CLOSED DEAL ALERT — $21,000,000 Performing Loan Sale

• Hospitality

• Jacksonville, FL

• Current deals available at www.missioncap.com

Go to Mission Market for more deals currently on the market.

CLOSED DEAL ALERT — $21,000,000 Performing Loan Sale

• Hospitality

• Jacksonville, FL

• Current deals available at www.missioncap.com

Go to Mission Market for more deals currently on the market.

Mission Capital Advisors. The Real #1 in Loan Sales in 2020.

• Number of Assets Offered: 3,717

• 2020 Total UPB: $2,076,815,327

• Deal Count: 25

Go to Mission Market for more deals currently on the market.

David Tobin, Principal of Mission Capital, discusses what our clients should expect from Mission Capital Advisors now that the company has been acquired by Marcus & Millichap. Hint: it’s good.

This is just the beginning so stay tuned to this space as we release more content pertinent to Mission Capital Advisors, Marcus & Millichap as well as Loan Sales and Real Estate Sales and Debt & Equity.

Mission Capital Advisors (MCA) is excited to announce it has been acquired by Marcus & Millichap, Inc. (NYSE:MMI) and will be a subsidiary of Marcus & Millichap Capital Corporation (MMCC). For the past few years we have given tremendous thought and had numerous exploratory conversations regarding how best to position our company for the future and to continue providing the best service and suite of offerings to you, our most valued clients. For us, providing you capital solutions for your transactions has excited and energized us. However, it is the ongoing and long-term client relationships and friendships formed in the process that are most precious to us.

So why Marcus & Millichap? The simple answer is that our core values and approach to client service are perfectly aligned. In business since 1971, Marcus & Millichap closes more transactions than any other brokerage firm in the country. Its 2,000 investment sales and capital markets professionals are located in over 80 offices across the U.S. and Canada. It is a New York Stock Exchange-listed company with a market cap of approximately $1.225B and a strong, debt-free balance sheet. On a daily basis, Marcus & Millichap delivers deep capital markets expertise, market intelligence, and extensive research to its clients. We can now share this access to transactions, capital sources, research, technology and more – with you. There are fantastic synergies across our respective organizations with very little overlap.

Mission Capital will be keeping its name, brand, and identity for many years to come and will continue to provide its suite of capital markets solutions, asset sales, diligence, consulting and document curative services.

Mission Capital is also pleased to announce that it has hired Spencer Kirsch as Vice President and John Jenkins as an Associate as part of the loan sale team.

Spencer Kirsch joins as a Vice President after a 5-year stint at Waterfall/ReadyCap REIT. He has extensive deal management and analytics experience in the small balance commercial and residential portfolio sectors, most recently in non-QM and SFR portfolio acquisitions. Spencer has a BS in Finance from Tulane University.

John Jenkins joins as an Associate after almost three years with the largest US residential mortgage REIT, Annaly Capital Management. He has specialized in the structuring, data analysis, and acquisition of billions of dollars of single-family loan portfolios. In addition, he has worked on both seasoned and new origination whole loan transactions. John has an MS in finance from Imperial College Business School, London, and BA in Business/Economics from Ursinus College and is a CFA.

Both John and Spencer will be located in the New York office and working closely with Mission executives in New York, Texas, California and Florida.

As always, we look forward to working with you in the future. If you have any questions, please do not hesitate to reach out to us.

Best Regards,

David & Joe

By Brian Spegele and Cezary Podkul

Updated Oct. 9, 2020 10:04 am ET

“There’s still financing available, particularly for the right deals, but it’s definitely a more challenging environment,” said Steven Buchwald, managing director at Mission Capital.

Read the full article now at https://www.wsj.com/articles/trumps-businesses-face-debt-deadlines-amid-economic-slowdown-11602252225?mod=hp_lead_pos3.

Due to an unprecedented volume of businesses seeking relief from the fallout of COVID-19, SBA-authorized Banks and Lenders receiving Paycheck Protection Program Form 2483 Applications are experiencing or will experience a variety of business process issues.

Mission Capital provides PPP Lender Support to Banks and Lenders in multiple ways:

Clarification of guidance and requirements for loan forgiveness / lender reimbursement are evolving. Mission Capital PPP Lender Support ensures that Banks and Lenders are prepared for Advance Purchase / Forgiveness Report Submission.

How to Get Started With Mission Capital PPP Lender Support:

You are important to us, and we are here to help you in this trying time.

|

Due to an unprecedented volume of businesses seeking relief from the fallout of COVID-19, Mission Capital is expecting long queues from most banking institutions qualified to lend the highly in-demand PPP SBA loans. We know that you and your assets need relief quickly, are focused on asset management and corporate concerns, and are seeking assistance. If you have a very strong banking relationship that is participating in the program it is always recommended to reach out to that institution first as they will give preference to existing customers in the queue. We are standing by to assist those without strong pre-existing relationships or are concerned about waiting in a queue with lenders who may be unable to get them PPP loans as soon as possible. The team at Mission Capital has been in constant contact with numerous SBA lenders – many of whom are our clients, as well as attorneys, and accountants to gain an understanding of how to size and optimize PPP proceeds and determine the effect the potential uses of proceeds has on loan forgiveness. We are ready to assist you in navigating this tricky process as your Agent at no cost to you. As your Agent we will be compensated by the Lender based on the limited SBA approved schedule. Starting on Friday, April 3, 2020, we can apply for these PPP loans on your behalf. We encourage you to reach out to us as soon as possible and are happy to discuss any nuances with you over the phone at 212-925-7708. In the meantime, please find relevant links below to expedite the loan application process.

Please send completed forms and documents to: sbacares@missioncap.com. We can also provide a secure FileBox link for files containing sensitive information. Feel free to reach out and/or send these items directly to your Mission Capital coverage executive as well. You are important to us, and we are here to help you in this trying time. Best Regards, |

From Steve Buchwald, Managing Director, Debt & Equity

March 24th, 2020

Appetite drastically varies by lender right now. They can be classified into the following groups:

Approximately 1/3 of the lenders are not lending right now, 1/3 are being highly cautious and more conservative, and 1/3 are pursuing deals at higher rate profiles. Expect new deals to execute at rates similar to those from 1.5-2 years ago at more conservative leverage levels.

Lenders are now preferring deals with less complication and story to those that are more difficult to understand and underwrite.A big outstanding question that remains is how deals will be closed right now given the difficulty doing site tours, inspections, etc.

Sectors hit hardest by recent events are (in order): hospitality, retail, senior and student housing, office, industrial, multifamily. Lending appetite will likely go in the opposite direction with hospitality and certain types of retail being the most challenging to finance in the short term. Oil markets are also highly impacted.

In early June, New York State Lawmakers passed the Housing Stability and Tenant Protection Act of 2019. The legislation is a sweeping overhaul of rent laws aimed at increasing tenant’s rights and limiting landlord’s ability to increase rents, evict delinquent tenants and move units to free market status. There are a number of notable changes that come as a result of the rent reform, as outlined below:

Rent Regulation Law Expiration: The new rent regulations are permanent unless the state government repeals or terminates them. Rent regulations previously expired every four to eight years.

Statewide Optionality: Prior geographical restrictions on the applicability of rent laws have been removed, allowing any municipality that otherwise meets the statutory requirements to opt into rent stabilization.

Security Deposit and Tenant Protection:

Vacancy & Longevity Bonus: Landlords were previously able to raise rents as much as 20% each time a unit became vacant. This bonus has been repealed.

High Rent Vacancy Deregulation & High Income Deregulation: Prior to the 2019 reform, units would become exempt from rent regulation laws once the rent reached a statutory high-rent threshold and the unit was vacated or the tenant’s income was $200,000 or higher in the previous two years. This decontrol is no longer applicable under the 2019 reform.

Preferential Rents: The new reform prohibits landlords who offered preferential rents to raise rents to the full legal rent upon tenant renewal. Under the current legislation, the landlord can only increase rents to the full legal rent once a tenant vacates.

Major Capital Improvements: Rent increases based on MCI’s are now capped at 2% annually amortized over a 144-month period for buildings with 35 or less units or 150-month period for buildings with more than 35 units. The new laws eliminate MCI increases after 30 years and require 25% of MCI’s be audited.

Source: Ariel Property Advisors

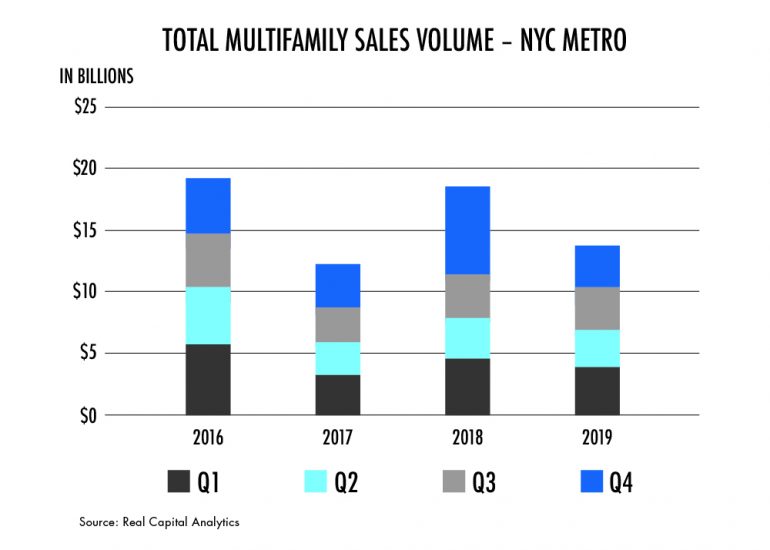

The new regulations make it difficult for landlords to upgrade and convert existing rent stabilized units into market-rate apartments, essentially limiting the potential upside from investing in primarily rent stabilized buildings. As a result, investment activity decreased significantly in 2019. Total sales volume for NYC multifamily properties was just $13.8Bn in 2019, down 26.1% from the $18.7Bn seen in 2018, according to Real Capital Analytics. The new regulations have halted individual apartment improvements as well as any major capital improvements as landlords are no longer rewarded with higher rents for improving units. It is important to note that while investment activity decreased significantly in 2019, sales volume still outpaced the $12.4Bn seen in 2017.

The new regulations make it difficult for landlords to upgrade and convert existing rent stabilized units into market-rate apartments, essentially limiting the potential upside from investing in primarily rent stabilized buildings. As a result, investment activity decreased significantly in 2019. Total sales volume for NYC multifamily properties was just $13.8Bn in 2019, down 26.1% from the $18.7Bn seen in 2018, according to Real Capital Analytics. The new regulations have halted individual apartment improvements as well as any major capital improvements as landlords are no longer rewarded with higher rents for improving units. It is important to note that while investment activity decreased significantly in 2019, sales volume still outpaced the $12.4Bn seen in 2017.

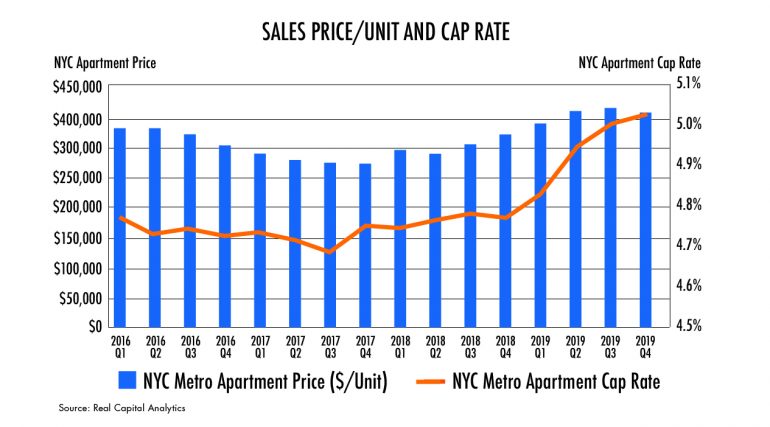

As we enter the first quarter of 2020, the possibility of discounted multifamily valuations coupled with historically low interest rates have attracted investors with a different business model buying loans at par where LTV’s have increased and maturity is looming. On the contrary, the new regulations create a unique challenge for those who have either purchased or lent on multifamily assets in New York under the assumption of significant future rent appreciation. For those investors/lenders, the future may not be as grim as they might expect. Despite several discount sales and declining sales volume, price per unit in the NYC multifamily market has remained steady, declining slightly at the end of 2019. Furthermore, cap rates have widened by just 26 bps in 2019, offering both investors and lenders the option to sell off assets that exceed their risk tolerance and mitigate any future losses. Investors and lenders should assess the viability of selling off assets that are heavily affected by the new regulations as strong pricing levels from market players with adapted business models may result in a less costly outcome than internal resolution.

As we enter the first quarter of 2020, the possibility of discounted multifamily valuations coupled with historically low interest rates have attracted investors with a different business model buying loans at par where LTV’s have increased and maturity is looming. On the contrary, the new regulations create a unique challenge for those who have either purchased or lent on multifamily assets in New York under the assumption of significant future rent appreciation. For those investors/lenders, the future may not be as grim as they might expect. Despite several discount sales and declining sales volume, price per unit in the NYC multifamily market has remained steady, declining slightly at the end of 2019. Furthermore, cap rates have widened by just 26 bps in 2019, offering both investors and lenders the option to sell off assets that exceed their risk tolerance and mitigate any future losses. Investors and lenders should assess the viability of selling off assets that are heavily affected by the new regulations as strong pricing levels from market players with adapted business models may result in a less costly outcome than internal resolution.

[Source: Real Capital Analytics www.rcanalytics.com]

New Yorkers have long shared apartments in order to afford the city’s famously high rents. This, of course, often entails hunting down an apartment with a real estate agent — and paying a broker’s fee, plus a hefty deposit — then furnishing the place, lining up roommates and getting electricity and internet service up and running.

For several years, co-living companies have been popping up, providing a fast, streamlined alternative in the form of fully furnished, move-in-ready rooms in shared apartments.

Lately the trickle of co-living activity has become a torrent.

Homegrown companies are expanding into new neighborhoods. Brands that have built up their businesses elsewhere are planting their flags here. And even traditional real estate companies are getting into the act.

“No one wants to be left behind,” said Matthew Polci, a managing director at Mission Capital Advisors, which has been financing an increasing number of co-living projects.

With so many in the pipeline, Brad Hargreaves, chief executive of the Brooklyn-born co-living company Common, predicts that the number of co-living rooms in the New York today — over 25,000, by some estimates — is a “fraction of a fraction of what it will be.” His own company, which he founded in 2015 and now operates in six cities, has 520 rooms in 20 buildings in New York alone, and more on the way.

But as more co-living companies muscle their way into New York — and competition among them heats up — some are upping the ante. They are jazzing up the décor in their buildings. They are giving some rooms private bathrooms and adding full-fledged studios and one-bedroom apartments so a resident can graduate from a shared apartment to his or her very own place. And they are not only retrofitting apartments in existing small- and medium-size buildings but also working with developers to add co-living to new large-scale projects — or even planning their own buildings from scratch.

The San Francisco-based Bungalow, which typically works with owners of small buildings, offers some of the least expensive co-living rooms in New York, based on a comparison of prices online. But the furnishings are fairly basic and the housekeeping monthly rather than weekly.

Generally, the all-inclusive rent for a co-living room starts at around $1,300 and can run well over $2,000 for a room with an en suite bath — not unreasonable, perhaps, considering all that’s covered in the monthly fee, but not exactly low budget.

Still, for those moving to New York for the first time, or for a finite period, the arrangement can be a boon.

It certainly has been for Andrew Athanasiadis, a Chicago native. He had two weeks to find a place to live here after landing a job at Cushman & Wakefield, but he didn’t know New York well and was loathe to get locked into a long-term lease for fear he’d end up in a neighborhood he didn’t like.

A Chicago friend had mentioned the co-living company Quarters, which was founded in Berlin and had opened a project in Mr. Athanasiadis’s hometown. Quarters, he learned, also operates two locations in Manhattan (and has three more in the works, in Brooklyn).

A bedroom was available in a three-bedroom, one-bath apartment in the company’s building in the East Village and he signed a six-month lease at a rate of $1,700. He was grateful not to have to “buy all new everything” and figured he could move once he got his bearings.

Recently he renewed his lease, locking in a discounted rate of $1,600 because he signed for another six months. Mr. Athanasiadis, who is 30, said that eventually he will want his own place. For now, he added, “as long as the price is right I see no reason to move.”

Although Mr. Athanasiadis’s building is a six-story brick apartment house from the 1920s that was retrofitted for co-living, Simon Baron Development’s Alta+ rental tower, which opened in 2018 in Long Island City, devoted the second through the 16th of its 43 floors to co-living from the start. The co-living operator Ollie advised on the layouts of the 169 shared suites on those floors and now manages them.

The model co-living apartment is 918 square feet — the size of a one-bedroom one-bath apartment on the regular upper floors of the building. By eliminating the living room, Ollie managed to fit in three modestly sized bedrooms, two baths and a kitchen. And perhaps borrowing a page from the micro-unit trend, the company outfitted the bedrooms with Murphy beds and multifunctional furniture so they could each feel like a living room during the day.

While Alta+ combines co-living and conventional apartments in a single building, the Collective, a London-based company, is experimenting with co-living/hotel hybrids.

The company recently acquired a century-old industrial plant in Long Island City that had been converted to a 125-room hotel called the Paper Factory (the building once produced newsprint). After a few tweaks and a rebranding, the property was relaunched late last year as the Collective Paper Factory, offering rooms available for a single night or up to 29 (the maximum stay starts at $2,300).

And the Collective has three ground-up projects in progress. Working with Tower Holdings Group, a local developer, the company will soon begin constructing a 439-unit project in the Bedford-Stuyvesant neighborhood of Brooklyn; it will offer a combination of short- and long-stay rooms across three buildings. In southeast Williamsburg, it will build a 26-story tower with 246 co-living units and 306 hotel rooms. And a central Williamsburg project will combine 97 rooms of student housing with 127 studios for nightly and monthly stays. All rooms will have private baths.

The projects, which are expected to be completed in 2022, will also offer amenities associated with luxury housing. The southeast Williamsburg building, for instance, will have multiple lounges along with a hammam/spa and a music practice room.

The largest of these, in East Harlem, will be developed by Common working with L+M Development Partners and LIHC Investment Group, an affordable housing owner. Two-thirds of the units in the project will go to tenants earning 50, 80 and 120 percent of city’s area median income. The lowest rent: around $800.

READ ORIGINAL ARTICLE HERE.

The London Interbank Offered Rate (LIBOR) is a benchmark interest rate that historically represented an average estimate of interest rates that the major global banks lent to one another on a short-term basis. Although originated in 1969 and currently one of the most frequently used interest rate benchmarks in lending, formal data collection did not occur until the mid 1980’s. It is estimated that approximately $250 trillion in LIBOR-benchmarked product is outstanding.

In 2012, financial regulators (currently the Financial Conduct Authority (FCA)) began requiring that reporting for LIBOR be based on actual transactions rather than estimates. Because of the new reporting requirement, several banks removed themselves from the process, resulting in declining participation. Additionally, the reporting requirement came at a time when unsecured borrowing was declining as banks began favoring overnight secured borrowing instead. With the decline in participation and in the reliability of the data being provided, experts began to question the validity of LIBOR as a benchmark. In fact, because of a growing sense of unreliability from market participants, the FCA decided that starting at the end of 2021 they would no longer require participating banks to continue to report nor would they publish the rate publicly, thus effectively ending LIBOR as a viable reference rate beyond 2021.

Following this announcement, consensus among lenders was that the lack of published rate could be problematic. Market participants are now contingency planning should LIBOR cease to exist. Appropriate plans should include the following: (i) a full review of loan portfolio to determine potential risk exposure (loans that mature after 2021), (ii) review of loan documentation, particularly interest-rate fall back language to determine potential risk exposure (unclear or inconsistent language, silent on fallback, etc.), (iii) after review, modify or sell loans that may have deficient fall back language, (iv) implement/review protocols to ensure they will be followed correctly, including the proper servicing of loans should fallback language be required to go into effect, (v) review preparedness of servicing systems to correctly capture modifications to affected loans in the event of a transition and (vi) consider originating new product using an alternative risk free rate.

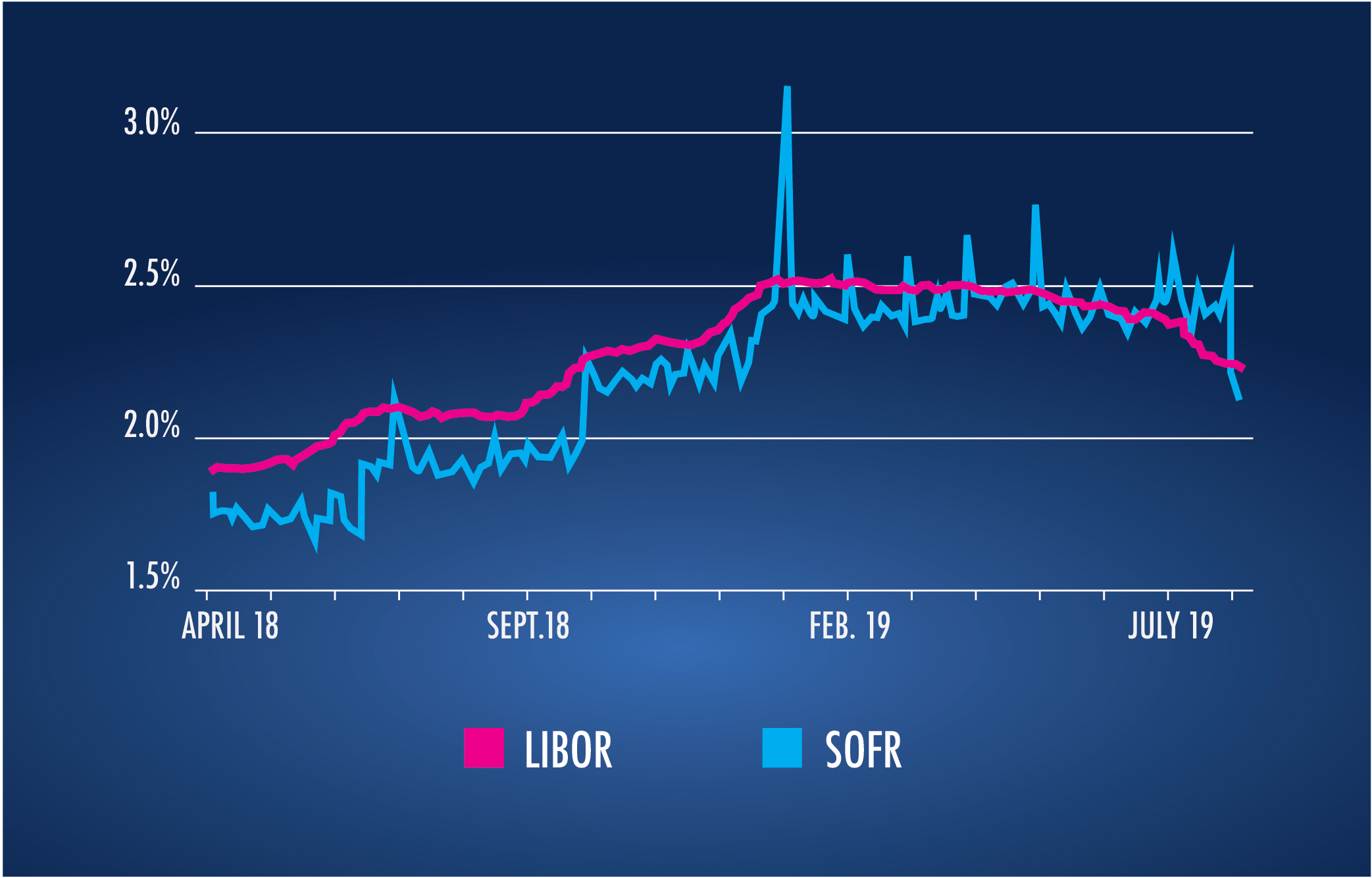

When modifying existing loans or originate new ones, lenders should transition to alternative risk-free rates such as the Secured Overnight Financing Rate (SOFR), which is currently backed by the Alternative Reference Rate Committee (ARRC). SOFR, which was established in April 2018 and currently monitored by the Federal Reserve Bank of New York, is one of the most popular alternative rates. The biggest difference between SOFR and LIBOR is that SOFR is entirely based on actual secured transactions that have occurred. Because of this, it has predominantly been a slightly lower rate than LIBOR over their corresponding lifetimes as displayed in the table below:

While it’s impossible to predict where LIBOR rates will be relative to any alternative rates when a potential hard stoppage of the publication of LIBOR occurs, at various times LIBOR and SOFR have been the same, or SOFR has been higher than LIBOR. This uncertainty may make modifications with borrowers a challenging proposition. Therefore, as stated above, lenders should assess the viability of selling off loans with deficient fall back language (or loans to borrowers that may be unresponsive) to mitigate portfolio risk in advance of a transition. Strong secondary market pricing from financial institutions that are equipped to navigate deficient rate language may result in a less costly outcome than internal resolution.

An online auction site is slated to open bidding at $4.5 million next month for a Fairfax County office complex that sold during the height of the real estate market in 2006 for nearly five times as much.

RealInsight Marketplace will kick off the auction Sept. 10 on behalf of Mission Capital Advisors LLC. The real estate capital markets firm was brought in by special servicer CWCapital Asset Management to help dispose of the Greenbriar Corporate Center after it was foreclosed on earlier this year. The prior owner of 13135 Lee Jackson Highway, an affiliate of North Bethesda-based Guardian Realty Investors LLC, defaulted on the debt it took out in 2006 to buy the property for $21.4 million, according to loan servicing notes and Fairfax County land records. It is now assessed at nearly $13.6 million.

Representatives for Guardian could not be reached for comment.

Kyle Kaminski, a director with Mission Capital, said he hopes the online auction will tap into a larger pool of investors looking for value-add properties like Greenbriar than traditional marketing would. Greenbriar, located just west of the Route 50 interchange with the Fairfax County Parkway, is a 116,581-square-foot property developed in the mid-1980s.

“I think it’s mostly a function of the market is active right now. There’s lots of groups out there paying good money for deals,” Kaminski said. “The auctions themselves tend to lend themselves well to situations like this, and this one happens to be one that has some positive momentum.”

Commercial real estate firm CBRE, handling leasing for the property, recently inked an 8,700-square-foot lease with Virginia Surgery Associates. As of July 31, Greenbriar was about 77% leased to tenants including Fairfax Pediatrics Associates, Long & Foster Real Estate and Re/Max Premier.

Greenbriar is one of a dwindling number of properties sold or renovated in the lead-up to the Great Recession with debt that was bundled into a larger pool of commercial mortgage-backed securities, or CMBS. Much of that debt has since come due, and many of the properties impacted have either been sold at deep discounts, foreclosed on, or given back to their lenders as deeds in lieu of foreclosure.

The Donohoe Cos. recently resolved the outstanding debt on 4000 Wisconsin Ave. NW, which was threatened with foreclosure, and is forging ahead with a mixed-use redevelopment to be called Upton Place. Douglas Development Corp. earlier this year paid $8.2 million for a Fair Lakes office building that sold in 2006 for $62 million.