Despite the loan’s quirks, the borrower found a large life insurance company delighted to take on the risk. Mission Capital’s Alex Draganiuk discusses with Globe Street.

View the full article here: [PDF Download]

Despite the loan’s quirks, the borrower found a large life insurance company delighted to take on the risk. Mission Capital’s Alex Draganiuk discusses with Globe Street.

View the full article here: [PDF Download]

WASHINGTON, DC – A few years ago Ashley Capital, a New York City-based real estate firm, purchased a building called the Interchange Business Center. A 792,000- square foot industrial property located on a 55-acre site in La Vergne, TN, it was a former Whirlpool manufacturing site about 16% occupied by the time Ashley Capital acquired it.

Ashley did a gut renovation on the property and then, recently, went looking to place permanent financing on it. The size of the loan it wanted was not very large but some of the demands by the borrower made the transaction less than vanilla. Still, eventually it found what it was looking for, despite the tightening capital market. Or perhaps that should be it found what it was looking for because of the tightening market. Ultimately Ashley Capital realized all of its demands because its lender recognized what a great sponsor it is and the building itself is a good investment, Alex Draganiuk, director of the Debt and Equity Finance Group for Mission Capital Advisors tells GlobeSt.com.

Briefly, the building’s repositioning, along with its convenient access to the area’s major freeways, brought it to full occupancy. Today the Interchange Business Center is tenanted by Penske Logistics, Amer Sports Company, Singer Sewing Company, and Fulfillment Supply Innovation.

This story should be a shot in the arm for borrowers with smaller-sized loans, especially as the CMBS market — where most such financing get done — remains uncertain and the policy environment for CRE not as clear as one might hope.

As Mission Capital took the Ashley Capital loan to market there were some constraints the borrower had put in place. It didn’t want to take all of the equity out of the project although there was a cash out, Draganiuk says. It also wanted a 15-year or 20-year term. Most permanent loans, of course, are ten-year fixed with a 25-year amortization, per the CMBS market. There were other elements as well that made the deal a bit unusual.

One was the size itself, which was $18 million.

“Eighteen million dollars is a tricky size,” Draganiuk says. “It is a tweener.” He explains that some life insurance companies — one obvious lending source — top out at $15 million per loan, while others don’t start until $20 million to $25 million. And of course at the higher end there is a broader array of lenders.

The other was that Mission Capital was placing it directly. Oftentimes insurance companies will not look at deals offered directly from brokers, Draganiuk says. Deals typically must go through a correspondent network of brokers that screen the transactions for insurance companies, he says.

Mission Capital only reps owners or borrowers on an exclusive basis, which means the lenders know the deal has been fully vetted and they can rely on the information Mission Capital provides about the borrower, Draganiuk says.

The third oddity about this loan is that it is self-liquidating — that is, the borrower wants it paid off by the end of the term. This in itself may not be uncommon but it is less common to get a broker to arrange it.

In the end none of that matter to lenders. Mission Capital received a number of competitive offers from lenders, and structured “a very favorable long-term deal with fantastic terms,” Draganiuk says.

A major life insurance company won the deal, which is not a surprise as the life insurance market is usually the beneficiary of volatility or uncertainty in the CMBS market. But then, life companies also come with their own set of constraints. Yet, “we were even able to negotiate the ability to upsize the loan on multiple occasions down the road, if desired,” Draganiuk said — yet another off-the-beaten track aspect to this loan.

Retail and office development pre-leased to tenants, including Target and Marshalls

NEW YORK (May 23, 2017) — Mission Capital Advisors announced that its Debt and Equity Finance Group has arranged $41.6 million in financing for the construction of Kingswood Plaza II, a 106,000-square-foot office and retail development located at 1715 East 13th Street in the Midwood section of Brooklyn, New York. The Mission Capital team of Jason Cohen, Ari Hirt, Steven Buchwald, Justin Hunt and David Behmoaras arranged the loan with a foreign bank on behalf of a joint venture between Infinity Real Estate and The Nightingale Group.

Located on the bustling Kings Highway retail corridor, Kingswood Plaza is ideally situated in the heart of Midwood, one of Brooklyn’s most populous and busiest neighborhoods. The development, which is 56-percent pre-leased to Target and Marshalls, will include three floors of professional/medical office space, in addition to its retail component.

“It is more challenging to get construction financing at this stage of the cycle, but lenders still have appetite for well-conceived projects in strong locations, and we generated multiple quotes on this deal from a wide range of lenders,” said Hirt. “We ultimately closed a very strong loan with a foreign bank, with high leverage and a low interest rate, attesting to the breadth of our lender contacts and the quality of the sponsor’s business plan.”

The property, a former two-story parking garage, is fully approved for the development and undergoing demolition. Located approximately a block from the subway station, the property provides convenient access to the B and Q trains, as well as several buses.

“The sponsors also own Kingswood Plaza I, a neighboring mixed-use property, and they have a keen understanding of the local market and the unmet demand for quality retail and office space. We had worked with Infinity in the past to secure acquisition financing for a property in Sheepshead Bay, and they recognized our unique ability to drum up lender interest – even at this stage of the cycle. With the retail pre-leased to investment-grade tenants, we were able to communicate the quality of the development to lenders, which enabled us to close a very favorable deal.” added Steven Buchwald.

Infinity Real Estate is a developer and operator of mixed-use real estate with more than 60 properties comprised of urban retail, boutique office, hospitality and over 1,000 rental apartments. The Nightingale Group is a privately held, vertically-integrated commercial real estate investment firm, whose portfolio spans over 11 million square feet of office and retail space across 22 states.

Mission Capital Advisors is extremely active at arranging construction financing, acquisition financing and refinancing for office, retail, hotel, multifamily, industrial and self-storage properties in markets across the country. In recent months, the firm has closed construction financing for hospitality and mixed-use properties in Illinois, Texas and Washington.

A slower than expected condo sales market, an abundance of bridge capital, and a belief in a fundamental value level in the market has made condo inventory financing available again. Financing is available from a variety of capital sources. Loans can be non-recourse. Leverage and rate largely depend on the size and location of the project.

Leverage is generally capped at 60%-70% of bulk sellout value. The lender will establish value based on a combination of an appraisal, the sponsor’s estimated sellout value, broker conversations, and, most importantly, other condo sales within the building and competitive properties.

The lender will establish minimum release prices on an individual unit or $/SF basis to make sure that sufficient value remains in the unsold condos as each condo is sold off. Cash flow leakage from sales can be negotiated and allows some portion of the net sales proceeds from individual unit sales to be returned to the borrower leaving a portion of the inventory loan outstanding. That structure is a win-win situation for the lender and borrower. It allows the lender to keep capital out longer and increases the borrower’s leveraged IRR by having equity returned earlier. Lenders care about the use of proceeds for the loan. They are more favorable to taking out an existing loan versus a pure repatriation of sponsor equity late in the sales process when the remaining collateral will usually consist of the least desirable units at the property.

Offers vary greatly from lender to lender so it is important to broadly survey the capital markets to create competition and get the best loan for the sponsor.

Click here to learn more about Mission Capital’s Debt & Equity team

Jordan Ray, principal of The Debt & Equity Finance Group at Mission Capital, discusses listening to the market to help hoteliers make the best use of investment dollars.

View the full article here: [Link] [PDF Download]

5/19/2017 Lodging Magazine May 2017

Ellen Meyer

Listening to the market helps hoteliers make the best use of investment dollars.

For the past several years, the hotel industry has enjoyed solid economics and record-setting growth following the difficult era of the Great Recession. Now, the tides are turning once more, and the industry is starting to show slower—but still steady—growth. While hoteliers are aiming to capitalize on a still-strong market, lenders are starting to tighten up and there is less available debt for the taking. This is making many investors move cautiously, looking to make the most of their dollars.

But what is the best way to invest?

Where should people be funneling their dollars? To gain a current perspective on the ever-changing hotel investment scene, LODGING recently spoke to representatives from both the financing and sales transaction sides of the equation. Among the topics they discussed were the current state of the market, the impact of tighter money, a stronger dollar, and changing consumer preferences on their respective businesses.

On the financing side is Jordan Ray, principal of The Debt & Equity Finance Group at Mission Capital Advisors, where he oversees business development, strategy, placement, and execution of real estate capital on behalf of major owners, investors, and developers nationwide.

Ray is quick to say that he rarely advises clients specifically on where they should invest, preferring instead to focus on the deals that are being done currently. He also makes clear that his comments are based on the deals being done at his own firm, which he says has no designated hotel group but likely handles more of those types of transactions than those that do. “Mission Capital represents a lot of really different and interesting hotels, developers, owners and operators, and projects,” Ray explains. “And we aim to do what’s best for our clients at any given part of the cycle.” Most of his deals, he says, involve raising debt, though his firm handles a few equity deals each year. He also adds that when his firm believes especially strongly in a particular deal, they may invest along with the client. “This is mainly because we believe in what we’re selling.”

Steve Kirby is managing principal of Mumford Company, a hotel brokerage and advisory services firm, where in addition to being an active broker, he manages the marketing and administration operations of the company’s five offices. Kirby says right now is a good time both for buyers and sellers, but maintains that it’s difficult to generalize what constitutes a “good investment” due to regional taste differences. “Lodging is a street-corner business; what works in Atlanta may not work in N.Y.” However, he maintains, the most popular type of hotel investments continue to be limited-service projects with a mid-market focus. “Most of those types of properties, which have been developed over the past 20 years, have been very successful.” Yet, noting what he calls “amenity creep,” Kirby says the lines are becoming blurred between upper-scale and mid-market properties. “It is often difficult to tell the difference other than in the meeting space. The rooms are just as nice. They have slightly more amenities at the full-service hotels, but in general, the product offerings in the guest rooms and in the public areas are very similar.”

CHANGING CONSUMER PREFERENCES

Perhaps in line with Kirby’s observation about “amenity creep,” Ray discussed how the rise of a new kind of consumer has driven investment in properties that would have been tough sells in the past. “Consumers’ preferences and what they actually want out of the lodging experience is changing. There is more demand for less traditional, more experiential hotel stays.”

Ray observes that the reasons for going to one hotel over another are changing. “While in the past, people might choose a hotel because it was a flagship, near a particular attraction or business location, or due to a loyalty program, an increasing number of people want to be able to work, eat, hang out, and do things in places where they are comfortable.” This, he says, can have a very desirable snowball effect. “When people enjoy spending time in the hotel as well as the location’s attractions, they are more likely to become loyal and spend their money as well as time there, and to generate buzz through social media and digital marketing, encouraging their friends to check out those places, too, when they come to those major markets.”

Ray notes also that in many of these major markets, an increasing number of hotels have become hubs for gathering. “Many people still want to hang out in the lobby of the Ace Hotel in Midtown Manhattan when visiting New York, but there are about 12 different places like that right now, where everyone wants to hang out in the lobby. The experiential part of that makes us want to stay there. So, there are a lot of other draws versus loyalty programs.”

Given his belief in these types of properties, it should come as no surprise that these are the ones his firm gets increasingly behind, to the extent that Mission Capital has developed a niche of sorts, financing less conventional, distinctive hospitality spaces; they include Graduate Hotels—which are in “dynamic university towns,” such as Ann Arbor, Michigan—and also what might be considered lifestyle or boutique hotels.

Ray says selling lenders on boutique properties isn’t that different than selling guests on booking a hotel stay. “It used to be challenging to finance these unique properties, but a market for these assets has developed, so there is now an appetite among lenders for these types of properties, which have become easier to sell,” says Ray. Being able to explain the appeal of an asset that provides an alternative experience, he says, is essential in order to sell a client on buying or developing it. “It all comes down to people. Just like other human beings, those making decisions about investments often need to do more than just hear or read about them. They often need to experience them for themselves to understand their appeal.”

DEMAND GENERATORS

Ray believes that properties that will stand the test of time are best located in environments where there are demand generators—e.g., state universities, capitals, and growth—and “a great sense of place.” He maintains, “Even though preferences change, a lot of really great assets are being created without the help of big brand names, and these assets are becoming synonymous with the place.”

Both Ray and Kirby noted the trend toward incorporating hotels into larger mixed- use developments, including those with residences. “The way that we look at that, is, obviously, there are shared elements between residence and hotels, but when you have condos, you end up dollar cost averaging down your basis in your hotel room,” says Ray. “I think nearly everywhere a developer has done some retail, restaurants, and living space, they try to incorporate a lodging product of some kind,” says Kirby.

CHANGING INVESTMENT ENVIRONMENT

Ray and Kirby also weighed in on the impact of a stronger dollar—which has made investment by foreigners more expensive—and the challenges posed by either the reality or perception of tighter money.

Although Kirby says he believes obtaining loans is becoming more difficult for both construction and purchase, he considers it “doable but more difficult” for new construction. “The lenders are tightening on the new construction front without a doubt. We had our first rate increase in 10 years, and fully expect a couple more, but I think that the developers and operators are pricing that into their offers these days.”

Ray agrees that there are challenges, but says it’s his job to identify and overcome obstacles and make smart decisions.

“Of course, we would rather finance cash-flowing assets at this point in the cycle, but we earn our stripes by getting deals done in a certain environment, and we are getting them done.” Whether or not it is due to less purchasing power by foreign investors and tourists or by perceived problems with hotel room supply in New York, Ray says, the reality is that more deals with his firm are currently happening in markets like Austin, Chicago, Seattle, L.A., and Miami.

As far as foreign investment goes, Kirby, who maintains that “the U.S. is probably the safest investment market in the world now,” finds it hard to tell if the strong dollar has hindered it. “Chinese investors seem to be hampered more by restrictions their own government is placing on the allowable number of large acquisitions than by the strong dollar’s impact on the cost of these acquisitions. I don’t know if they limited it, but they have restricted it to further review before they allow the large acquisitions that they once did.”

LOOKING AHEAD

While Kirby says there are opportunities for both buyers and sellers now, he believes prices are maintaining high levels despite the spate of new construction—a pipeline that includes 4,960 projects and 598,688 rooms as of the end of 2016, according to Lodging Econometrics.

Kirby also says, “We think now is a good time for a lot of people to get out, not necessarily to get out of the market, but to reallocate their capital.” However, buyers who can operate a property more efficiently than the previous owner, he says, can profit by driving more money to the bottom line, if the top line stays the same. “I think we are going to see a lot of transactions this year, but now is a good time to take some profits if you can.” He reassures that this will change, as always, and there will be a buy and building opportunity over the next few years again.

“Labor costs will definitely rise over the next few years. The top line should be okay, the bottom line is probably going to be weaker going forward for the near term,” he explains.

BACKING A BRAND

Keeping investor interests in mind when developing Tru by Hilton Though the current lodging cycle is thought to be winding down, it hasn’t stopped the deluge of new hotel brands joining the market. However, it has affected the way that the big hotel companies are developing them. As these companies choose to invest in launching new brands, there is careful consideration given to developers’ return on investment.

An example of this phenomenon is the new midscale brand Tru By Hilton.

Launched just last January at the 2016 Americas Lodging Investment Summit, Tru is already seeing massive investment from the lodging community at large. As of February of this year, the brand has accumulated more than 170 signed deals in the U.S. and Canada and has more than 400 more in various phases of negotiation. This level of interest from the hotel community was not entirely unexpected— Tru was conceived and developed to be a smart investment for hoteliers. The hotels can be built on as little as an acre and a half of land, giving it a market flexibility that other flags might not offer. Additionally, Tru properties require less capital upfront, which makes financing easier.

Hilton also saw opportunities in the midscale segment, an area of the market that the company has not really explored in the past. “It’s always a good time to invest or buy in the midscale segment,” says Alexandra Jaritz, global head of the Tru by Hilton brand. “I don’t want to say that the segment is recession proof, but it’s definitely safer,” she adds. The first Tru property is due to open May 25 in Oklahoma City, Okla., and eight more will follow this year. Sixty more properties are set to open in 2018. As it stands, Tru is the fastest growing brand in Hilton’s history.

BIG HOTEL OPPORTUNITIES IN THE BIG APPLE

With a pipeline of 192 properties and 30,541 rooms, New York City has the largest hotel development pipeline in the United States. The Big Apple is also the most populated city in the country, home to more than 8 million residents and hundreds of major corporations including Morgan Stanley, Citigroup, and ABC.

Comprised of five boroughs, the iconic city is full-to-the-brim with tourism hot spots such as the Empire State Building, Central Park, and Times Square. With a positively booming year-round tourism industry, New York City brought in more than 58 million visitors in 2015, around 12 million of which were international travelers, according to NYC and Company, a destination and marketing organization focused on New York’s five boroughs. Also in 2015, tourists spent more than $42 billion, which has a huge impact on the city’s overall economy.

As far as hotels are concerned, in 2016, NYC had an average occupancy of 85.8 percent and an average ADR of $258.89. Even though the statistics are impressive, hotel competition in the Big Apple is quite fierce, especially with all the new supply entering the market. That’s why many of the hotels opening over the next few years have a hook, helping them stand out to travelers. One such hotel will be the Graduate Roosevelt Island, due to open on the narrow island in the city’s East River in 2019.

As a brand, Graduate Hotels is focused on development in college towns. The Roosevelt Island property is located in the center of Cornell Tech and is the first and only hotel on Roosevelt Island.

David Rochefort, vice president of investments and asset management at AJ Capital Partners, the company behind the Graduate brand, believes it important for hotels to emphasize their uniqueness, especially in NYC. “There is an extreme draw to be a part of this city and to design something extremely unique within our portfolio,” he says. “It’s the best hotel market in the world.”

DIVERSE DRIVERS AND A BUSINESS-FRIENDLY ENVIRONMENT PRIME THE HOUSTON HOTEL MARKET FOR CONTINUED GROWTH

Following the January 2016 crash in oil prices, it wouldn’t be too much of a stretch to think that the economy in Houston, Texas—a city internationally recognized for its energy market—would be suffering. But that is very much not the case. Houston’s economy has an ever-diversifying set set of drivers, from renewable energy sources like wind and solar, to healthcare and biomedical research, and even aeronautics.

According to Chris Green, COO of Greenbelt, Md.-based hotel management company Chesapeake Hospitality, Houston’s economy succeeds because the city is very business-friendly. “It’s a great place to do business. There aren’t a lot of barriers to entry and people are building new businesses there all the time.” Chesapeake manages two properties in the Houston market, including The Whitehall Houston, which is located in the city’s downtown.

The hotel pipeline in Houston is the second largest in the United States, totaling 169 properties and 18,373 rooms. Even with all the new supply coming in, Green isn’t particularly concerned about the longterm viability of Chesapeake’s Houston properties.

“You’ve got a really large marketplace with lots of amazing submarkets. You’ve got a whole bunch of city centers within one marketplace that all have their own unique business drivers,” he explains. “There’s something for everyone.”

INFRASTRUCTURE IMPROVEMENTS AND AN EXPANDING URBAN CENTER MAKE THIS TEXAS CITY A DEVELOPMENT HOTSPOT

With a pipeline of 140 properties and 17,291 new rooms, the city of Dallas, Texas has the third largest hotel development pipeline in the United States. For those familiar with the area, these numbers are no surprise— in 2016, the city had the highest year-over-year population growth in the country and it boasts the fifth largest metropolitan economy. It’s also home to a number of major corporations, including State Farm, Toyota, and JP Morgan.

With such a strong business environment and so much hotel competition coming to the Dallas market, many of the city’s existing properties are upping their game, investing in renovations to draw a bigger share of travelers. One of these hotels is the Sheraton Dallas Hotel by the Galleria. Purchased by North Palm Beach, Fla.- based Driftwood Hospitality Management in late 2016, the hotel is currently in the midst of major guestroom renovations. Steve Johnson, executive vice president of Driftwood, says that the renovations were a necessary move, especially considering the hotel’s location, which is surrounded by major office buildings and high-end residences. “We needed to have a product that would allow us to improve occupancy and RevPAR,” he describes. The hotel also sits right next to the city’s freeway, which was recently widened and updated during a $2 billion improvement project—just one example of the steps the city is taking to continue its growth and invest in its own infrastructure.

“Dallas has been growing well for as long as I can remember, and certain sectors— like ours—are growing faster than others. We feel really good about our investment in the Sheraton, and we expect it to remain strong for the foreseeable future,” says Johnson.

THE CAPITAL OF TENNESSEE’S BOOMING TOURISM SECTOR IS MUSIC TO THE HOTEL INDUSTRY’S EARS

For the past several years, the city of Nashville, Tenn., has enjoyed significant economic growth. The city is also experiencing increased wages and a tighter labor market. It’s currently a major music recording and production hub for both major and independent labels, earning it the moniker “The Music City.” Nashville is also a major healthcare hotspot—more than 300 health care companies call the area home. And in 2015, Nashville was named Business Facilities’ number one city for economic growth potential.

With so many ties to the music industry, Nashville tourism is booming. More than 670,000, tourists flock to the “Music City” annually to experience what it has to offer, including Music Row—an area dedicated to country, gospel, and Christian music—the Country Music Association, Country Music Television, and Universal Music headquarters.

With so many travelers and businesses coming to Nashville, it is a great time to be a hotelier developing in the area. There are 121 hotels and 14,873 rooms in the Music City’s hotel development pipeline. Projected RevPAR for this year is up 3.9 percent from 2016, and demand growth has climbed 4.4 percent.

Virgin Hotels started looking into the Nashville market immediately after launching their brand in 2010. “When we first visited the city, there was a lot of energy and an overall good vibe. We could feel the underlying culture that made the city tick. That culture was a perfect fit with what we were looking to offer Virgin customers,” says Allie Hope, head of development and acquisitions at Virgin Hotels. In December 2015, the company acquired a site on Music Row. The planning stage has been extensive, but Virgin will break ground on the property this summer and open the hotel in 2019. “We cannot wait,” says Hope. The 260-room property will have a rooftop pool and food and beverage options that reflect the Nashville culture.

EVEN WITH HIGH BARRIERS TO ENTRY, THE HOTEL MARKET IN THE CITY OF ANGELS IS VERY IN-DEMAND

Home to one of the largest populations in the United States—3.8 million—and a strong economy where one in every six people works in a creative industry, Los Angeles, Calif., is a prime location for hotel development. However, getting a project off the ground in L.A. can be a major feat. The market is already very saturated and inflation and construction costs are steadily increasing. Southern California has also made it consistently difficult to build with complex zoning laws and height limits. However, this hasn’t really stopped people from trying—and succeeding—to bring new hotels to this market.

Even with numerous barriers to entry, Los Angeles boasts the fifth largest hotel construction pipeline in the United States—111 hotels and 18,723 rooms. According to Eric Jacobs, chief development officer at Marriott International, a lot of this supply can be traced back to 2009, when the recession offered developers a major opportunity to enter the L.A. market. “The southern California hotel market got very soft. Developers who otherwise wouldn’t have been able to open a hotel in this area could. Things in L.A. move very slowly. A lot of the hotels that are opening in the next couple of years have actually been in process since 2009.”

Right now, Marriott has many Los Angeles-based projects in the works. “When developing in L.A., hoteliers should keep in mind that the due to the city’s size, there are many different submarkets worth pursuing. There is no reason to limit yourself to downtown,” Jacobs notes.

Commercial and industrial (C&I) loan portfolios are often overlooked when considering assets for disposition via the secondary loan market. The more liquid nature of real estate debt versus C&I often results in lenders first considering disposition of these assets when making portfolio management decisions. Despite this, C&I loans secured by business assets and/or business real estate, should be high on lender’s list when considering asset sales due to demand by other banks (for performing or re-performing) and investors (for troubled or non-performing).

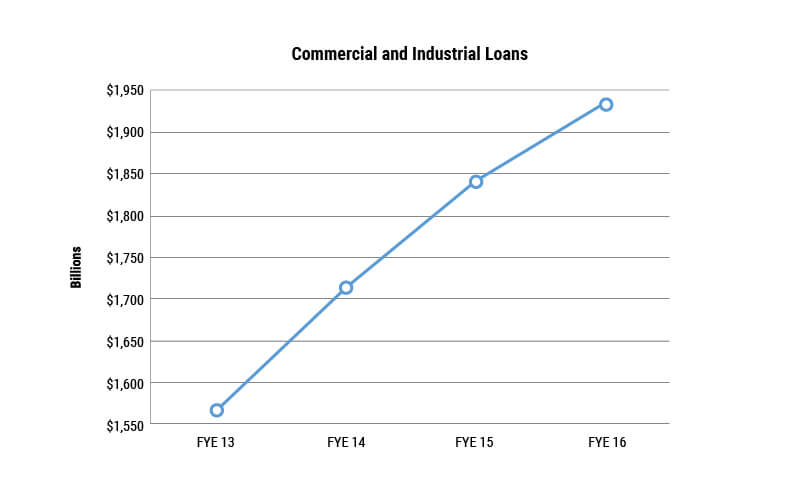

Per the FDIC, C&I lending has grown over the past several years, reaching an apex of $1.936 trillion dollars as of year-end 2016.

While much of this growth is the result of new businesses seeking capital, loan growth can also be attributed to lenders diversifying away from real estate and construction lending often at the direction of regulators. Some of this increase in loan growth can result in borrowers becoming over-levered, having taken advantage of easier money and loosening credit standards.

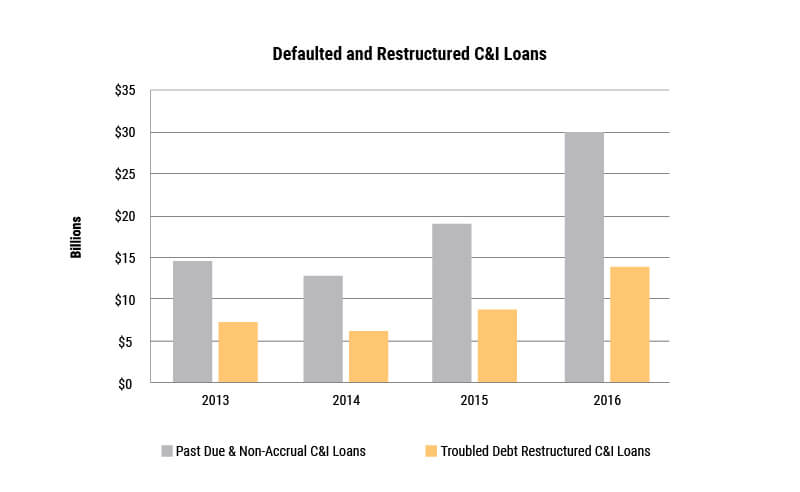

Since the end of 2016, the pace of loan growth has abated, with negative growth observed during 11 of the past 17 weeks according to Federal Reserve data. Furthermore, delinquencies in the C&I space are rising, with the number of delinquencies growing every quarter since 4Q14. The FDIC reports that 1.56% of C&I loans are currently past due or on non-accrual (see below chart). According to BankRegData.com, in 4Q16, there were approximately $26.6bn of non-performing C&I loans, which represented 19.84% of all non-performing loans.

The increase in delinquencies is largely attributable to challenges within the energy sector, as readily observed at a regional level among banks with exposure to markets that derive an outsized amount of economic activity from oil and gas exploration. Additional delinquencies are likely to be observed due to macro-economic factors in the coming months. C&I loans not secured by fixed assets are frequently pegged to variable rates. As indices rise in response to anticipated Fed rate hikes, borrowers may breach debt service covenants, or find themselves in payment default, should they fail to grow revenue in tandem with increased interest expense.

Banks have responded to increased delinquencies by building reserves and increasing their loan-loss provisions by approximately $3.6bn in 2016. At the same time, credit focused hedge funds / investment funds, merchant capital firms that specialize in providing working capital to small and middle market companies, value investment credit firms, global private equity firms, and opportunistic regional banks have raised funds to take advantage of market dislocation. Many of these investors have a penchant for assisting borrowers facing difficulty making good on their credit obligations by restructuring loans in tandem with providing additional “rescue” capital, accounting and other financial support, and general business guidance. In doing so, these investors are able to resuscitate companies that might otherwise suffocate under the burden of mounting debts. This additional capital allows investors to offer compelling bids relative to the typical recovery experienced by lenders. A study conducted by the FDIC indicated that loss given default experienced by failed banks averaged 45.5% for C&I loans on a weighted average basis, significantly higher than losses associated with CRE loans, because of a myriad of operating company issues (difficulty paying vendors, obtaining raw materials, distributing inventory, making payroll) which result in a massive decline in enterprise value.

By way of example, Mission Capital recently traded a sub-performing C&I loan secured by the business assets of a home goods supplier whose credit had been frozen, resulting in difficulty obtaining raw materials and in turn constraining production of finished goods. The prognosis for this company was bleak in the face of declining revenue which would have further impaired an already struggling business. Mission created a market for the debt, generating multiple bids in a competitive process. Ultimately the loan traded to a buyer with a penchant for restructuring small business debt at a price that resulted in a gain on the lender’s book value.

At a time when lending activity is slowing, lenders may find themselves playing a game of “hot potato” with classified assets as borrowers struggle to refinance debt in the face of declining lending appetite and tightening credit standards. This, in tandem with increased delinquencies, creates an environment where high loss severities associated with C&I loans are likely to be realized. In the face of headwinds in the C&I lending space, now is an optimal time for lenders to evaluate their C&I assets to determine if a loan sale is a viable and potentially optimal method of portfolio management.

Click here to learn more about Mission Capital’s Asset Sales team

AVG Partners, which owns the UBS Center in Stamford, Conn., has purchased the defaulted CMBS loan against the 682,327-square-foot property. The Beverly Hills, Calif., investor, which specializes in properties that are triple-net leased to their tenants, paid $54.2 million for the loan, which was securitized through LB-UBS Commercial Mortgage Trust, 2004-C1. The loan’s sale was orchestrated by Mission Capital Advisors.

Commercial Real Estate Direct: [Link] [PDF Download]

Commercial Real Estate Direct Staff Report

AVG Partners, which owns the UBS Center in Stamford, Conn., has purchased the defaulted CMBS loan against the 682,327-square-foot property.

The Beverly Hills, Calif., investor, which specializes in properties that are triple-net leased to their tenants, paid $54.2 million for the loan, which was securitized through LB-UBS Commercial Mortgage Trust, 2004-C1.

The loan’s sale was orchestrated by Mission Capital Advisors, which declined to comment on the transaction.

The loan originally had a balance of $229.7 million and was provided in 2004 to facilitate Eaton Vance Management’s $243 million purchase of the property at 677 Washington Blvd. The property was subject to a ground lease with UBS. It’s not known whether that lease has been restructured. At the time, the complex was fully occupied by UBS Investment Bank under a triple-net lease that was to run through this December.

The property was constructed in 1997 and expanded four years later. It includes a 13-story office building, a three-story building occupied by daycare and fitness centers and an eight-story building that houses a 103,000-sf trading floor – the world’s largest, and big enough to hold 22 full-sized basketball courts. Eaton Vance in recent years sold the property to AVG.

After the financial crisis, UBS decided that it no longer needed as much space as it was occupying at the property. So it gradually started reducing its footprint, all the while paying rent on the space it leased. Two years ago, it signed a lease for 120,000 sf at the nearby 600 Washington Blvd., which previously served as the U.S. headquarters for Royal Bank of Scotland.

Soon after, the loan, which had been amortizing on a 23.75-year schedule, was transferred to specialservicer CWCapital Asset Management. Early this year, the collateral property was appraised at a value of only $44.4 million . Even though UBS’ lease ran through the end of this year, its agreement allowed it to cease paying rent 14 months before its maturity.

So, it was surprising that the loan attracted such a high offer. And the buzz is that AVG wasn’t the only bidder. Mission Capital took two rounds of offers and is said to have received interest from a number of local investors. Prodding them were the prospects for state and local incentives for businesses to locate in the state.

Nonetheless, the Stamford office market remains hobbled. Its overall vacancy rate is 27 percent, according to Reis Inc. The silver lining, however, is that no space is projected to come online in the coming years. So absorption, which has been negative for years, should turn around. Reis projects that the city’s vacancy rate ought to improve to less than 22 percent within three years. And rents are expected to climb by more than 15 percent in that time.

Meanwhile, the CMBS trust that held the loan suffered a $100.4 million loss as a result of the sale. That’s after taking into account $9.1 million of liquidation expenses.

Wells Fargo Securities, which highlighted the loss this morning in a CMBS Recon alert, noted that one other loan in the LBUBS 2004-C1 trust had liquidated in the most recent reporting period, resulting in losses totaling $116.5 million. That means the deal so far has suffered losses of 10.5 percent, which Wells noted was the largest loss for any 2004 CMBS deal. Transactions securitized in that year have suffered an average loss of 3.5 percent.

The $54.2 million price paid for the UBS Center loan would value the collateral property, without taking into account the price that AVG previously had paid, at just less than $80/sf. That compares with the $70/sf price that Building & Land Technology two years ago had paid for 1 Elmcroft Road, an empty 550,000-sf office property, also in Stamford, that previously was fully occupied by Pitney Bowes Inc.

Building & Land also owns 200 Elm St., with 423,291 sf that formerly housed the headquarters of General Reinsurance Corp.

It bought the property for $50/sf in 2012, when it was completely vacant. It subsequently embarked on a massive turnaround. The property, now two interconnected buildings, currently is nearly half full and will get closer to being fully occupied when Henkel Corp. takes the 155,000 sf it recently leased. The home-care products company is relocating its U.S. headquarters from Scottsdale, Ariz., and got $20 million in state aid to do so.

Banks have been reluctant to part with well yielding performing loans despite strong premium pricing in recent years. The common themes warranting sales include overall CRE concentration issues (>300% of total risk based capital), portfolio risk management sales (tenant exposure, lease roll, etc.), divesting of non-strategic geographies and/or high risk asset classes (e.g. hospitality) or exiting non-strategic borrower relationships (e.g. offered loan is bank’s sole asset with a borrower). M&A activity, monetizing legacy assets on disparate servicing systems or taking profits on low basis reperforming loans have also emerged as top themes for banks seeking to sell performing debt. Despite weak supply, 2016 performing sales attracted a broad bidder market from community banks to large super-regionals (who were not always able to out price smaller rivals). Transactions settling in late Q4 suffered a relatively minor post-election setback, as well as negative price adjustments following the Fed’s rate hike announcement in December. Despite the adjustment, transactions continued to execute by year end with premium pricing. 2017 has seen increased sales resulting from mergers. Additionally, the volume of conduit “kick-out” loans has increased, as smaller CMBS shops struggle to compete under “risk retention” paradigm and others close their doors.

![]()

PERFORMING COMMERCIAL & MULTIFAMILY LOAN SALES

![]()

PORTFOLIO CHALLENGE

![]()

CRE Concentration Regulatory

Guidance

Regulator guidance to banks cautions that CRE

concentration in bank portfolios should not exceed

300% of risk based capital, and the outstanding balance

of bank CRE portfolio should not grow more than 50%

during the prior 36 months

MISSION CAPITAL SOLUTION

![]()

![]()

Over-Exposure to Specific Borrower Strategic dispositions when lending limits to specific borrowers impede ability to originate new loans to the borrower

Mission Capital advises clients

nationwide on the sale of performing

Exit Non-Strategic Borrower

Relationships

Offered loan is bank’s sole relationship with a borrower

(i.e. no depository or other banking services)

loan portfolios, delivering custom asset marketing solutions via our world-class talent, proprietary![]()

Prudent Risk Management Exiting geographies, change in credit appetite, exiting deals with tenant roll risk, divesting asset classes, etc.

technology, transactional experience, and deep relationships.![]()

M&A Activity![]()

Legacy or Reperforming Portfolios

Strategic disposition of assets outside desired footprint / outside lending parameters

Monetize legacy assets on disparate systems or

low basis reperforming TDRs

![]()

![]()

CRE Loans, Performing

![]()

CRE Loans, Performing

![]()

Healthcare & Multifamily/Student Housing, Performing

CRE Loans, Performing

$23mm total UPB, recently originated, traded at 100.85%. High demand from secondary market.

$11.6mm total UPB, traded at 100.11%. Bids ranged from 90% of par to 100.11%. High demand from secondary market, market accustomed to asset type.

$194mm total UPB, traded at 91%. Government Seller. High demand from secondary market.

$12.3mm total UPB, traded for 89%. Portfolio made up of non- seller originated loans previously acquired on the secondary market. High demand from secondary market.![]()

|

KEY FACTORS FOR UPSIDE PRICING |

|

|

KEY FACTORS FOR UPSIDE PRICING |

At or above market coupon |

|

KEY FACTORS FOR UPSIDE PRICING |

Strong cash flow and payment history |

|

KEY FACTORS FOR UPSIDE PRICING |

LTV < 70%; DSCR > 1.3x; Maturity < 5 yrs |

|

KEY FACTORS FOR UPSIDE PRICING |

Average asset size > $2.5mm |

|

KEY FACTORS FOR UPSIDE PRICING |

Variable rate or limited remaining fixed rate term |

|

KEY FACTORS FOR UPSIDE PRICING |

Reasonable floor on variable rate portion of term |

|

KEY FACTORS FOR UPSIDE PRICING |

Prepayment protection |

|

KEY FACTORS FOR UPSIDE PRICING |

Full recourse / Personal guarantees |

|

KEY FACTORS FOR UPSIDE PRICING |

Credit tenant |

|

KEY FACTORS FOR UPSIDE PRICING |

No lease hangout on single tenant loans |

|

KEY FACTORS FOR UPSIDE PRICING |

“Full doc” / in compliance with financial reporting requirements |

|

KEY FACTORS FOR UPSIDE PRICING |

Recent appraisals |

|

KEY FACTORS FOR UPSIDE PRICING |

Tel: 212-925-6692

Tel: 561-622-7022

Tel: 512-327-0101

Tel: 949-706-3001