Commercial real estate professionals were largely unsurprised by the Federal Reserve’s interest rate hike Wednesday, and many do not expect the move to have an immediate impact on the market. Should the Fed continue to bump short-term rates at a fast clip, however, it could adversely impact the industry and the overall economy.

June 13, 2018

“In general, these moves are a function of an improving economic environment whereby inflation is expected to rise. Higher rates will increase the cost of capital, but there is a record amount of fundraising seeking a home in CRE and so we do not anticipate higher short-term interest rates to diminish access to capital,” Cushman & Wakefield Economist and Americas Head of Forecasting Rebecca Rocket said in an email.

Following the monthly two-day Federal Open Market Committee meeting, Fed officials increased the benchmark federal-funds rate by a quarter-percentage point to a range of 1.75% to 2%. This marked the second move of the year, after the Fed bumped rates to a range of 1.5% to 1.75% in March.

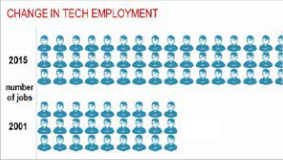

Recently appointed Fed Chair Jerome Powell suggested two more rate hikes could be on the horizon as the Fed looks to temper a growing economy and keep the inflation rate at 2%. The labor market continues to boom with employers adding 223,000 jobs in May and unemployment reaching historic lows of 3.8% — a level the U.S. has only experienced twice in the past half-century.

Recently appointed Fed Chair Jerome Powell suggested two more rate hikes could be on the horizon as the Fed looks to temper a growing economy and keep the inflation rate at 2%. The labor market continues to boom with employers adding 223,000 jobs in May and unemployment reaching historic lows of 3.8% — a level the U.S. has only experienced twice in the past half-century.

“The decision you see today is another sign that the U.S. economy is in great shape,” Powell said during the press conference following the meeting, the Wall Street Journal reports. “Growth is strong. Labor markets are strong. Inflati on is close to target.”

Should the Fed maintain its pace of rate hikes, commercial real estate developers and borrowers could be adversely affected by higher lending costs and tighter access to construction financing, which could, in turn, stifle deal volume and further compress margins for investors. As it stands, another two bumps in short-term rates this year are not expected to stifle investor access to capital, but it will lead to higher borrowing costs.

The market foresees a 75% probability of a third move in September and a 50% chance of a fourth and final move in December, according to a Cushman & Wakefield survey. Bisnow asked six economists and real estate professionals in the debt and finance space about the impact of this move on the industry. Read their responses below.

Mission Capital Advisors Director of Debt and Equity Finance Group Jillian Mariutti

What was your reaction to this boost in rates?

FOMC said in March that it was likely to raise rates two more times this year, so — especially with the economy humming along so strongly — today’s announcement was not surprising, and didn’t seem to give the markets any shock. It is also now expected that there will be two more rate hikes this year, for a total of four (not three, as was expected in March).

Some economists predict the Fed will boost rates four times this year. How will these moves impact CRE lending activity and access to capital, if at all?

Thus far, the rate hikes have not made any major waves. However, we may see some borrowers in need of refinancing their properties try to lock in loans before further increases. It’s noteworthy that the FMOC median projections show the Fed funds rate climbing from 2.375% in 2018 to 3.375% in 2020. LIBOR generally lives at about 20 basis points above the Fed target rate, so we could see LIBOR north of 2.5% by the end of the year and more than 3.5% by 2020. This will obviously have a significant impact for CRE borrowers with floating-rate debt.

What does this move signal about the state of the U.S. economy and its continued recovery?

The rate hike is definitely an expression of the strength of the overall economy, which will hopefully have positive ripple effects across the industry. The factors that the Fed will look at in determining whether to make future rate hikes include sustained expansion of economic activity, the strength of the labor market and inflation near their 2% objective. With unemployment just below 4% — its lowest rate since 2000 — and other factors on track, everything points to the Fed hitting its expectation of four increases in 2018.

Where does the 10-year Treasury stand now in relation to the long-term average, and what does this rate hike signal for the industry moving forward?

The 10-year now stands at 2.98%, well below its long-term average.

Any parting thoughts?

Since LIBOR moves in lockstep with the Fed rate, more or less, if we do indeed have two additional rate hikes this year, that would continue to push LIBOR up and increase the cost of capital. As a result of that, we’re likely to see an increasing number of borrowers execute hedges to mitigate their interest-rate risk.

Ten-X Chief Economist Peter Muoio

What was your reaction to this boost in rates?

We were unsurprised. The Fed had signaled this increase and the strength of the economy suggested that there would be no hesitation to the increase.

Some economists predict the Fed will boost rates four times this year. How will these moves impact CRE lending activity and access to capital, if at all?

We believe that CRE investors have already factored this into their thinking. Capital remains available and we don’t foresee this diminishing. Higher financing costs and upward pressure on cap rates will likely exert downward pressure on pricing and perhaps make negotiations more prolonged.

What does this move signal about the state of the U.S. economy and its continued recovery?

The U.S. economy is strong, and the job market is healthy. Consumers are confident and spending, so the Fed continues to tighten as expected.

Where does the 10-year Treasury stand now in relation to the long-term average, and what does this rate hike signal for the industry moving forward?

The 10-year is still low by historical standards, it’s just up from the extreme lows of recent years. Clearly, increases in rates can have an impact on pricing and deal flow, but we are not at some choke point for the CRE capital markets.

Any parting thoughts?

Absent some external disruption to the economy, the Fed will continue to tighten.

Cushman & Wakefield Economist and Americas Head of Forecasting Rebecca Rocket

What was your reaction to this boost in rates?

This was a widely expected move, so the only cause for concern would been if the FOMC did not vote to raise the federal funds rate.

Some economists predict the Fed will boost rates four times this year. How will these moves impact CRE lending activity and access to capital, if at all?

We agree that the FOMC is likely to vote to raise rates at four meetings this year, but decisions will continue to be data-driven. We are halfway there. In general, these moves are a function of an improving economic environment whereby inflation is expected to rise. Higher rates will increase the cost of capital, but there is a record amount of fundraising seeking a home in CRE and so we do not anticipate higher short-term interest rates to diminish access to capital.

What does this move signal about the state of the U.S. economy and its continued recovery?

It signals that the economy is performing well and we are well beyond the point where the expansion is considered a “recovery.” Inflation is rising because the labor market is tight, and the U.S. and global economies are strong. It also signals that the FOMC anticipates continued growth and inflation, since it has been clear that it is willing to allow inflation to overshoot its target for short periods.

Where does the 10-year Treasury stand now in relation to the long-term average, and what does this rate hike signal for the industry moving forward?

The 10-year Treasury rate ended the day around 3%, which is 285 basis points below the historical average. A hike, while signaling that the economy is improving and inflation brewing, does not reflect the fact that capital is still relatively cheap compared to the past. Longer-term interest rates will continue to rise and commercial real estate will continue to benefit from continued economic and job growth. Jobs have been created at a 2 million year-over-year pace for a record 62 consecutive months now, which puts into perspective some of the tailwinds buttressing demand for commercial space.

JLL Ports, Airports and Global Infrastructure Managing Director, Economist and Chief Strategist Walter Kemmsies

What was your reaction to this boost in rates?

I was not surprised. [Every] cost-push factor is going up: commodity prices, labor, transportation rent/lease rates. The Fed is exactly on target.

Some economists predict the Fed will boost rates four times this year. How will these moves impact CRE lending activity and access to capital, if at all?

The impacts are already being felt in lending activity, not just in real estate but also infrastructure — the surge in municipal Bain’s issuance is substantial in the last few months.

What does this move signal about the state of the U.S. economy and its continued recovery?

[It] says demand growth remains in excess of supply growth [and signals the] need to moderate demand growth via rate increases.

Any parting thoughts?

Consumer balance sheets are still fragile. I am struggling a bit to see four holes this year. But [I] am in consensus on four hikes this year.

Colliers International USA Chief Economist Andrew Nelson

What was your reaction to this boost in rates?

With inflation running at multi-year highs simultaneous with unemployment at multi-decade lows, there should be little surprise that the Fed is moving more consistently now to cool the economy. Since starting to raise rates in December 2015, the Fed has hiked the Federal Funds Target Rate a total of seven times in 2.5 years, with a cumulative increase of 175 basis points.

With another two hikes likely this year and more to follow next year, we can expect these hikes to start taking their toll — eventually.

But context is important, as these hikes are rather measured compared with prior economic cycles. In the last expansion, for example, the Fed raised rates 17 times in the two years from mid-2004 through mid-2006, with a cumulative increase of 425 basis points. But even then, the economy still ran hot for another two years into 2008 as the impacts of rate hikes take time to work through the system.

So the recent rate hikes will have limited immediate impact on the economy and property markets. But expect the economy to start cooling next year as higher interest rates begin to slow corporate borrowing and consumer spending — just as the fiscal stimulus from the federal tax cuts and spending hikes begin to fade.

JLL Chief Economist Ryan Severino

What was your reaction to this boost in rates?

Completely as I expected. Not remotely a surprise.

Some economists predict the Fed will boost rates four times this year. How will these moves impact CRE lending activity and access to capital, if at all?

If we get two more hikes of 25 basis points this year, we will get closer to the point where interest rate increases have a more prominent impact on CRE and the economy. Individual rate hikes do not mean much, but the cumulative impact over time will.

What does this move signal about the state of the U.S. economy and its continued recovery?

The economy is performing well, especially relative to potential. Fiscal stimulus should have a robust positive impact over the next couple of quarters.

Where does the 10-year Treasury stand now in relation to the long-term average, and what does this rate hike signal for the industry moving forward?

Most of the upward movement in the 10-year had probably happened already unless the Fed raises their long-run target rate. I’d expect more movement upward at the short-end than the long-end, causing the yield curve to flatten further. That typically happens during tightening cycles.

Any parting thoughts?

For now, the interest rate environment remains positive for the economy and CRE, but as rate increases continue, they will eventually slow the economy and have an impact on the market.

Read the full story here: