a $108.1 million portfolio of mixed-quality commercial mortgages and residential loans on behalf of a bank client.

But instead of slicing the portfolio into a number of smaller pools, it is aiming to sell all 432 loans to one investor. Its thinking is that quite a few institutional investors have developed the capabilities needed to service and manage large pools of assets, so demand for large portfolios should be healthy.

A case in point is Capmark Bank's recent sale of a $911 million portfolio of office, hotel and golf course properties to Deutsche Bank. That portfolio was marketed for sale through Eastdil Secured, which normally would have been divided into smaller pools. But it chose to market it as a portfolio because of the strong demand from large investors. Deutsche is said to have agreed to pay 82 cents on the dollar for the loans.

Mission Capital's offering contains 241 commercial real estate loans with a balance of $70.6 million; 69 acquisition, development and construction loans against land parcels with a balance of $15.4 million; 60 single-family home loans with a balance of $12.8 million; 55 business loans with a balance of $9.1 million; and 7 unsecured credits with a balance of $311,947.

All of the loans are in some sort of distress. A total of 200, with a balance of $53.8 million, are less than 30-days late, but the remainder are more delinquent. And 148 loans with a balance of

$40.4 million have matured. A total of 97 of those, with a balance of $33.8 million, are still making their interest payments.

The loans' average size is $250,326. And most – 281 – have balances of $250,000 or less. Ten loans have balances of more than $1 million each. The loans in the portfolio have a weighted average origination date of 2006, maturity of 2015 and coupon of 6.3 percent.

Mission Capital has set a June 26 deadline for indicative bids. It will then invite certain investors to conduct more thorough due diligence and plans to take final bids on July 17. It expects to close a sale by Aug. 1.

For additional details, contact Mission Capital at (212) 925-6692.

Comments? E-mail Orest Mandzy, or call him at (215) 504-2860, Ext. 211.

Copyright ©2012 Commercial Real Estate Direct, a service of FM Financial Publishing LLC. All rights reserved.

Tight inventories of homes for sale in certain markets bode well for continued price gains in those areas, said Luis E. Vergara, director of Mission Capital Advisors in New York. But that’s not enough. “We still need to see greater breadth across markets on a consistent basis to say that we’ve reached an inflexion point and recovery is underway at the national level,” he said.

Luis E. Vergara, a director at Mission Capital Advisors said the CoreLogic report suggests an increase in the velocity with which servicers are liquidating non-performing loans. “However, the CoreLogic methodology omits 90+ day delinquent loans that were recently cured or modified and the likely occurrence of re-default for a subset of this group,” said Vergara. “The drop in shadow inventory may not be as rosy as the report implies.”

With the extra competition now coming from abroad, will domestic buyers be pushed out or priced out by foreign buyers? At this point it’s not likely, says Luis Vergara, director at financial services firm Mission Capital Advisors. Although he’s seen an uptick in sales to foreign buyers in his home market of New York City, overall international buyers still make up a relatively small percentage of total sales.

Mission Capital Advisors is marketing a $345 million special servicer loan sale on behalf of special servicer CW Capital Asset Management. Will Sledge, a managing director, said that though individual bids will be considered, the pool might best be sold in large chunks, maybe even to a single institutional investor, since these have shown increased aggression as of late.

June 2012

$345 Million in Distress on Offer from Mission

![]()

Oversight by CW Capital Asset } Management kept collateral sh·ong.

Mission Capital Advisors is ma rketing a $345 million special servicer loan sale on behalf of special servicer CW Capita l Asset Management, The Mongage Obsen,er has learned. The assignment marks

the growi ng market demand for distressed loans.

Will Sledge, a Mission managing director, said that. though individual bids will be considered, the JX>OI might best be sold in large chunks, maybe even to a single in

sdwtional inveswr, since these have shown increased ag

gression of late.

"It's going m be attractive to inscitutional investors as well as local owner-operacars who might be interested in bidding for specific assers," Mr.Sledge said. "Bur more co the point, the institutional invescors who have been grow ing more aggressive and have outbid to a large degree re cendy the loan-w wn

ter this portfolio as well."

The dozens of assets securing the pool are diverse and spread from coast to coast. However, in the New York tristate area they include a $12-million industrial and cold storage facilicy in B rooklyn and a Melvile office propercy saddled with an unpaid balance of$10 million.

TilE MORTGAGE OBSER.Vffi

"The asset class spectrum is broad," Mr. Sledge told The Morrgage Observer. "lc's pretty much everything that you'd expect to see from a special servicer-you have office, recail, multifamily, industrial, hospitalicy, manufac tured housing, self storage.

And the l ist kind of goes on and on."

Interest, he added, has already been scrong. This is due in pan to collateral that is "rypically very sol id in comparison to oth er bank loan sales that are out there currcndy in the market," Mr. Sledge said. Oversight of the propenies

by CV Capital Asset Managemem has helped as well.

"You have structured documentation because these as sets were originated to be sold imo securitization so that documentation is fairly straightforward and clean," he said. "And you have good data because you have an active asset management process on CW's behalf, so you don't have many holes in terms of trying to fill in the blanks in terms of what's happened from the point of origination to today."

As co how, and if, the pool is broken up, Mr. Sledge

said that it's too early to tell but that "price will diccate the direction."

Two months after matching its lowest reading in a year, the delinquency rate for commercial mortgage-backed securities (CMBS) reached its second-highest reading of all time in April, according to recent data released by Trepp LLC. To understand what impact this will have on the overall state of commercial real estate, MortgageOrb spoke with David Tobin, principal at Mission Capital Advisors.

Mission Capital attended this years NAIOP SoCal’s Night at the Fights event, which drew more than 900 attendees ranging from developer-owners, finance companies, law firms, and representatives from the brokerage world.

Mission Capital is structuring a pool with at least $20 million in loans that should close by mid-August. “The buyer side is robust; a lot of liquidity has been amassed,” says Thomas E. Lane, a director at Mission Capital. “But they aren’t interested in looking at groups of loans in the $3 million to $4 million range. There needs to be a critical size to catch their eye.”

May 16, 2012 By Roberta Barba

Small Banks Warm Up to Pooled Asset Sales

For community banks looking to shed a few problem assets, a flea-market approach might be

better than a garage sale.

Several community bank advisors are structuring pools that would bundle loans from multiple banks to pitch to potential buyers. Mission Capital in New York is structuring a pool with at least

$20 million in loans that should close by mid-August, and Clark Street Capital in Chicago wants

to structure at least two pools that would close in the third or fourth quarter.

While some larger community and regional banks have managed to unload big swathes of troubled loans through distressed sales, smaller banks have been largely locked out.

Small banks either lack the capital to withstand purging all their problems, or the amount of as-

sets they can offer is too small to garner interest from buyers.

“The buyer side is robust; a lot of liquidity has been amassed,” says Thomas E. Lane, a director at Mission Capital. “But they aren’t interested in looking at groups of loans in the $3 million to $4 million range. There needs to be a critical size to catch their eye.”

Lane said the company is in serious talks with about ten banks so far. The firm hopes to have a pool structured by June 15. The goal is to have each participant kick in at least $5 million of notes to the pool. Lane says the pool could swell to as much as $35 million, based on current discussions.

Independent Bank (IBCP) in Ionia, Mich., is one of the banks considering participating in Mis- sion’s pool. The $2.4 billion-asset company had $52 million of nonperforming assets at March

31.

“It is an appealing concept and it is something we are evaluating,” says Robert Shuster, Indepen- dent’s chief financial officer. “We would need to make a basic decision concerning every problem credit to make sure that the execution through these means would be superior to what we can do on our own.”

Lane says there are cases where sellers might have a better outcome handling its own sales, including instances where the bank has already taken the collateral. Out-of-market assets left over from a branch sale, however, would be an example of where a bulk sale might make sense.

1 of 2

Jon Winick, the president of Clark Street Capital, says that participating banks should expect a better return than they would get on their own. Clark Street has structured pooled sales on par- ticipation loans before, but the pools it is building now would represent the first time it will group disconnected banks.

“The theory is that the larger the pool, the greater the interest and thus a greater execution,” Winick says. “It doesn’t always work that way, but the idea is that more people show up to the auction, and that drives the price higher.”

A pooled structure is not without difficulties. Winick and Lane say that splitting proceeds among the banks is complicated. Clark Street’s approach is to accept bids for the whole pool, but bid- ders must allocate values to each asset. Mission is using the size to attract buyers, but the expectation is that potential buyers will bid on individual assets or the smaller pools from each bank.

Kingsley Greenland, chief executive of DebtX, which brokers loan sales, says there has been a rise in buyers looking for large deals. His firm markets loans individually and as parts of pools so that sellers can pick the best value for them.

“Over the past six months, we have seen a premium in aggregate bids and that is not something we’d seen before,” Greenland says. “There is a lot of capital that needs to be deployed, so the larger players can reach out more on a bigger deal.”

To see the article online, please visit

http://www.americanbanker.com/issues/177_94/nonperforming-assets-bulk-sales-independent-1049335-1.html

2 of 2

“Europe is definitely more undercapitalized than their U.S. counterparts and more likely to do extensions and other maneuvers to preserve capital,” said David Tobin, principal at Mission Capital Advisors, which is marketing several real-estate portfolios for North American banks.

This month, The Mortgage Observer spoke to Mission Capital Advisor’s Jordan Ray about the climate at Mission Capital Advisors, where he sees capital flowing and the importance of supercharging borrowers.

may 2012

Q&A:

The M.O. chats with Mission Capital Advisor’s Jordan Ray

Despite Q4

drop in distress,

Schechtman, Knakal and

others rack up note sale deals

The Insider’s Monthly Guide to New York’s Commercial Mortgage Industry

Power Profile:

Kevin

Cummings

How Investors Bank Will Grow, Serving Underserved

Savills USA CEO John Lyons Talks

Cross- Border Investment

Stein’s Law: Pitfalls to Avoid for Loan Guarantors

Michael Stoler

Takes an In-Depth Look at

Construction Financing

Capstone’s Recap of

Iconic 14 Wall Street

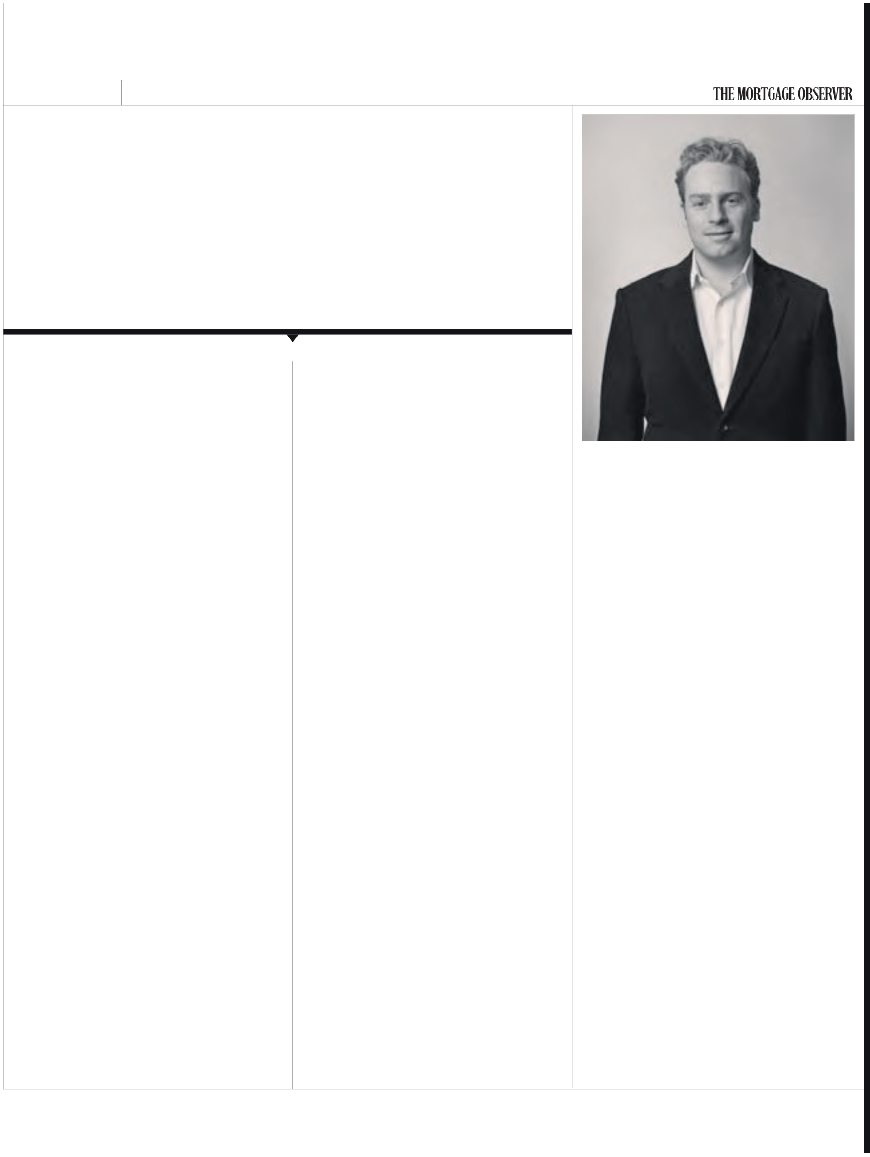

Q&A / May 2012

Jordan Ray

Mission Capital Advisors

This month, The Mortgage Observer spoke to Mission Capital Advisor’s Jordan Ray about the climate at Mission Capital Advisors, where he sees capital flowing and the importance of supercharging borrowers.

by Ian Thomas

age here is in the 30s. We all sort of rode the wave

of technology boom like everybody else did. One of

the things that attracted me to Mission was that when

The Mortgage Observer: Can you tell me a little

about your background and how you got started in real estate?

![]()

Jordan Ray: I’ve been in the business since 2001. I started out at Ackman-Ziff and I was there for almost five years. I’ve been a commercial mortgage broker and equity advisor for my entire career—ever since graduating from the NYU program. I grew up in Mon- treal and in Palm Beach County, Florida, and went to school in D.C. at American University.

I started working at Ackman-Ziff when I was in grad school—it was a great place to grow up in this side of the business. In 2009 when the world started to turn and there really wasn’t a lot of financ- ing, everybody started thinking about the future. It was an opportunity for me to come here to join Mission with a colleague of mine, Jason Cohen, be- cause he knew the guys over here and Mission has been one of the most active loan sales advisors in the country—selling about a billion dollars of sub- and nonperforming debt every quarter. And they had no real finance desk. The idea was to come here and sell loans for a year to do something because there wasn’t much going on, but always have an eye toward starting the finance business when the mar- ket came back. Last year was our first year back in the finance business—we did about $540 million of debt and equity.

Can you give me some idea of what your day-to- day is like?

When a deal comes in I’m spending about 85 percent of my time on the deal. Now that we’re hiring more execution folks, I’m planning to spend more time looking for new business. On the execution side when we’re placing business we spend a lot of time up front on a deal figuring it out.

We have a very heavy technology focus here at Mission. That sort of sets us apart from where I used to be—not that there’s anything bad. It’s just a little different because we’re a younger firm. The average

they sell loans, generally investors know it is a very tech-heavy process, so we spend a lot of money on proprietary data rooms and proprietary customer rela- tions management so we know exactly who is doing what at any given time.

What’s the firm’s philosophy regarding growth?

We have very little turnover here, which is something that is rare. The guys who make the decisions about this business all come from other brokerage firms. So we’ve all seen the pitfalls of growth. We’ve seen good and bad. We’ve seen smart growth and we’ve seen just adding bodies to add bodies because it makes more money. We’ve been very slow to add bodies because when you bring someone in, you want to make a com- mitment to them and you want to know that they’re going to be there for the long haul because we have a very interesting environment.

Regarding the economic climate—is there less uncertainty out there compared with six months or a year ago?

We’re adding jobs slowly. We’re adding different kinds of jobs in places like New York. There’s a lot of tech now—a lot less finance, a lot more tech. Rates are probably artificially low, as we all know. Unfortunately I’m not much of an economist. I’m just an advisor, so all I can do is try to find the best deals for my clients at any given time in the cycle. I do know that when you look at some of the things that are holding our side down, i.e. banks that are stuck with product, too many loans clogging their pipelines, that stuff is fil- tering out slowly. There’s more lending because the cream is rising to the top a little bit but the healthy lenders are starting to lend and ones that aren’t are sort of petering out. And that’s another point, by the way, just to back up for a second. The loan sale busi- ness has helped us find and start relationships with regional and local banks that I probably never would have had before because those are the clients on the loan sale side.

Is lending loosening a little bit? Or is it still for the select borrower in select markets?

It always helps to have a high-class, very-top-tier spon- sor. We’ve done a couple of deals where, especially on the construction side, where you have a great deal but in order to have it financeable in our opinion you need to bring in a partner to add horsepower to the borrow- ing entity. So we’ve done a couple of deals where that has been the case and we think that if you are going to do a large construction deal, you sort of need to be a bank’s … you need to be their one or two deals like that that year right now.

Where do you see capital flowing today? Is it the usual places?

Look, everybody likes to use the sound bytes and they’re all the same—gateway markets and all that boring stuff and you can even joke about that, but the reality is that there’s a reason we call them gateway markets and capital cities. Lenders and investors want to be in markets where the recovery is happening the fastest. We’ve been doing a lot of work in New York, D.C. and Miami.

We did a large condominium project here in New York last year where we brought in a very prominent private equity fund to be a partner in the equity. It’s a deal on 18th street—210 West 18th Street. We rep- resented that venture to close in a $97.5 million con- struction loan. That was a two bank deal.

Where do you see the securitization market going these days? Is it picking back up?

It’s certainly picking up. There’s a lot of fixed-rate se- curitization shops out there—secondary and primary shops. When the securitization market is chugging it’s sort of a commodity. It’s about who can give you the best execution.

28

The market for distressed debt has grown increasingly aggressive as clarity related to asset values emerge, said Will Sledge, a managing director at Mission Capital. Also driving demand is the need for private equity to deploy capital raised in the early stages to take advantage of the impending sell-off.