CLOSED DEAL ALERT — $21,000,000 Performing Loan Sale

• Hospitality

• Jacksonville, FL

• Current deals available at www.missioncap.com

Go to Mission Market for more deals currently on the market.

CLOSED DEAL ALERT — $21,000,000 Performing Loan Sale

• Hospitality

• Jacksonville, FL

• Current deals available at www.missioncap.com

Go to Mission Market for more deals currently on the market.

Mission Capital Advisors. The Real #1 in Loan Sales in 2020.

• Number of Assets Offered: 3,717

• 2020 Total UPB: $2,076,815,327

• Deal Count: 25

Go to Mission Market for more deals currently on the market.

David Tobin, Principal of Mission Capital, discusses what our clients should expect from Mission Capital Advisors now that the company has been acquired by Marcus & Millichap. Hint: it’s good.

This is just the beginning so stay tuned to this space as we release more content pertinent to Mission Capital Advisors, Marcus & Millichap as well as Loan Sales and Real Estate Sales and Debt & Equity.

Mission Capital Advisors (MCA) is excited to announce it has been acquired by Marcus & Millichap, Inc. (NYSE:MMI) and will be a subsidiary of Marcus & Millichap Capital Corporation (MMCC). For the past few years we have given tremendous thought and had numerous exploratory conversations regarding how best to position our company for the future and to continue providing the best service and suite of offerings to you, our most valued clients. For us, providing you capital solutions for your transactions has excited and energized us. However, it is the ongoing and long-term client relationships and friendships formed in the process that are most precious to us.

So why Marcus & Millichap? The simple answer is that our core values and approach to client service are perfectly aligned. In business since 1971, Marcus & Millichap closes more transactions than any other brokerage firm in the country. Its 2,000 investment sales and capital markets professionals are located in over 80 offices across the U.S. and Canada. It is a New York Stock Exchange-listed company with a market cap of approximately $1.225B and a strong, debt-free balance sheet. On a daily basis, Marcus & Millichap delivers deep capital markets expertise, market intelligence, and extensive research to its clients. We can now share this access to transactions, capital sources, research, technology and more – with you. There are fantastic synergies across our respective organizations with very little overlap.

Mission Capital will be keeping its name, brand, and identity for many years to come and will continue to provide its suite of capital markets solutions, asset sales, diligence, consulting and document curative services.

Mission Capital is also pleased to announce that it has hired Spencer Kirsch as Vice President and John Jenkins as an Associate as part of the loan sale team.

Spencer Kirsch joins as a Vice President after a 5-year stint at Waterfall/ReadyCap REIT. He has extensive deal management and analytics experience in the small balance commercial and residential portfolio sectors, most recently in non-QM and SFR portfolio acquisitions. Spencer has a BS in Finance from Tulane University.

John Jenkins joins as an Associate after almost three years with the largest US residential mortgage REIT, Annaly Capital Management. He has specialized in the structuring, data analysis, and acquisition of billions of dollars of single-family loan portfolios. In addition, he has worked on both seasoned and new origination whole loan transactions. John has an MS in finance from Imperial College Business School, London, and BA in Business/Economics from Ursinus College and is a CFA.

Both John and Spencer will be located in the New York office and working closely with Mission executives in New York, Texas, California and Florida.

As always, we look forward to working with you in the future. If you have any questions, please do not hesitate to reach out to us.

Best Regards,

David & Joe

Due to an unprecedented volume of businesses seeking relief from the fallout of COVID-19, SBA-authorized Banks and Lenders receiving Paycheck Protection Program Form 2483 Applications are experiencing or will experience a variety of business process issues.

Mission Capital provides PPP Lender Support to Banks and Lenders in multiple ways:

Clarification of guidance and requirements for loan forgiveness / lender reimbursement are evolving. Mission Capital PPP Lender Support ensures that Banks and Lenders are prepared for Advance Purchase / Forgiveness Report Submission.

How to Get Started With Mission Capital PPP Lender Support:

You are important to us, and we are here to help you in this trying time.

|

Due to an unprecedented volume of businesses seeking relief from the fallout of COVID-19, Mission Capital is expecting long queues from most banking institutions qualified to lend the highly in-demand PPP SBA loans. We know that you and your assets need relief quickly, are focused on asset management and corporate concerns, and are seeking assistance. If you have a very strong banking relationship that is participating in the program it is always recommended to reach out to that institution first as they will give preference to existing customers in the queue. We are standing by to assist those without strong pre-existing relationships or are concerned about waiting in a queue with lenders who may be unable to get them PPP loans as soon as possible. The team at Mission Capital has been in constant contact with numerous SBA lenders – many of whom are our clients, as well as attorneys, and accountants to gain an understanding of how to size and optimize PPP proceeds and determine the effect the potential uses of proceeds has on loan forgiveness. We are ready to assist you in navigating this tricky process as your Agent at no cost to you. As your Agent we will be compensated by the Lender based on the limited SBA approved schedule. Starting on Friday, April 3, 2020, we can apply for these PPP loans on your behalf. We encourage you to reach out to us as soon as possible and are happy to discuss any nuances with you over the phone at 212-925-7708. In the meantime, please find relevant links below to expedite the loan application process.

Please send completed forms and documents to: sbacares@missioncap.com. We can also provide a secure FileBox link for files containing sensitive information. Feel free to reach out and/or send these items directly to your Mission Capital coverage executive as well. You are important to us, and we are here to help you in this trying time. Best Regards, |

The London Interbank Offered Rate (LIBOR) is a benchmark interest rate that historically represented an average estimate of interest rates that the major global banks lent to one another on a short-term basis. Although originated in 1969 and currently one of the most frequently used interest rate benchmarks in lending, formal data collection did not occur until the mid 1980’s. It is estimated that approximately $250 trillion in LIBOR-benchmarked product is outstanding.

In 2012, financial regulators (currently the Financial Conduct Authority (FCA)) began requiring that reporting for LIBOR be based on actual transactions rather than estimates. Because of the new reporting requirement, several banks removed themselves from the process, resulting in declining participation. Additionally, the reporting requirement came at a time when unsecured borrowing was declining as banks began favoring overnight secured borrowing instead. With the decline in participation and in the reliability of the data being provided, experts began to question the validity of LIBOR as a benchmark. In fact, because of a growing sense of unreliability from market participants, the FCA decided that starting at the end of 2021 they would no longer require participating banks to continue to report nor would they publish the rate publicly, thus effectively ending LIBOR as a viable reference rate beyond 2021.

Following this announcement, consensus among lenders was that the lack of published rate could be problematic. Market participants are now contingency planning should LIBOR cease to exist. Appropriate plans should include the following: (i) a full review of loan portfolio to determine potential risk exposure (loans that mature after 2021), (ii) review of loan documentation, particularly interest-rate fall back language to determine potential risk exposure (unclear or inconsistent language, silent on fallback, etc.), (iii) after review, modify or sell loans that may have deficient fall back language, (iv) implement/review protocols to ensure they will be followed correctly, including the proper servicing of loans should fallback language be required to go into effect, (v) review preparedness of servicing systems to correctly capture modifications to affected loans in the event of a transition and (vi) consider originating new product using an alternative risk free rate.

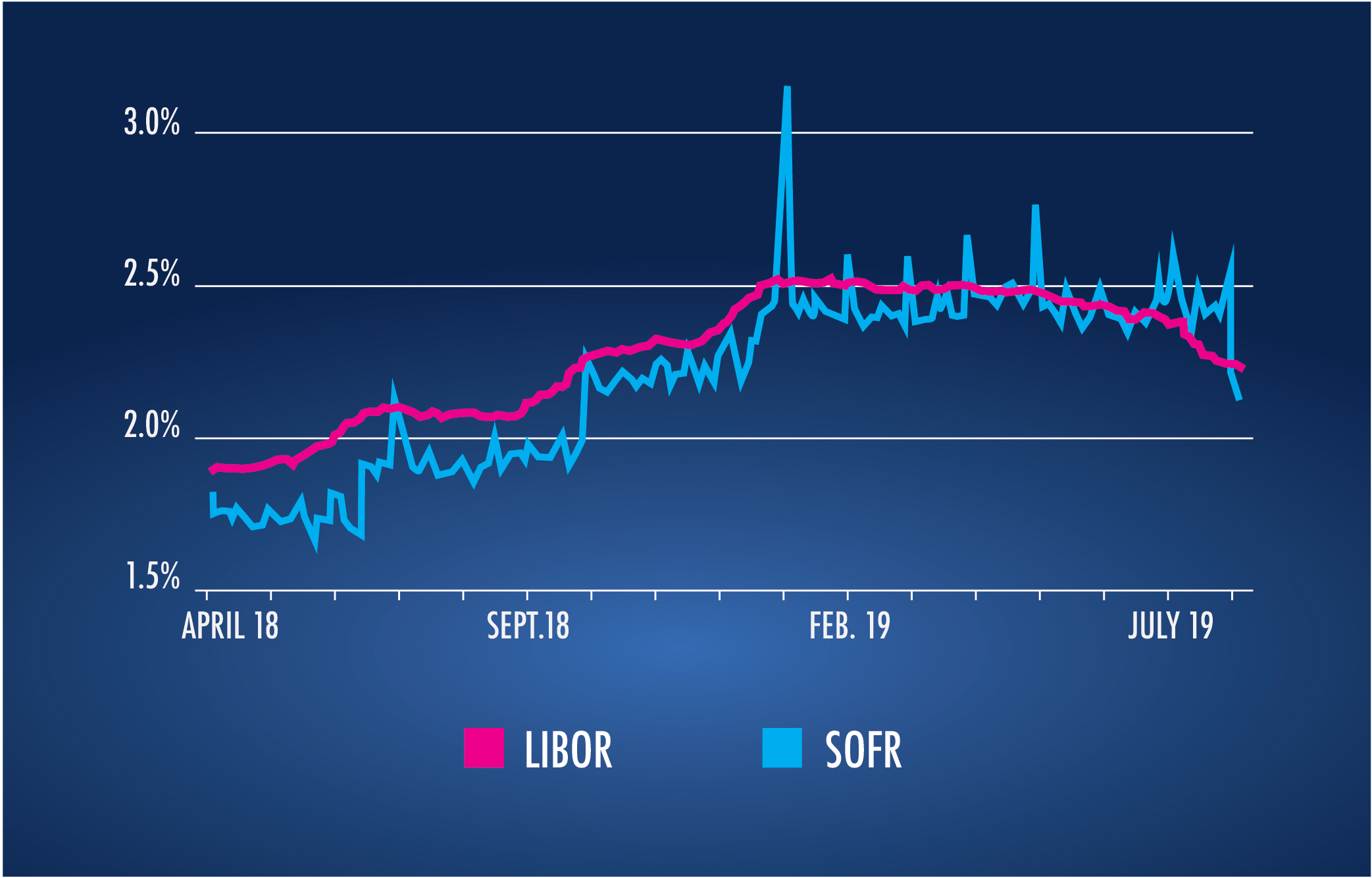

When modifying existing loans or originate new ones, lenders should transition to alternative risk-free rates such as the Secured Overnight Financing Rate (SOFR), which is currently backed by the Alternative Reference Rate Committee (ARRC). SOFR, which was established in April 2018 and currently monitored by the Federal Reserve Bank of New York, is one of the most popular alternative rates. The biggest difference between SOFR and LIBOR is that SOFR is entirely based on actual secured transactions that have occurred. Because of this, it has predominantly been a slightly lower rate than LIBOR over their corresponding lifetimes as displayed in the table below:

While it’s impossible to predict where LIBOR rates will be relative to any alternative rates when a potential hard stoppage of the publication of LIBOR occurs, at various times LIBOR and SOFR have been the same, or SOFR has been higher than LIBOR. This uncertainty may make modifications with borrowers a challenging proposition. Therefore, as stated above, lenders should assess the viability of selling off loans with deficient fall back language (or loans to borrowers that may be unresponsive) to mitigate portfolio risk in advance of a transition. Strong secondary market pricing from financial institutions that are equipped to navigate deficient rate language may result in a less costly outcome than internal resolution.

An online auction site is slated to open bidding at $4.5 million next month for a Fairfax County office complex that sold during the height of the real estate market in 2006 for nearly five times as much.

RealInsight Marketplace will kick off the auction Sept. 10 on behalf of Mission Capital Advisors LLC. The real estate capital markets firm was brought in by special servicer CWCapital Asset Management to help dispose of the Greenbriar Corporate Center after it was foreclosed on earlier this year. The prior owner of 13135 Lee Jackson Highway, an affiliate of North Bethesda-based Guardian Realty Investors LLC, defaulted on the debt it took out in 2006 to buy the property for $21.4 million, according to loan servicing notes and Fairfax County land records. It is now assessed at nearly $13.6 million.

Representatives for Guardian could not be reached for comment.

Kyle Kaminski, a director with Mission Capital, said he hopes the online auction will tap into a larger pool of investors looking for value-add properties like Greenbriar than traditional marketing would. Greenbriar, located just west of the Route 50 interchange with the Fairfax County Parkway, is a 116,581-square-foot property developed in the mid-1980s.

“I think it’s mostly a function of the market is active right now. There’s lots of groups out there paying good money for deals,” Kaminski said. “The auctions themselves tend to lend themselves well to situations like this, and this one happens to be one that has some positive momentum.”

Commercial real estate firm CBRE, handling leasing for the property, recently inked an 8,700-square-foot lease with Virginia Surgery Associates. As of July 31, Greenbriar was about 77% leased to tenants including Fairfax Pediatrics Associates, Long & Foster Real Estate and Re/Max Premier.

Greenbriar is one of a dwindling number of properties sold or renovated in the lead-up to the Great Recession with debt that was bundled into a larger pool of commercial mortgage-backed securities, or CMBS. Much of that debt has since come due, and many of the properties impacted have either been sold at deep discounts, foreclosed on, or given back to their lenders as deeds in lieu of foreclosure.

The Donohoe Cos. recently resolved the outstanding debt on 4000 Wisconsin Ave. NW, which was threatened with foreclosure, and is forging ahead with a mixed-use redevelopment to be called Upton Place. Douglas Development Corp. earlier this year paid $8.2 million for a Fair Lakes office building that sold in 2006 for $62 million.

A fully occupied freestanding retail building is hitting the auction block in Tuscaloosa.

The building currently occupied by Crunch Fitness at 3325 McFarland Blvd. E will be up for auction on the RealINSIGHT Marketplace platform July 29-31 via New York City-based Mission Capital Advisors. A CMBS Special Servicer is the seller.

The one-story 42,274-square-foot building was built in 2013 for outdoor retailer Gander Mountain. Crunch, which took occupancy in October 2018, signed a 15-year lease at the 4-acre site.

“The property has excellent frontage in a highly trafficked area of Tuscaloosa, near several main transportation routes and near the University of Alabama,” said Kyle Kaminski, a director with Mission Capital. “Further, Crunch has performed very well in the space since opening and greater market conditions point toward the brand’s continued growth. With the substantial increase in enrollment at the university, and the recent Mercedes Benz expansion, this is a tremendous market to currently be in.”

David Tobin, Principal, chats about legacy small balance commercial real estate loan portfolios in this new video.

Legacy portfolios, which is to say portfolios of loans originated pre-financial crisis, are trading at extraordinary prices relative to intrinsic value. The reason for this is higher than market coupons, long payment history and solid economic fundamentals combined with intense market liquidity from bank and non-bank sources. The opportunity to exit these portfolios in as little as 45 to 60 days exists in the marketplace. And it’s a good sound judgment call to exit portfolios of loans which are above market but which have not prepaid in this highly liquid market post-financial crisis. We expect that these portfolios will exhibit elevated levels of default as well as elevated losses compared to their post-financial crisis-originated counterparts. Banks would do well to liquidate small-balance commercial real estate loan portfolios at peak market pricing today and redeploy those proceeds into other alternative lending opportunities.

William David Tobin is one of two founders of Mission Capital and a founder of EquityMultiple, an on-line loan and real estate equity syndication platform seed funded by Mission Capital. He has extensive transactional experience in loan sale advisory, real estate investment sales and commercial real estate debt and equity raising. In addition, Mr. Tobin is Chief Compliance Officer for Mission Capital.

Under Mr. Tobin’s guidance and supervision, Mission has been awarded and continues to execute prime contractor FDIC contracts for Whole Loan Internet Marketing & Support (loan sales), Structured Sales (loan sales) and Financial Advisory Valuation Services (failing bank and loss share loan portfolio valuation), Federal Reserve Bank of New York (loan sales), Freddie Mac (programmatic bulk loan sales for FHFA mandated deleveraging), multiple ongoing Federal Home Loan Bank valuation contracts and advisory assignments with the National Credit Union Administration.

From 1992 to 1994, Mr. Tobin worked as an asset manager in the Asset Resolution Department of Dime Bancorp (under OTS supervision) where he played an integral role in the liquidation of the $1.2 billion non-performing single-family loan and REO portfolio. The Dime disposition program included a multi-year asset-by-asset sellout culminating in a $300 million bulk offering to many of the major portfolio investors in the whole loan investment arena. From 1994 to 2002, Mr. Tobin was associated with a national brokerage firm, where he started and ran a loan sale advisory business, heading all business execution and development.

Mr. Tobin has a B.A. in English Literature from Syracuse University and attended the MBA program, concentrating in banking and finance, at NYU’s Stern School of Business. He has lectured on the topics of whole loan valuation and mortgage trading at New York University’s Real Estate School. Mr. Tobin is a member of the board of directors of H Bancorp (www.h-bancorp.com), a $1.5 billion multi-bank holding company that acquires and operates community banks throughout the United States. Mr. Tobin is a member of the Real Estate Advisory Board of the Whitman School of Management at Syracuse University and a board member of A&M Sports / Clean Hands for Haiti.

David Tobin, Principal, chats about loan portfolios secured by memory care and assisted living facilities.

In light of the recent termination of Silverado by the Welltower REIT of 20 properties that are standalone memory care facilities, it’s incumbent upon regional, super regional and large community banks to examine their memory care and assisted living loan portfolios and understand the risk embedded in those deals.

In particular, standalone, private-pay, assisted-living and memory care facilities in over-billed markets are particularly prone to default and credit stress. One of the factors contributing to this is the fact that Baby Boom has not caught up with the demand for memory care services as the height peak Baby Boom population is moving through its early to mid-sixties, and memory care demand does not occur until late seventies and early eighties.

Banks should take this opportunity and a highly liquid marketplace to shed assets, which have a higher propensity to default or which have already defaulted. The opportunity to exit portfolios of assisted living and memory care assets is in the marketplace today, and an opportunity may not exist tomorrow.

William David Tobin is one of two founders of Mission Capital and a founder of EquityMultiple, an on-line loan and real estate equity syndication platform seed funded by Mission Capital. He has extensive transactional experience in loan sale advisory, real estate investment sales and commercial real estate debt and equity raising. In addition, Mr. Tobin is Chief Compliance Officer for Mission Capital.

Under Mr. Tobin’s guidance and supervision, Mission has been awarded and continues to execute prime contractor FDIC contracts for Whole Loan Internet Marketing & Support (loan sales), Structured Sales (loan sales) and Financial Advisory Valuation Services (failing bank and loss share loan portfolio valuation), Federal Reserve Bank of New York (loan sales), Freddie Mac (programmatic bulk loan sales for FHFA mandated deleveraging), multiple ongoing Federal Home Loan Bank valuation contracts and advisory assignments with the National Credit Union Administration.

From 1992 to 1994, Mr. Tobin worked as an asset manager in the Asset Resolution Department of Dime Bancorp (under OTS supervision) where he played an integral role in the liquidation of the $1.2 billion non-performing single-family loan and REO portfolio. The Dime disposition program included a multi-year asset-by-asset sellout culminating in a $300 million bulk offering to many of the major portfolio investors in the whole loan investment arena. From 1994 to 2002, Mr. Tobin was associated with a national brokerage firm, where he started and ran a loan sale advisory business, heading all business execution and development.

Mr. Tobin has a B.A. in English Literature from Syracuse University and attended the MBA program, concentrating in banking and finance, at NYU’s Stern School of Business. He has lectured on the topics of whole loan valuation and mortgage trading at New York University’s Real Estate School. Mr. Tobin is a member of the board of directors of H Bancorp (www.h-bancorp.com), a $1.5 billion multi-bank holding company that acquires and operates community banks throughout the United States. Mr. Tobin is a member of the Real Estate Advisory Board of the Whitman School of Management at Syracuse University and a board member of A&M Sports / Clean Hands for Haiti.

The Community Reinvestment Act (CRA) is a federal law that requires the Federal Reserve, FDIC and the Office of the Comptroller of the Currency (OCC) to encourage financial institutions to lend to low and moderate income (LMI) neighborhoods. The CRA was passed in 1977 as part of an effort to reverse urban blight and redlining of the time by requiring lenders to address the banking needs of all members within their respective footprints. The regulatory agency’s ratings are somewhat subjective, as there are no specific quotas banks must meet, but each bank ends up with one of four post-assessment ratings: Outstanding, Satisfactory, Needs to Improve or Substantial Noncompliance. The CRA applies to all FDIC insured institutions, such as national banks, state-chartered/community banks and thrift institutions. The ratings are made available to the public on the FDIC website.

An institution’s CRA rating is important because it is considered when regulators review applications for deposit facilities, branch openings and mergers & acquisitions. Due to the subjectivity of the CRA ratings and application review process, it is in the lender’s best interest to exceed regulatory standards beyond a doubt as failure to comply could diminish growth opportunities. Also, maintaining a strong CRA track record results in less frequent CRA evaluations in the future which will decrease compliance costs. While banks are encouraged to make CRA loans, they are not required to sacrifice lending standards as their loans should be “consistent with safe and sound banking operations”, per the FDIC.

Recently there have been calls to modernize the CRA from regulators, economists and politicians. As lending moves increasingly online from branch-based origination, many believe that the proximity rules in the CRA are out of date. Currently banks must lend in “assessment areas” or places surrounding where banks have branches or offices. Comptroller Joseph Otting of the OCC recently floated the idea of eliminating these “assessment areas” before backing off after several community groups expressed concern that the change would lead to decreased investments in LMI neighborhoods. Conversely, the current “assessment area” approach underserves rural distressed areas because there are not enough local banks to meet LMI needs.

The secondary market can match lenders that have excess CRA production with banks that are seeking this product. Demand arises due to lack of direct origination channels, inadequate production, bank acquisition (with or without overlapping footprint), and CRA rating remediation efforts. Mission Capital can source CRA loan production for banks with highly specific geographic and product needs from lenders with excess CRA loans. While typically sold on a servicing-released basis, CRA loans can may be acquired on a servicing-retained basis. In these trades, the seller benefits from retaining a servicing strip while the purchaser increases CRA exposure without having to board and service loans. This option is also useful for lenders looking to diversify their CRA product exposure across asset classes they typically do not focus on; small business loans for banks focused on consumer lending or single-family mortgage loans for banks primarily engaged in commercial banking.

While changes may be on the horizon for CRA, banks endeavoring to comply with existing regulations should consider loan acquisitions as means of supplementing existing origination channels on a wholesale basis.

Resources for Additional CRA Information:

https://www.fdic.gov/regulations/resources/director/presentations/cra.pdf

https://www.investopedia.com/terms/c/community_reinvestment_act.asp

https://www.americanbanker.com/opinion/dont-overhaul-cra-just-for-the-sake-of-it?feed=00000159-89d1-da1e-af7f-fdd7b5650000

https://www.federalreserve.gov/consumerscommunities/cra_about.htm

https://www.americanbanker.com/opinion/setting-the-record-straight-on-cra-reform

https://www.wsj.com/articles/fed-chairman-revisions-to-community-reinvestment-act-implementation-must-strengthen-laws-mission-11552347946

https://www.wsj.com/articles/shake-up-considered-on-how-banks-lend-to-the-poor-1524838519