Mission Capital’s David Tobin comments on the use of big data in the industry.

The Future Of Big Data In Real Estate

AUGUST 12, 2016 | BY CARRIE ROSSENFELD

IRVINE, CA—As big data becomes more readily available in the marketplace, it will also become increasingly important for businesses to identify quality curators of this data so that the foundation for their decision making is solid, ATTOM Data’s Daren Blomquist tells GlobeSt.com in

this EXCLUSIVE story.

Blomquist: “Big data will become increasingly important to businesses that want to make the best decisions possible.”

IRVINE, CA—As big data becomes more readily available in the marketplace, it will also become increasingly important for businesses to identify quality curators of this data so that the foundation for their decision making is solid, ATTOM Data’s VP Daren Blomquist tells GlobeSt.com. We spoke with Blomquist and Sheridan Hitchens, VP of data products for Ten- X; Elliot Vermes, CEO of ResiModel; Joe Derhake, CEO of Partner Engineering & Science; Norm Miller, Hahn Chair of real estate finance at the Burnham-Moores Center for

Real Estate, within the School of Business at the University of San Diego; David Tobin, founder of Mission Capital Advisors; and Charles Clinton, CEO of EquityMultiple, about the future of big data and real estate. Stay tuned for a more in-depth feature on big data and real estate in the July/August issue of Real Estate Forum.

GlobeSt.com: Where do you see big data heading in relationship to the real estate industry?

Blomquist: Big data will become increasingly important to businesses that want to make the best decisions possible. It also will likely become more readily available in the marketplace, but as it does it will also become increasingly important for businesses to identify quality curators of big data so that the foundation for their decision-making is solid.

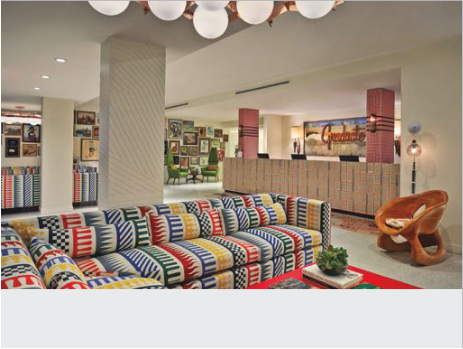

Hitchens: Real estate data is becoming both more robust and more accessible. I’ve been asked about what the best source of real estate data is, and I’ll often tell people: “Google.” That’s a bit tongue-in-cheek, of course, but the fact is that anyone can locate an address on Google and view it down to the street view—that’s a data set in itself.

I also believe we’ll see a fairly rapid expansion of new data sets in addition to the firming up of this core asset information. I was speaking at MIT’s Real Estate Conference a few weeks back, and I saw a fantastic presentation by one of the professors leading the work on Internet of Things. A lot of the work revolves around sensors in buildings. They can monitor exit/entry flow and traffic in any part of the building. There are many additional tools that have been or are being developed that will help to portray the atmosphere and experience of actually being

inside a building without setting foot in it.

Vermes: There is around $60 trillion worth of real estate in the United States, but analysts only have a finite amount of time. Through their ability to crunch data much faster than the human mind, big-data tools give analysts the ability to broaden their scope. For example, in the future, we may see investors use big data to analyze properties that are not currently for sale. While current time constraints dictate that time should be spent evaluating properties that are on the market, when time is less of a concern, investors may begin to also analyze other properties, ultimately approaching the owners of properties that may offer upside value.

Another way we may see big-data tools evolve is by more directly influencing decisions. Currently, big-data solutions are largely focused on aggregating and arranging data for human

consumption. But people are more and more feeling inundated by information and do not simply

need even more data, what they’re really seeking is answers.

Derhake: The reason that we don’t track the effects of quality HVAC systems on rents is because nobody has that data. However, if you were to draw a pie chart on what tenants complain about, poor HVAC systems is likely to be a fat slice. Personally, I am being forced to relocate one of my offices for exactly that reason. What if we could tease these effects out of real estate? This type of effects would really explain some of the incongruent comps in the rental market. We should track things like HVAC quality, elevator speeds, energy efficiency, and Internet speeds and develop their statistical relationship with rents.

Of course, big data is only valuable if it can be segmented and analyzed into actionable information. So, I think that technologies and programs that enable the smart and dynamic management of data will lead the revolution of big data in the real estate industry. On a property-management level, for example, we’ve seen a huge spike in demand for

our SiteLynx program, which enables property data to be managed in a live, customizable

format.

Miller: We are still in the early stages of adoption. In traveling the world, I have seen different states of implementation of big data. For example, Schneider Electric, headquartered in Paris, France, monitors every person in its headquarters and uses real-time management systems. Japan seems to have the most-automated parking systems. At Google’s or Microsoft’s headquarters, everything is connected to the Internet, from fire extinguishers to security systems. We will see a huge gap from the most intensively managed buildings to the average buildings for some time yet, perhaps a decade or more, just as we see a huge gap from the most sustainable buildings to the average building out there. Conferences

like www.realcomm.com, produced by Jim Young, help close the gap, but only a small

percentage of professionals are trying to be leaders in terms of big-data utilization.

Tobin: The amount of data we already have access to on properties and loans is impressive. At some point in the near future, we will have “perfect” data on every single property and every loan in the United States. This trend is also taking hold in other countries and will eventually impact virtually every major city around the world, and then … everywhere.

In the United States, we take it for granted that one can go online and zoom in and see property

photos of nearly every building or lot in the country. We will ultimately reach that point in many countries across the world.

Clinton: We’re at the beginning of a wave of change that will permeate the business. Other fields are way ahead of us in effectively employing data, and the trend is that once an industry starts to become more data focused, they don’t pull back. There are nearly endless applications. From asset analysis and pricing on the investment side of the business to tracking consumer usage and traffic patterns in the retail sector, data will be a key way that smart companies compete.